Service & Supply | Quarterly / Earnings Reports | Oilfield Services | Third Quarter (3Q) Update | Financial Results | Capital Markets

NXT Energy Solutions Third Quarter 2020 Results

NXT Energy Solutions Inc. reported its Q3 2020 results.

All dollar amounts herein are in Canadian Dollars

Q3 Financial and Operating Highlights

- Repayment was received from Alberta Green Ventures Limited Partnership ("AGV") in respect of the previously disclosed loan arrangement whereby NXT loaned AGV US$250,000 for the purpose of furthering shared objectives under the Co-operation Agreement (the "Loan Arrangement");

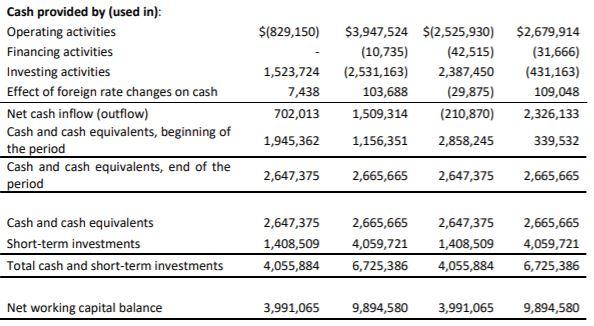

- Cash and short-term investments at September 30, 2020 were $4.06 million;

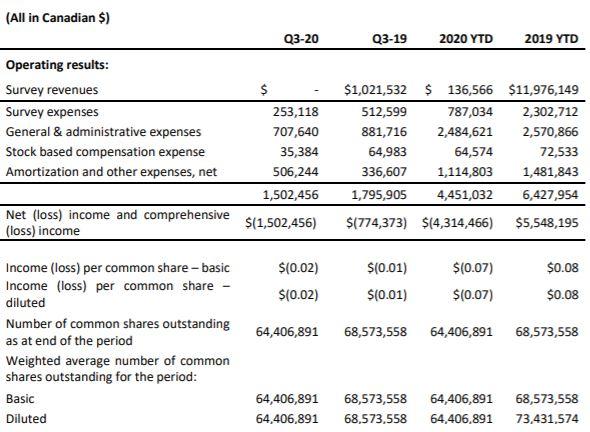

- Survey revenues in Q3-20 were nil and 2020 YTD were $0.137 million;

- A net loss of $1.50 million was recorded for Q3-20, including stock based compensation and amortization expense of $0.48 million;

- A net loss of $4.31 million was recorded for YTD 2020, including stock based compensation and amortization expense of $1.40 million;

- Cash flow used in operating activities were $0.83 million of cash during Q3-20 and $2.53 million YTD 2020;

- Net loss per common share for Q3-20 was ($0.02) basic and diluted;

- Net loss per common share for YTD 2020 was ($0.07) basic and diluted;

- General and administrative costs for Q3-20 as compared to Q3-19 decreased by $0.17 million or 20%, mostly due to the Canada Emergency Wage Subsidy ("CEWS") of $0.12 million and the Scientific Research and Experimental Development Tax Credit ("SR&ED") of $0.07 million; and

- General and administrative costs for YTD 2020 as compared to YTD 2019 decreased by $0.09 million or 3%, due primarily to the CEWS of $0.23 million and the SR&ED of $0.7 million, one less headcount in the first half of 2020, offset by partially by salary costs being allocated to survey costs in YTD 2019.

George Liszicasz, President, and CEO of NXT, commented, "Although no survey revenues were recorded in Q3, contract opportunities remain in discussion in our core areas of interest in Africa, North and South America, and South-East Asia. We remain highly confident in the approach we have taken to realize near term opportunities with National Oil Companies that have a long term strategic approach to the development of reserves. Given uncertain times, patience is required to reach definitive agreements.

"I am pleased to update you on the progress of our new algorithms that assist in the interpretation of SFD data in a manner that can be integrated more effectively with conventional seismic data interpretation. Over the last quarter we have prototyped mathematical data transformation routines to enhance the quality and repeatability of SFD data. While the methods need final formalization and field testing, NXT expects that the eventual application of these transformations will allow the extraction of additional important information to increase the reliability of interpretation and to increase the overall efficiency of operations. These methods are also expected to provide the first steps towards algorithmic interpretation and to significantly increase the value that SFD provides in the hydrocarbon exploration cycle.

"I am also pleased to announce that we extended our MOU with BGP Inc., a subsidiary of China National Petroleum Corporation, for an additional two years to further explore opportunities for NXT and BGP Inc. to work together. NXT's forward strategy is to secure SFD contracts with BGP and its affiliates."

Result Summary

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results