Hedging | Capital Markets | Capital Expenditure | Drilling Program | Capital Expenditure - 2021

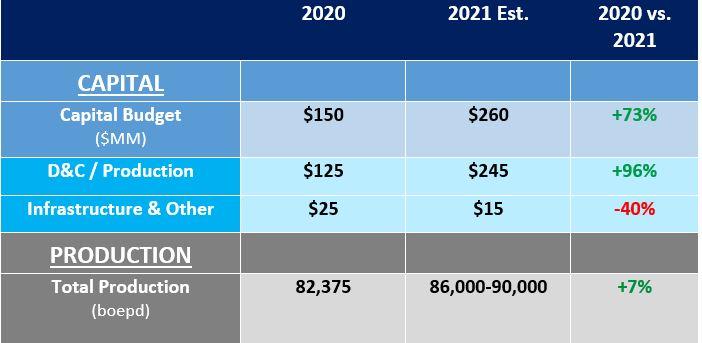

MEG Energy Accelerates Spending 73% for 2021 to $260 Million

MEG Energy Corp. has reported its 2021 capital investment plan.

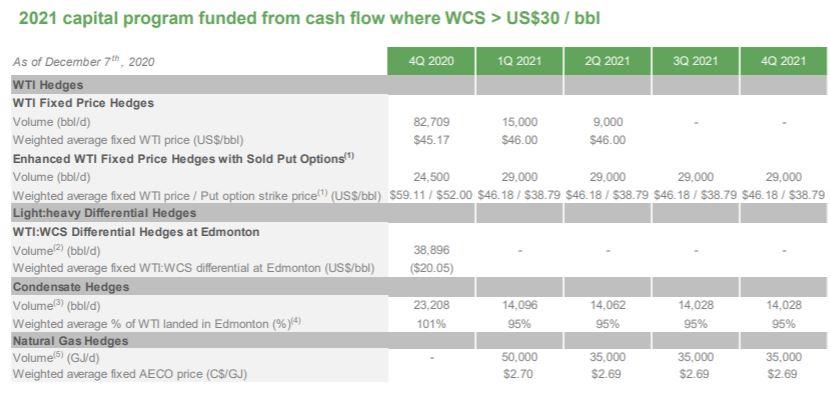

Its 2021 program is designed to be fully funded within 2021 cash flow at a full year average WCS price of approximately US$30.00 per barrel.

2021 Plan

- Capital Budget: $260 million - up 73% from $150 million for 2020

- D&C / Production Capital: $245 million

- Infrastructure & Other: $15 million

- Average Production: 86,000 to 90,000 BOEPD - up 7% vs 2020

Program Details

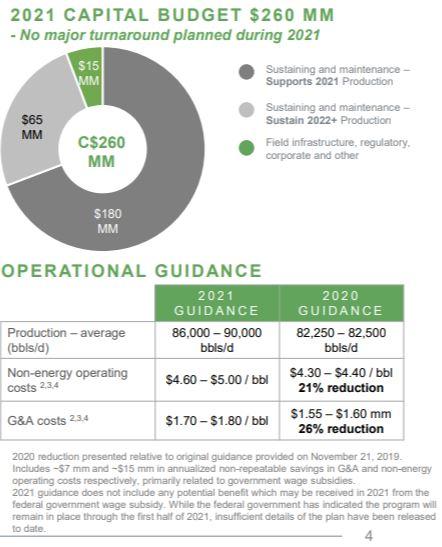

Of the $245 million of sustaining and maintenance capital, approximately $180 million, or 75%, directly supports MEG’s 2021 production guidance. This capital, of which approximately 45% will be invested in the first quarter of 2021, will be primarily directed toward the drilling, completing and tying in of new SAGD and infill wells. The majority of the production associated with this capital will begin to ramp up in the second half of 2021, reaching full production levels in mid-2022.

The remaining $65 million of sustaining and maintenance capital represents a portion of the investment required to sustain production levels in 2022 and beyond. Approximately two-thirds of this capital is targeted for investment in the second half of 2021 and will be directed to the initiation of the development of new well pads which are part of MEG’s medium-term sustaining and maintenance capital investment program.

The $15 million of capital investment targeted to field infrastructure, regulatory, corporate and other represents capital necessary to maintain MEG’s business that is not directly associated with sustaining and maintenance of production at Christina Lake.

2021 Hedges

For 2021, MEG has entered into benchmark WTI fixed price hedges and enhanced WTI fixed price hedges with sold put options for approximately 40% of forecast bitumen production at an average full year price of US$46.15 per barrel. The first half weighting of these WTI hedges primarily reflects the first half weighting of MEG’s capital investment profile. MEG has also hedged approximately 35% of its expected 2021 condensate requirements at a landed at Edmonton price of approximately 95% of WTI and approximately 30% of expected 2021 natural gas requirements at C$2.69 per GJ.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Canada News >>>

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)