Service & Supply | Quarterly / Earnings Reports | Oilfield Services | First Quarter (1Q) Update | Financial Results | Capital Markets

Halliburton First Quarter 2022 Results; Revenue by Region, Call Highlights

Halliburton Co. reported its first quarter 2022 results.

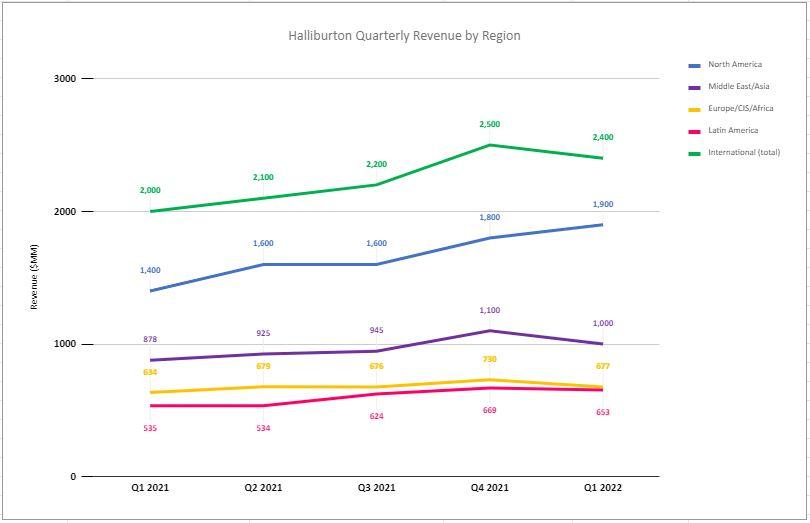

Quarterly Revenue by Region

U.S. revenue was up $100 million from the previous quarter, while International dipped by $100 million.

Conference Call Highlights

See also: Shale Experts Takes a Look at Permian Permit Activity 2019-present

US Markets: Frac Activity Surges, Rig Count Up 62% YOY

- Drilling, Completions Accelerate: "In North America, revenue grew 37% year-on-year with the acceleration of both drilling and completions activity. Higher utilization in March and net pricing gains drove margin expansion despite weather and sand disruptions earlier in the quarter."

- Market Tightness Across All Service Segments: "[In North America,] we see market tightness across all service segments. In the first quarter, average US rig count increased 14% sequentially and is up 62% year-on-year. Additionally, frac activity surged in March after winter weather and supply chain disruptions occurred earlier in the quarter. Halliburton's hydraulic fracturing fleet remains sold out and the overall market appears all, but sold out for the second half of the year. The market today presents several positive elements, previously absent in North America, and they give me confidence in the continued strength of this market over the coming years."

- Spending Growth Prediction Upsized (further insight in questions below): "Last quarter, I shared with you my view that North America customer spending would grow more than 25% year-on-year. Today, as I look at a combination of customer activity and inflation, my outlook has improved, and I now expect North America spending to increase by over 35% this year."

Q: I heard you right, you talked about North America growing 35% in terms of CapEx this year versus your previous estimate of 25%. Can you talk a little bit about what gives you confidence around that view?

- Well, a lot of that inflation that we see. It's -- and obviously, there's been a lot of inflation if we just look at the cost of inputs separate from our own, we've seen inputs ranging and cost increases from 20% to 100%, depending on what the item is. And so that weighs on it. Rig counts up 45% if we were to stop today, frac crews are up 20% if we were to stop today and the cost of each of those are more. And so look, I think really what we're seeing is public companies will stick -- are sticking with activity outlook. It's not necessarily increasing activity. And then with privates, we continue to see more activity and they keep growing. And so I think that operators all have different strategies and are very, very sharp around this. And so I expect that they will manage their business the way they plan to manage it, but there's just no question that when I see inflation and activity and clearly privates, to make clear, the private growth is an important part of that outlook. We just -- my view is that we've moved up from where we were a quarter ago.

Q: We clearly build in the rig count here and we're seeing an intention for to come into 2023 a little bit hotter from a production standpoint. But when we talk to producers, the constraint continues to be around labor and pressure pumping equipment. Do you see new capacity being added into the market by your competitors? And ultimately, will that be a constraint on the US production profile over the next couple of years?

- "Yes. I think it will be a constraint. I'm going to go back to my earlier remarks about a closed-loop system and terms of generating cash in order to build equipment and there’s a lot of equipment repair that needs to still happen or replacement in the marketplace. So I think that will be a constraint, labor and certainly equipment. And that's one of the reasons we take a very long view of fleet health, and we've got one of the healthiest fleets in the marketplace. But inside of our capital budget, we're always replacing aging equipment, and we're looking ahead today to 2023 and 2024 in terms of what that fleet composition needs to look like. So we're unique in that regard in terms of where we sit. But I do think that we don't -- I don't see capacity and I don't see meaningful capital to support any kind of build cycle at this point. Reality is this industry is still in recovery mode."

