Exploration & Production | Oil Sands | Production Rates

MEG Doubles Production, Lowers Capital Spending from 2013

MEG Energy Corp. has reported third quarter 2014 operating and financial results.

Highlights include:

- Record quarterly production of 76,471 barrels per day (bpd), an increase of 11 per cent over second quarter 2014 results;

- Record non-energy operating costs of $7.16 per barrel with cash operating netbacks of $48.70 per barrel, a continuation of strong second quarter 2014 results;

- Near-record cash flow from operations of $238.7 million, driven by increased production levels and continuing strong cash operating netbacks.

Bill McCaffrey, President and Chief Executive Officer said: "While there has been significant volatility in the general oil markets this quarter, MEG's third quarter shows that we are very much on track with our strategy.

The critical parts of the equation - higher production, lower costs and attractive and more stable heavy oil pricing - are all reflected in our results."

MEG's production during the third quarter of 2014 increased to a record of 76,471 barrels per day (bpd), more than 120 per cent over comparative third quarter 2013 production of 34,246 bpd. Higher production rates reflect the ramp-up of MEG's Christina Lake Phase 2B project, as well as incremental production associated with the company's RISER initiative on phases 1 and 2 of the Christina Lake Project. For the first nine months of 2014, average production rose to 68,108 bpd from 32,980 bpd in the same period of 2013. Nine month production volumes for both 2013 and 2014 were impacted by planned maintenance.

On phases 1 and 2 of the Christina Lake Project, commercial deployment of MEG's proprietary enhanced and modified steam and gas push (eMSAGP) continued to advance, with its implementation on all original well pads from both phases. Steam-oil ratios and production trends have met or exceeded expectations.

Bitumen sales for the third quarter of 2014 were 69,757 bpd. The difference between sales and production in the third quarter is primarily due to MEG utilizing approximately 6,100 bpd of bitumen for linefill for the Access Pipeline expansion. The pipeline (50% MEG-owned) and the Stonefell Terminal (100% MEG-owned) are central to the company's 'Hub and Spoke' marketing strategy. MEG's Hub and Spoke strategy provides low-cost transportation to the Edmonton area marketing hub and the ability to temporarily store products during periods of market disruption or transportation constraint.

Third quarter 2014 non-energy operating costs decreased to $7.16 per barrel from $9.20 per barrel in the same period of 2013, primarily as a result of production increases that spread fixed costs over higher volumes. Net operating costs, which include natural gas energy costs as well as the benefit of electricity sales, were $10.31 per barrel in the third quarter of 2014, compared to $9.40 per barrel in the third quarter of 2013. The difference reflects higher natural gas energy costs and a decrease of approximately 22 per cent in average prices for electricity sold into the Alberta power grid.

Cash operating netback - the net revenue received by MEG after adjusting for operating and transportation costs - remained strong at $48.70 per barrel in the third quarter of 2014 compared to $51.45 per barrel in the second quarter. Cash operating netbacks for the first nine months of 2014 were $48.18 per barrel compared to $40.32 per barrel for the first nine months of 2013. The increase in year-to-date cash operating netbacks is primarily due to increased crude oil benchmark prices and narrowing light-heavy oil differentials, partially offset by an increase in natural gas energy prices and a decrease in power sales pricing.

McCaffrey said: "Pricing for Western Canadian heavy oil blends remains attractive.

This is a trend that we expect to see continue as new infrastructure, such as the Flanagan-Seaway pipeline system and expanded rail-loading facilities, come into play over the next several months."

Record production volumes, low operating costs and strong price realizations in the third quarter of 2014 contributed to quarterly cash flow from operations of $238.7 million ($1.06 per share, diluted), compared to $144.5 million ($0.64 per share, diluted) in the third quarter of 2013. MEG's third quarter 2014 cash flow from operations is the second highest quarter on record for the company.

Operating earnings, which are adjusted for items that are not indicative of operating performance, increased to $87.5 million ($0.39 per share, diluted) in the third quarter of 2014 from $56.2 million ($0.25 per share, diluted) in the same period of 2013, reflecting the same factors that impacted cash flow from operations.

MEG recorded a net loss of $101.0 million ($0.45 per share, diluted) in the third quarter of 2014 compared to net income of $115.4 million ($0.51 per share, diluted) in the third quarter of 2013. The difference primarily reflects $203.1 million of unrealized foreign exchange losses on the translation of the company's US$ denominated debt in the third quarter of 2014 compared to unrealized foreign exchange gains of $64.3 million in the third quarter of 2013.

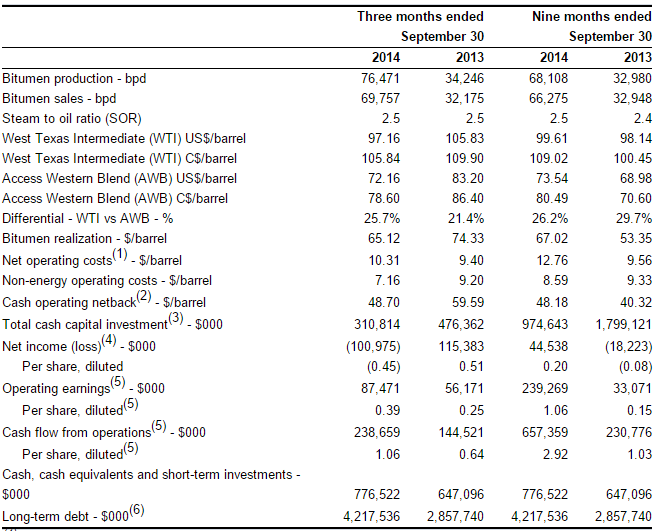

Operational and Financial Highlights

The following table summarizes selected operational and financial information of the Corporation for the periods noted. All dollar amounts are stated in Canadian dollars unless otherwise noted:

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)