Exploration & Production | Service & Supply | Rig Count | Top Story | Oilfield Services | Financial Results | Capital Markets | Drilling Contractor

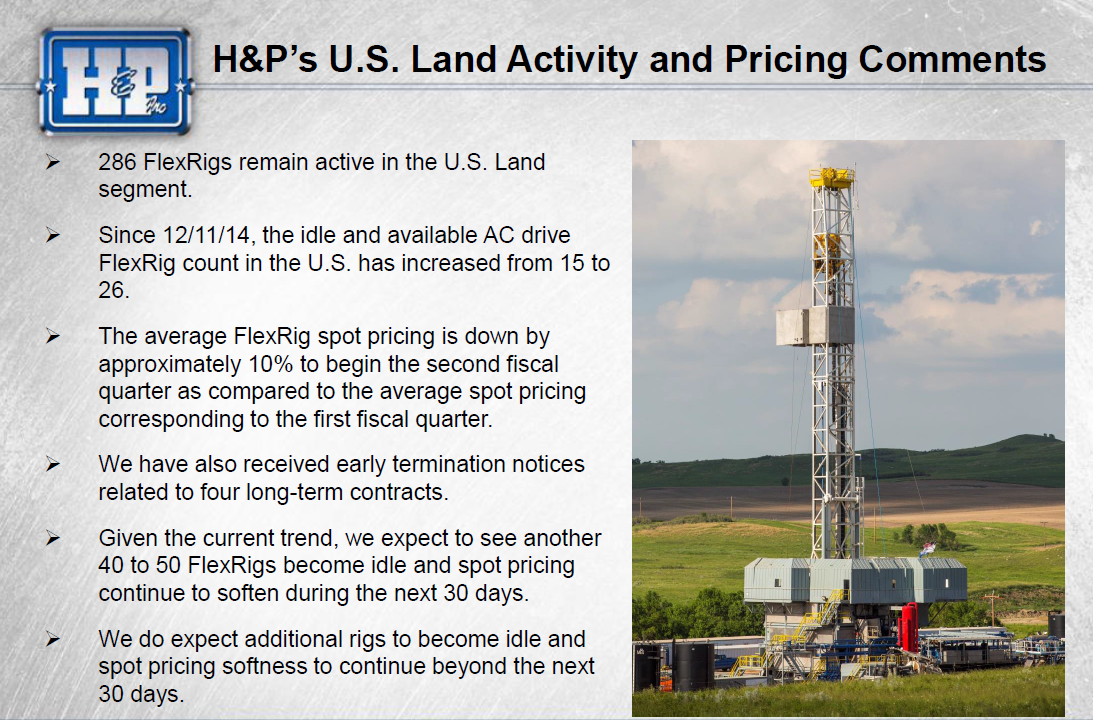

Helmerich & Payne Talks Rig Cancellation; 50% Rate Cut

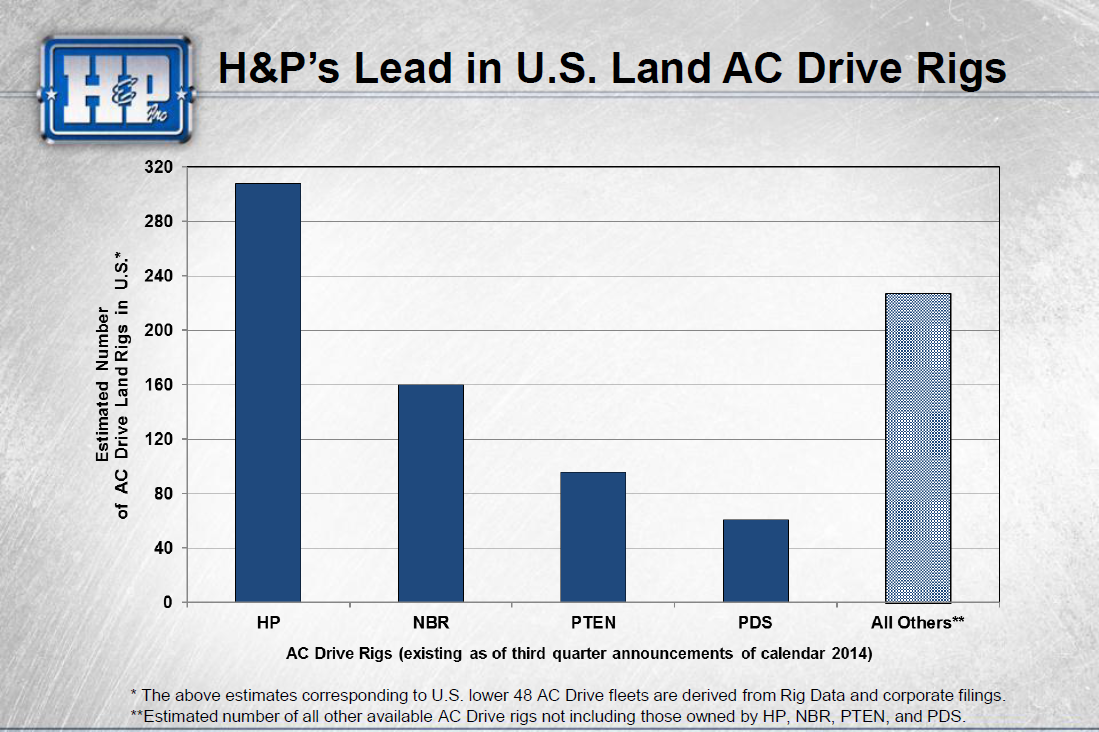

Top Eagle Ford and Permian Basin driller Helmerich & Payne is seeing a big rig revenue hit as low oil prices are forcing companies to cut operations.

The company stated that the average rig revenue per day increased by 1.6% to $28,603. And the average rig expense per day decreased by less than 1% to $13,046, resulting in an average rig margin per day of $15,557.

Helmerich & Payne further noted that they could see rig counts dip below the 200 count mark by the end of the quarter.

Juan Pablo Tardio, Vice President & CFO, commented: "Looking ahead at the second quarter of fiscal 2015, we expect revenue days to decrease by roughly 25% quarter-to-quarter. And given the current trend, we could have less than 200 rigs active by the end of the quarter. Excluding the impact of revenues corresponding to early-terminated long-term contracts, we expect our average rig revenue to decline to levels between $27,000 and $27,500 per day. The average rig expense per day level is expected to increase to roughly $13,350 as we deal with some volatilities and significant changes in activity levels."

