Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Drilling Activity

Kelt Exploration Second Quarter 2020 Results

Kelt Exploration Ltd. reported its Q2 2020 results.

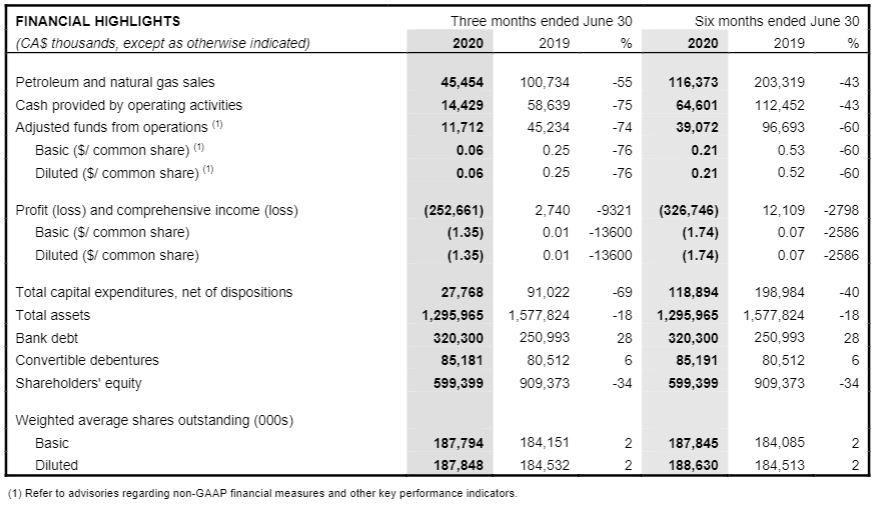

The Company’s financial results are summarized as follows:

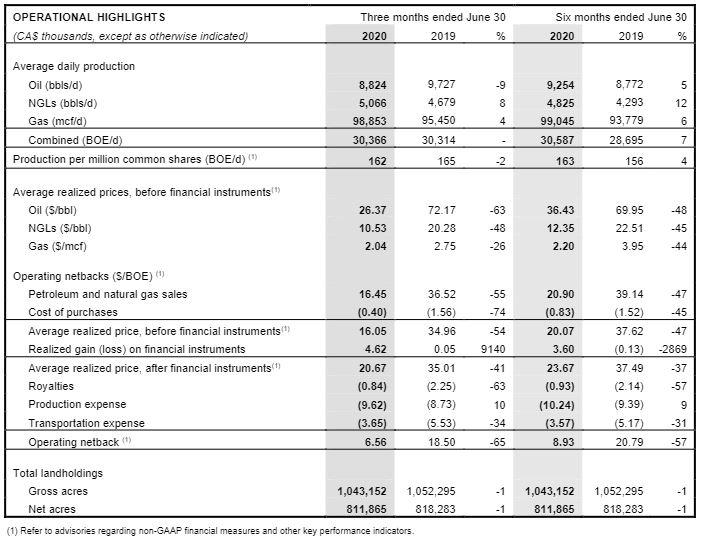

Kelt’s operating results for the second quarter ended June 30, 2020 are summarized as follows:

Kelt continues to monitor current market conditions resulting from the COVID-19 pandemic. The Company’s highest priority remains the health and safety of its employees, partners and the communities where it operates. Kelt continues to maintain measures that have been put in place to protect the well-being of these stakeholders and is proud of the dedication of its workforce to maintain safe operations and business continuity in a challenging environment.

Average production for the three months ended June 30, 2020 was 30,366 BOE per day, relatively unchanged compared to average production of 30,314 BOE per day during the second quarter of 2019. Production for the three months ended June 30, 2020 was weighted 46% oil and NGLs and 54% gas.

Kelt’s realized average oil price during the second quarter of 2020 was $26.37 per barrel, down 63% from $72.17 per barrel in the second quarter of 2019. The significant decrease in realized oil prices were primarily related to the unprecedented decline in global oil demand resulting from the COVID-19 pandemic, despite the efforts of global oil producers to reduce supply by curtailing portions of their oil production. The realized average NGLs price during the second quarter of 2020 was $10.53 per barrel, down 48% from $20.28 per barrel in the same quarter of 2019. The decrease in realized NGL prices corresponded with the much weaker Edmonton benchmark prices for pentane and butane during the second quarter of 2020.

