Top Story | Maps | Deals - Acquisition, Mergers, Divestitures | Capital Markets | Private Equity Activity

Maps : A&D Transactions: Southern Delaware Basin, SCOOP/STACK

Shale Experts Deal Maps:

Every month we create leasehold maps depicting A&D transactions. Below are two examples.

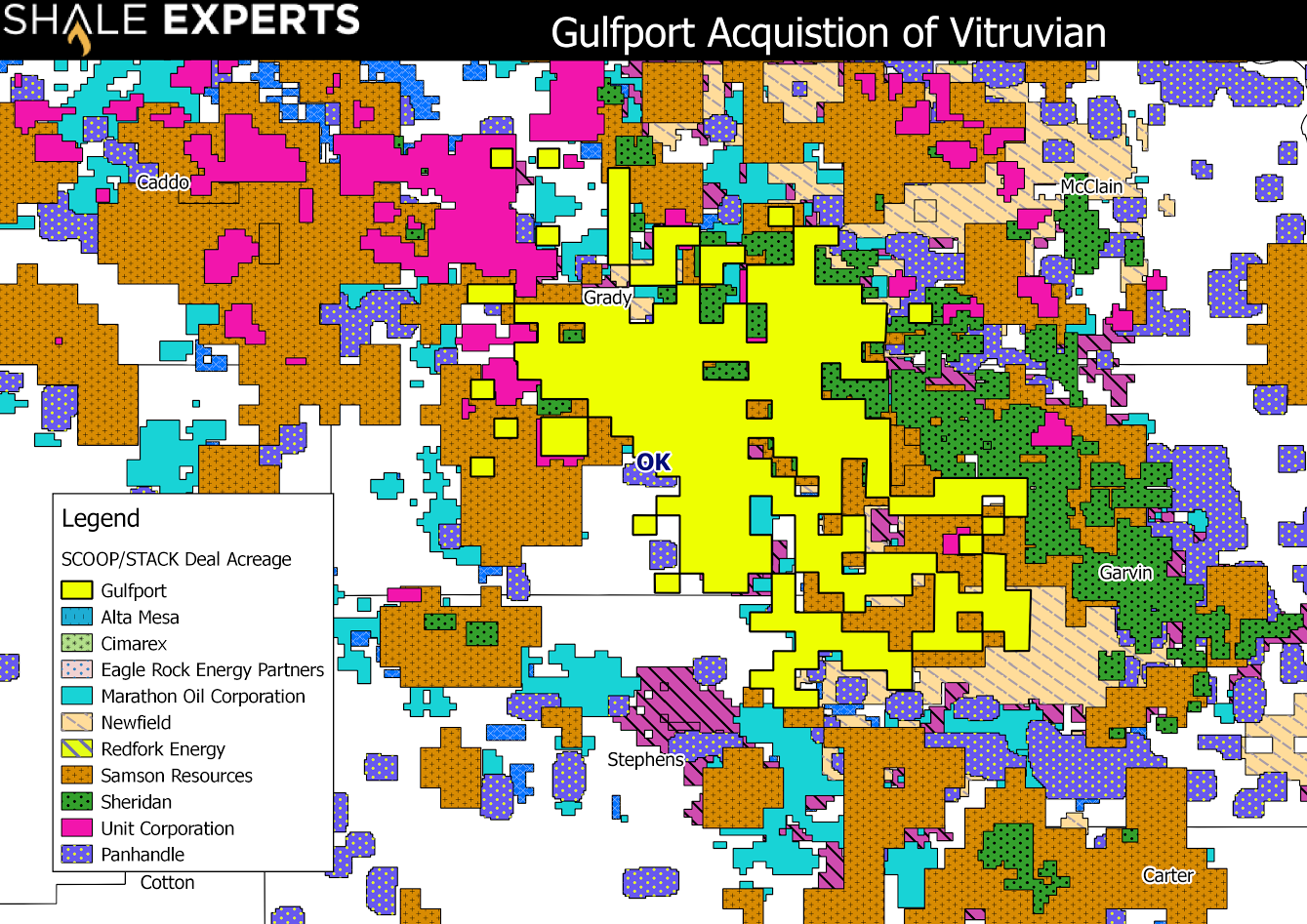

Mid-Con SCOOP Deal

Gulfport Makes Big Splash; Enters SCOOP With Acquisition of Vitruvian II For $1.8 Billion

Vitruvian is a sizable SCOOP player, offsetting operators including Marathon, Unit Corp, and Samson Resources.