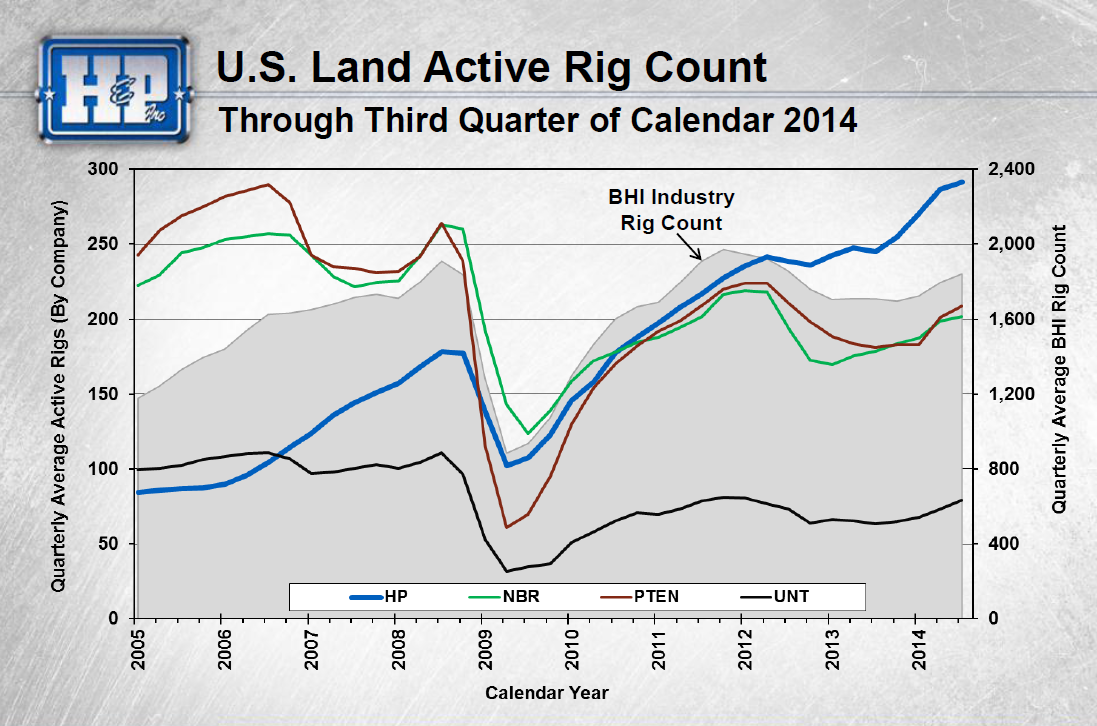

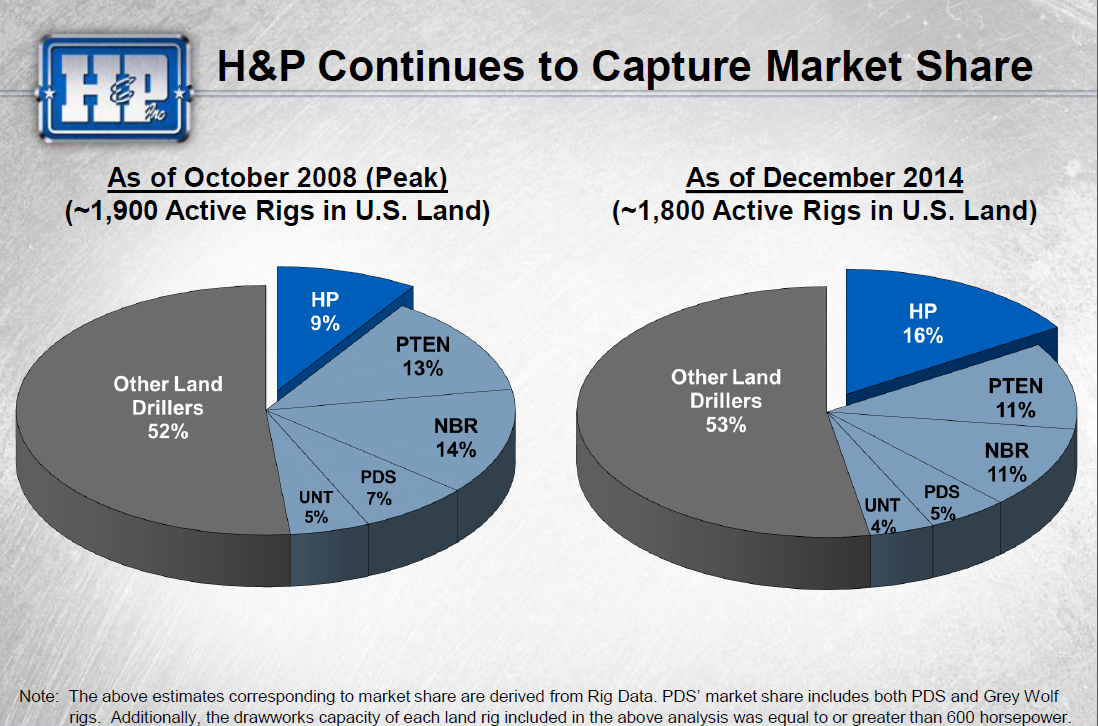

John W. Lindsay, President & CEO, added: "Drilling activity and spot pricing has significantly declined in the U.S. Many industry analysts have predicted a 500- to 900-rig count reduction in U.S. land. And since the peak of activity at the end of October 2014, recent rig counts already appear to be down by 300 to 500 rigs. This wide range depends on the rig count source and how inclusive it is of smaller rigs."

Lindsay also noted rig release percentage by play:

- Niobrara: Over 50%

- Marcellus: ~50%

- Woodbine: 60%

- Bakken/Three Forks: ~40%

- Eagle Ford: 25-28%

- Permian Basin: 30%

Click here to access Eagle Ford Shale budget plans in Shale Experts' CapEx Database

Click here to access Permian Basin budget plans in Shale Experts' CapEx Database

Related Categories :

Rig Count

More Rig Count News

-

EQT Provides an Update on Rigs & Frac Crews, Post Recent Transaction -

-

These Permian Companies Will Frac 3600 Wells In 2025, Using 160 Rigs & 55 Frac Crews -

-

Appalachia E&P Details 2025, Rig, Wells & Completion Crew Programs -

-

Patterson-UTI Expects +50 Rigs To be Added in 2023; PE-backed E&P To Lead.

-

Coterra Energy Second Quarter 2022 Results

Gulf Coast - South Texas News >>>

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Coterra’s Strategic Pivot: Realigning Rig Activity and Capital Deployment in 2025 -

-

Coterra Energy – 2025 Development Summary -

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

Permian News >>>

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

-

New Comapny : New Permian E&P Secures Funds From Large PE-Firm

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

These Permian Companies Will Frac 3600 Wells In 2025, Using 160 Rigs & 55 Frac Crews