Kelt’s realized average gas price for the second quarter of 2020 was $2.04 per Mcf, down 26% from $2.75 per Mcf in the corresponding quarter of the previous year. As producers in Canada and the United States shut in certain oil and gas wells during the COVID-19 pandemic, North American gas supply was reduced considerably. However, the pandemic also resulted in global gas demand destruction which in turn negatively impacted North American LNG exports. As a result, natural gas prices dropped significantly in most North American gas hubs as gas storage levels were running significantly ahead of historical levels.

For the three months ended June 30, 2020, revenue was $45.5 million and adjusted funds from operations was $11.7 million ($0.06 per share, diluted), compared to $100.7 million and $45.2 million ($0.25 per share, diluted) respectively, in the second quarter of 2019.

Net capital expenditures incurred during the three months ended June 30, 2020 were $27.8 million, down 69% from $91.0 million in capital expenditures during the second quarter of 2019. The majority of the capital expenditures during the second quarter of 2020 was incurred on facilities and pipelines for projects that were initiated in late 2019 and early 2020.

At June 30, 2020, the Company’s bank debt outstanding (before working capital) was $320.3 million. Kelt and its syndicate of lenders agreed to extend the revolving period applicable to the Company’s existing $350.0 million revolving credit facility to August 31, 2020.

On July 22, 2020, Kelt announced that it had entered into an agreement to sell its Inga/Fireweed/Stoddart assets (“Inga Assets”) in British Columbia that are held by its wholly owned subsidiary, Kelt Exploration (LNG) Ltd. (“Kelt LNG”), to ConocoPhillips (the “Purchaser”). Kelt will receive cash proceeds of $510.0 million, prior to closing adjustments, and the Purchaser will assume certain specific financial obligations related to the Inga Assets in the amount of approximately $41.0 million. The effective date for the transaction is July 1, 2020. Completion of the transaction is subject to customary closing conditions and is expected to occur on or around August 21, 2020.

Kelt, pro-forma the completion of the sale of its Inga Assets, will be in a position of financial strength, with no debt, positive working capital and a large Montney land acreage position (374,528 net acres or 585 net sections) to grow the Company’s remaining production base as commodity prices improve. In addition to its three remaining Montney play areas at Wembley/Pipestone, Pouce Coupe/Progress and Oak/Flatrock, the Company will also be in a position to develop its Charlie Lake play (74,719 net acres or 117 net sections) in Alberta.

Average production for the second quarter of 2020, excluding production related to the Inga Assets, was 15,937 BOE per day (38% oil and NGLs and 62% gas). The Company, excluding wells related to the Inga Assets, currently has an estimated 7,500 to 8,500 BOE per day of production behind pipe associated with 11 wells that have been drilled and are awaiting tie-in as follows:

- Wembley (sfc 12-5) 00/09-04-073-06W6 – drilled, completed & tested;

- Wembley (sfc 10-28) 00/03-04-074-07W6 – drilled, completed & tested;

- Wembley (sfc 02/14-2) 00/13-13-073-08W6 – drilled, completed & tested;

- Wembley (sfc 16-26) 00/13-13-072-07W6 – drilled, completed & tested;

- Wembley (sfc 03/16-8) 02/16-10-72-7W6 – drilled (DUC);

- Oak (sfc 5-31) 00/13-05-087-18W6 – drilled, completed & tested;

- Oak (sfc A5-31) 00/16-06-087-18W6 – drilled, completed & tested;

- Oak (sfc 5-33) 00/01-09-087-18W6 – drilled (DUC);

- Oak (sfc A5-33) 00/04-10-087-18W6 – drilled (DUC);

- Oak (sfc A13-12) 00/16-23-087-18W6 – drilled (DUC); and,

- Oak (sfc B13-12) 00/14-24-087-18W6 – drilled (DUC).

Kelt will continue to reassess its ability to reasonably estimate and provide financial guidance during this period of heightened commodity price volatility and economic uncertainty. Management looks forward to updating shareholders with 2020 third quarter results on or about November 10, 2020.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)