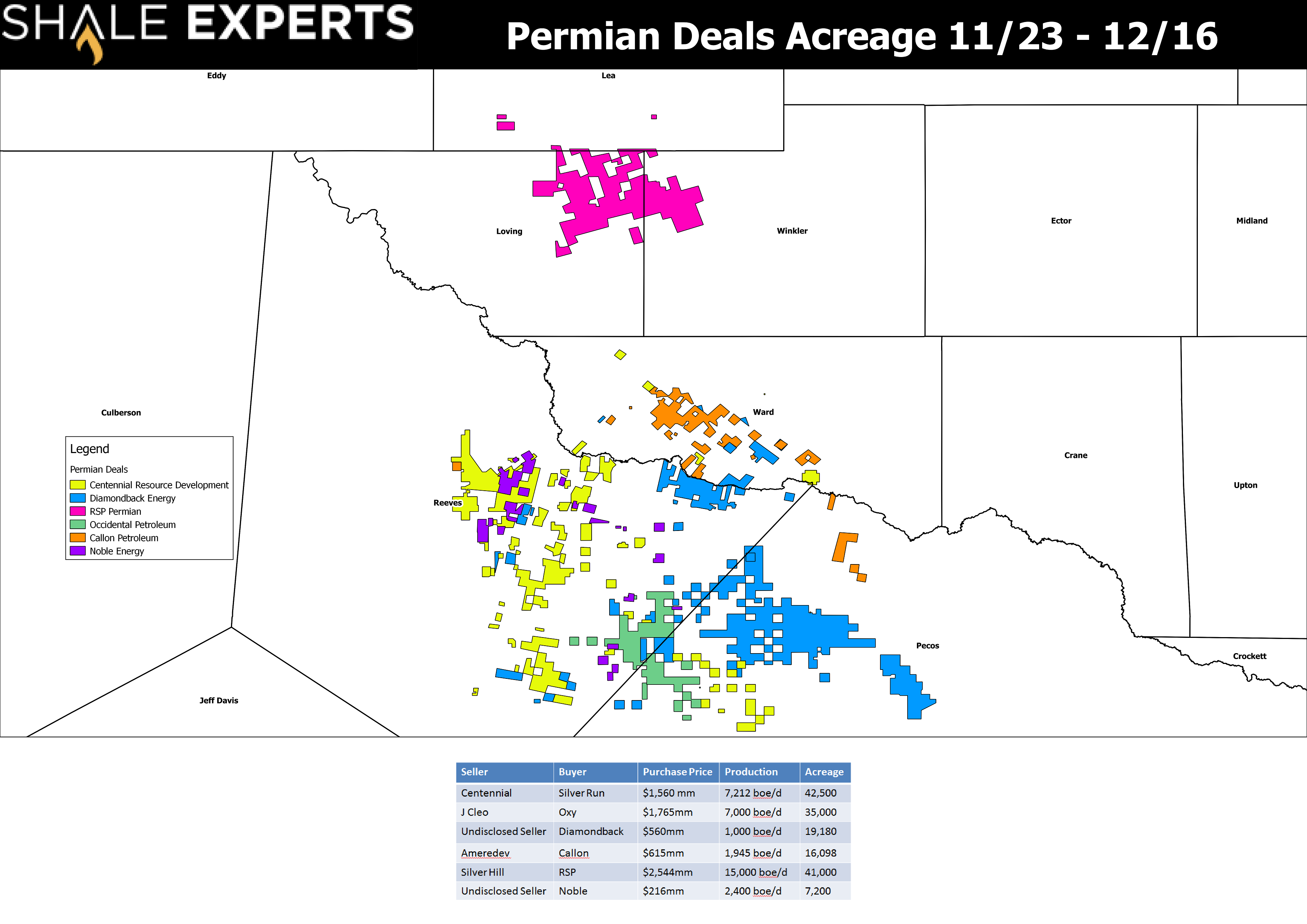

Permian Basin Deals

Diamondback at it Again; Acquires Private Equity Backed Brigham Resources For $2.43 Billion

Callon Enters Delaware Basin With Acquistion Of Ameredev

Noble Bolts On Delaware Basin Position; 7,200 Acres

Mark Papa at it Again; Centennial Buys Delaware Basin E&P Silverback

Related Categories :

Mid-Continent News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

Permian News >>>

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -