Midstream - Pipelines | Quarterly / Earnings Reports | Third Quarter (3Q) Update

Magellan Reports $249 MM Distributable Cash Flow; Project Updates

Magellan Midstream reported it's third quarter results today.

Revenue : $196 million in the 3Q-2016 vs $251 million in 3Q-2015.

Distributable Cash Flow : $243.9 million in Q3-2016 vs $230 million in 3Q-2015

Projects / Infrastructure Update

“During the third quarter of 2016, we successfully started operation of the Little Rock and Saddlehorn pipelines, representing key infrastructure projects to deliver refined petroleum products and crude oil to important demand centers.”

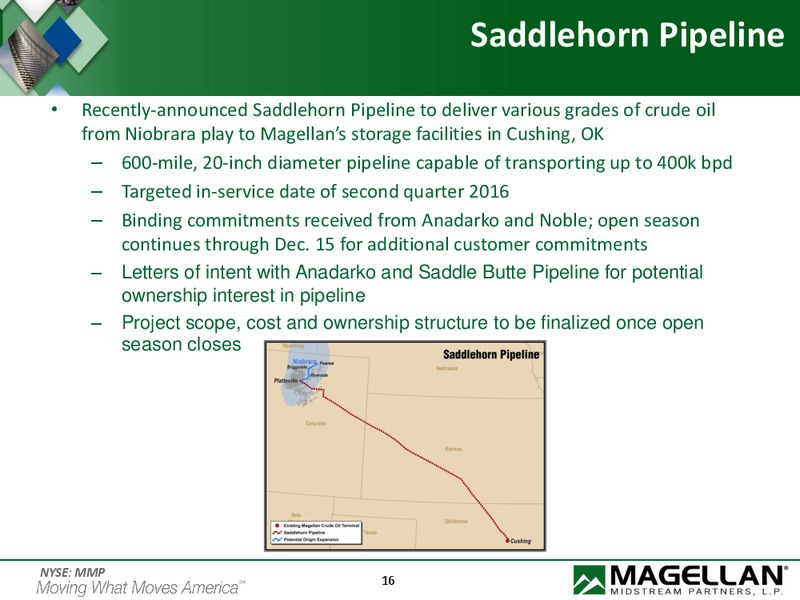

As previously mentioned, the Little Rock pipeline began operations in July 2016 and the Platteville-to-Cushingsegment of the Saddlehorn pipeline became operational during September. Pipeline installation continues for the Carr-to-Platteville segment of Saddlehorn, with this pipe extension expected to be operational in early 2017.

Saddlehorn Pipeline Project

Construction is nearing completion for Magellan’s Corpus Christi condensate splitter, with commissioning of the facility underway. The splitter is currently expected to be commercially operational late in the fourth quarter of 2016.

Significant progress has been made on the partnership’s HoustonLink and Seabrook Logistics joint ventures, with both projects expected to become operational during the first quarter of 2017.

Divisional Updates

Refined products. Refined products operating margin was $183.6 million, a decrease of $58.0 millionprimarily related to the impact of MTM adjustments for New York Mercantile Exchange (NYMEX) positions used to hedge the partnership’s commodity-related activities.

Crude oil. Crude oil operating margin was $98.7 million, an increase of $4.1 million. Transportation and terminals revenue decreased slightly primarily due to lower pipeline volumes, partially offset by new leased storage contracts at the partnership’s East Houston, Texas terminal. Shipments declined on the Longhorn pipeline as customers utilized credits set to expire during third quarter 2016 that had been earned by moving volume in excess of minimum commitments in the past.

Marine storage. Marine storage operating margin was $33.2 million, an increase of $1.0 million and a quarterly record for this segment.

Related Categories :

Rockies - DJ Basin News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

PDC Energy, Inc., First Quarter 2023 Results

-

Denbury Inc., First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

.jpg&new_width=60&new_height=60&imgsize=false)