- Private Companies with Most Rigs: "With respect to activity, over 60% of the US land rig count sits with private companies and they keep growing, while public E&Ps remain committed to their activity plans. Activity and demand for our services are increasing, both internationally and in North America. With our unique value proposition, clearly defined strategic priorities and global presence, I expect Halliburton will deliver profitable growth, solid free cash flow and industry-leading returns and outperform as this upcycle accelerates."

- Activity to Build through 2023, Beyond: "Look, I think we're going to see building activity sooner than that. I think it builds throughout the balance of 2022 and then probably continues to get legs in 2023, likely beyond. I think the key is that $100 oil, everything is busy. And people want to be busy, but the question is, can they be busy? And what we've seen is really seven years of underinvestment around the entire world spending about half of what we used to spend. And that's not something that's overcome in a day or a year or – that just takes time to – to get momentum."

International Markets

- Activity Growing: "International revenue grew 15% compared to the first quarter of 2021, with activity accelerating across all international markets. Strong growth in Latin America and the Middle East/Asia offset the winter weather impacts in Europe."

- Further Growth Expected in 2Q: "We expect international activity to gain momentum in the second quarter, led by the Middle East and Latin America and further accelerate in the second half of the year. More importantly, our strong first quarter Drilling and Evaluation division margins demonstrate our focus on profitable international growth."

1Q22 Results

Halliburton reported net income of $263 million, or $0.29 per diluted share, for the first quarter of 2022. This compares to net income for the first quarter of 2021 of $170 million, or $0.19 per diluted share. Adjusted net income for the first quarter of 2022, excluding impairments and other charges and a loss on the early extinguishment of debt, was $314 million, or $0.35 per diluted share. Halliburton’s total revenue for the first quarter of 2022 was $4.3 billion compared to revenue of $3.5 billion in the first quarter of 2021. Reported operating income was $511 million in the first quarter of 2022 compared to reported operating income of $370 million in the first quarter of 2021. Excluding impairments and other charges, adjusted operating income was $533 million in the first quarter of 2022.

CEO Jeff Miller commented: “I am pleased with Halliburton’s first quarter results. Our performance demonstrated the resilience of our unique strategy in action and the importance of our competitive positioning both in North America and international markets.

“Total company revenue increased 24% and adjusted operating income grew 44% compared to the first quarter of 2021. Both of our divisions delivered strong margin performance despite weather and supply chain disruptions, with Drilling and Evaluation margin eclipsing 15% in the first quarter for the first time since 2010.

“We see significant tightness across the entire oil and gas value chain in North America. Supportive commodity prices and strengthening customer demand against an almost sold-out equipment market are expected to drive expansion in Completion and Production division margins.

“I expect our strong international business to increase throughout the remainder of the year. First quarter revenue growth in all our international regions together with North America demonstrates that this multi-year upcycle is well underway.

“I’m excited about the accelerating pace of global activity, pricing improvement, and Halliburton’s strong outlook. With our unique value proposition, clearly defined strategic priorities, leading technology portfolio, and global market presence, I expect Halliburton will deliver profitable growth, strong free cash flow and industry-leading returns."

Operating Segments

Completion and Production

Completion and Production revenue in the first quarter of 2022 was $2.4 billion, an increase of $483 million, or 26%, when compared to the first quarter of 2021, while operating income was $296 million, an increase of $44 million, or 17%. These results were driven by increased pressure pumping services and artificial lift activity in the Western Hemisphere, higher completion tool sales throughout the Western Hemisphere and the Middle East, increased cementing activity in Africa and Middle East/Asia, and improved well intervention services in North America land and the Eastern Hemisphere. These improvements were partially offset by lower activity across multiple product service lines in Europe and lower completion tool sales throughout Asia.

Drilling and Evaluation

Drilling and Evaluation revenue in the first quarter of 2022 was $1.9 billion, an increase of $350 million, or 22%, when compared to the first quarter of 2021, while operating income was $294 million, an increase of $123 million, or 72%. These results were due to increased drilling-related services globally, improved wireline activity in North America land, Latin America, and the Middle East, increased testing services internationally, and higher project management activity in Latin America, India, and Oman. Partially offsetting these increases were lower project management activity in Iraq, as well as lower fluid services in the Caribbean, Brunei, and Mozambique.

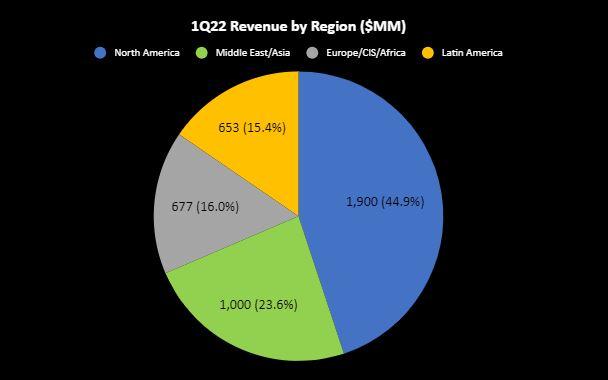

Geographic Regions

North America

North America revenue in the first quarter of 2022 was $1.9 billion, a 37% increase when compared to the first quarter of 2021. This increase was primarily driven by increased pressure pumping activity and drilling-related services in North America land, higher stimulation, artificial lift, and drilling-related activity in Canada, and higher completion tool sales in the Gulf of Mexico. These increases were partially offset by reduced fluid services in the Gulf of Mexico.

International

International revenue in the first quarter of 2022 was $2.4 billion, a 15% increase when compared to the first quarter of 2021. This improvement was primarily driven by increased activity across multiple product service lines in Brazil, Argentina, Mexico, and Egypt, increased drilling-related activity in Europe/Africa/CIS and Latin America, improved well construction services in the Middle East, Colombia, and West Africa, increased testing services in all regions, and higher completion tool sales throughout the Middle East and Latin America. Partially offsetting these increases were reduced activity across multiple product service lines in the United Kingdom and lower completion tool sales in Norway and throughout Asia.

Latin America revenue in the first quarter of 2022 was $653 million, a 22% increase year over year due to improved activity across multiple product service lines in Brazil, Argentina, and Mexico, increased well construction services in Colombia, higher completion tool sales in Guyana, improved project management activity in Ecuador and Colombia, increased testing services and wireline activity across the region, and increased artificial lift activity in Ecuador. Partially offsetting these increases were reduced fluid services in the Caribbean and lower project management and stimulation activity in Mexico.

Europe/Africa/CIS revenue in the first quarter of 2022 was $677 million, a 7% increase year over year. This improvement was primarily driven by higher activity across multiple product service lines in Egypt, increased drilling-related activity in Azerbaijan, increased well intervention and testing services across the region, improved well construction services in West Africa, and higher completion tool sales and cementing activity in Angola. These increases were partially offset by reduced activity across multiple product service lines in the United Kingdom, reduced well construction services and completion tool sales in Norway, and decreased fluid services in Mozambique.

Middle East/Asia revenue in the first quarter of 2022 was $1.0 billion, a 17% increase year over year, primarily resulting from improved well construction services in Saudi Arabia and Oman, increased wireline activity and completion tool sales in the Middle East, and increased testing services across the region. These increases were partially offset by reduced project management activity in Iraq, lower completion tool sales throughout Asia, decreased fluid services in Brunei, and lower stimulation activity in Bangladesh.

Other Financial Items

- Halliburton recorded a pre-tax charge of $22 million in the first quarter of 2022 primarily related to the write down of all its assets in Ukraine, including $16 million in receivables, due to the ongoing conflict. This charge was included in "Impairments and other charges" on the Company's condensed consolidated statement of operations for the three months ended March 31, 2022.

- Halliburton redeemed $600 million of its $1 billion aggregate principal amount of 3.80% Senior Notes due November 2025. The redemption of the notes resulted in a loss of $42 million consisting of premiums and unamortized expenses. This first quarter loss was included in "Loss on early extinguishment of debt" on the Company’s condensed consolidated statement of operations for the three months ended March 31, 2022.

Selective Technology & Highlights

- Halliburton opened the Halliburton Chemical Reaction Plant – the first of its kind in Saudi Arabia – to manufacture a broad range of chemicals for the entire oil and gas value chain as well as many other industries. The facility expands Halliburton’s manufacturing footprint in the Eastern Hemisphere and strengthens and accelerates its ability to serve the chemical needs of Middle East customers.

- Halliburton introduced Obex™ IsoLock™, a new compression-set packer that prevents sustained casing pressure. The Obex IsoLock packer collar serves as an effective barrier to mitigate fluid migration and support multiple-stage cementing through integrated stage cementing ports in the tool.

- Halliburton introduced StrataStar™, a deep azimuthal resistivity service that provides multilayer visualization to maximize well contact with the reservoir and improve real-time reserves evaluation. For more decisive well placement, the StrataStar service acquires real-time measurement and visualization of surrounding geology and fluids up to 30 feet around the wellbore. It applies a sophisticated algorithm to accurately map the position, thickness, and resistivity of interbedded rock and fluid layers to stay within targeted boundaries.

- Halliburton announced that Petrobel, a joint venture between ENI and the Egyptian General Petroleum Corporation, awarded it a contract to deploy iEnergy® Stack, Halliburton’s cloud solution that runs on-premise, to manage petrotechnical software applications.

- Halliburton announced that Energean plc, an independent E&P company focused on developing resources in the Mediterranean and the North Sea, awarded it a study to assess carbon storage potential of the Prinos basin in Greece.

- Halliburton announced the addition of Ms. Tobi Young and Mr. Earl Cummings to its board of directors. The appointments went into effect on February 23, 2022, and both will stand for election by shareholders at the annual meeting on May 18, 2022.

- Halliburton Labs selected three new companies to participate in its collaborative environment to advance and scale cleaner, affordable energy. Chemergy, EVA, and Novamera will receive access to a broad range of industrial capabilities, technical expertise, and global network connections to scale their respective businesses. Halliburton Labs also added two new advisory board members – Jennifer Holmgren, CEO, LanzaTech and Maynard Holt, CEO, Veriten.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

-

Operator Reports 1Q'24 Results; Chop Frac Plans Again -

Europe News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Touchstone Exploration, Inc., First Quarter 2023 Results -

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

.jpg&new_width=60&new_height=60&imgsize=false)