Drilling & Completions | Production | Exclusives / Features | Drilled Uncomplete (DUC) | Corporate Strategy

New Survey Polls E&P, Service Providers on Industry Future: Rigs, DUCs, Production, Goals

In a study released this week, we are getting a good look at what E&Ps, service providers and top oil executives are expecting from the oil and gas industry in the coming months.

The survey was conducted by the Federal Reserve Bank of Dallas and recorded responses from over 160 oil and gas firms regarding their outlook on production, rig count, DUCs/completions and geopolitics.

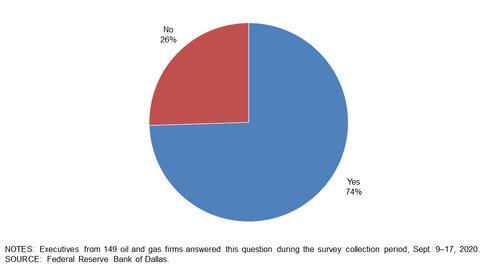

OPEC's Power to Grow

Execs were polled on their outlook in regard to OPEC - 74% believe the organization's role in determining oil price will grow.

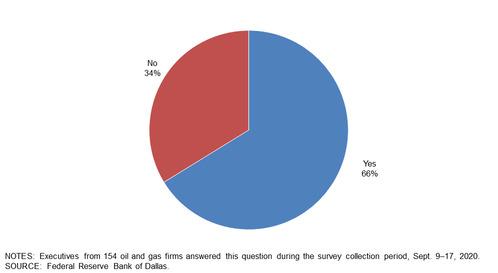

Over 60% See US Production at Peak

Of the 154 executives polled, the majority of respondants believe that production in the US has reached its peak, with 66% saying yes.

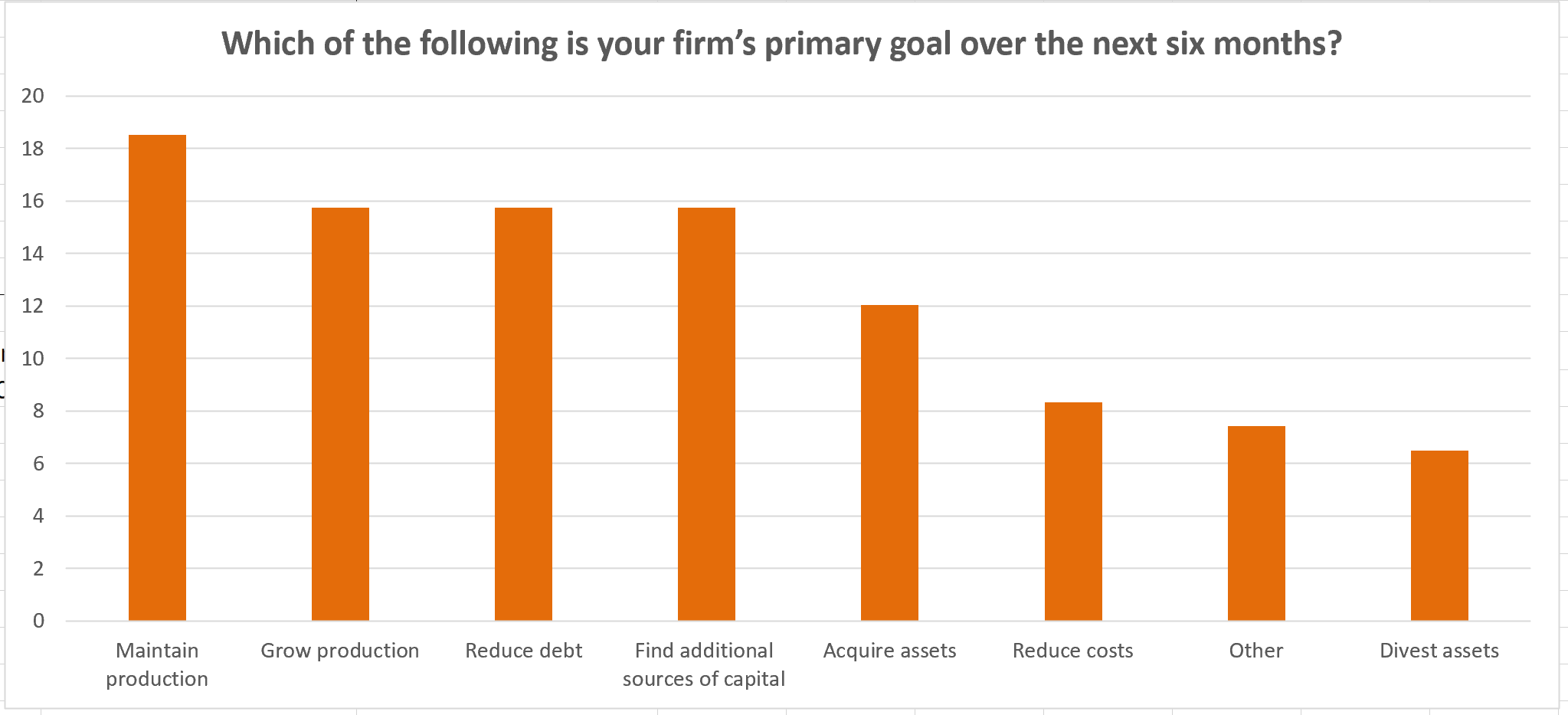

E&Ps to Focus on Production, Debt & Capital

The survey also asked firms what their focus would be in the coming months.

"Maintaining Production" came in at the top, being chosen by 19% of the total respondants.

There was a three-way tie for the second most popular response, with each of the following 16% of the total:

- Growing Production

- Reducing Debt

- Find New Sources of Capital

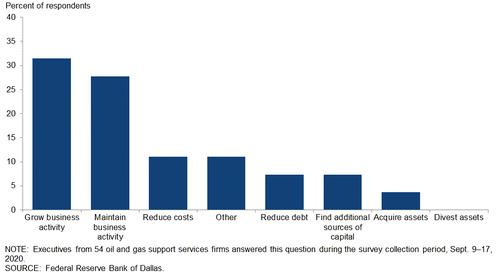

Service Providers Eye Growth

The service sector was more decisive in their future goals when compared to E&P companies.

"Growing the Business" was the most popular selection, which was chosen by 31% of the total respondants.

"Maintain Business Activity" was the runner-up with 28% of the votes, while "Reduce Costs" was the third most popular option with 11% of the votes.

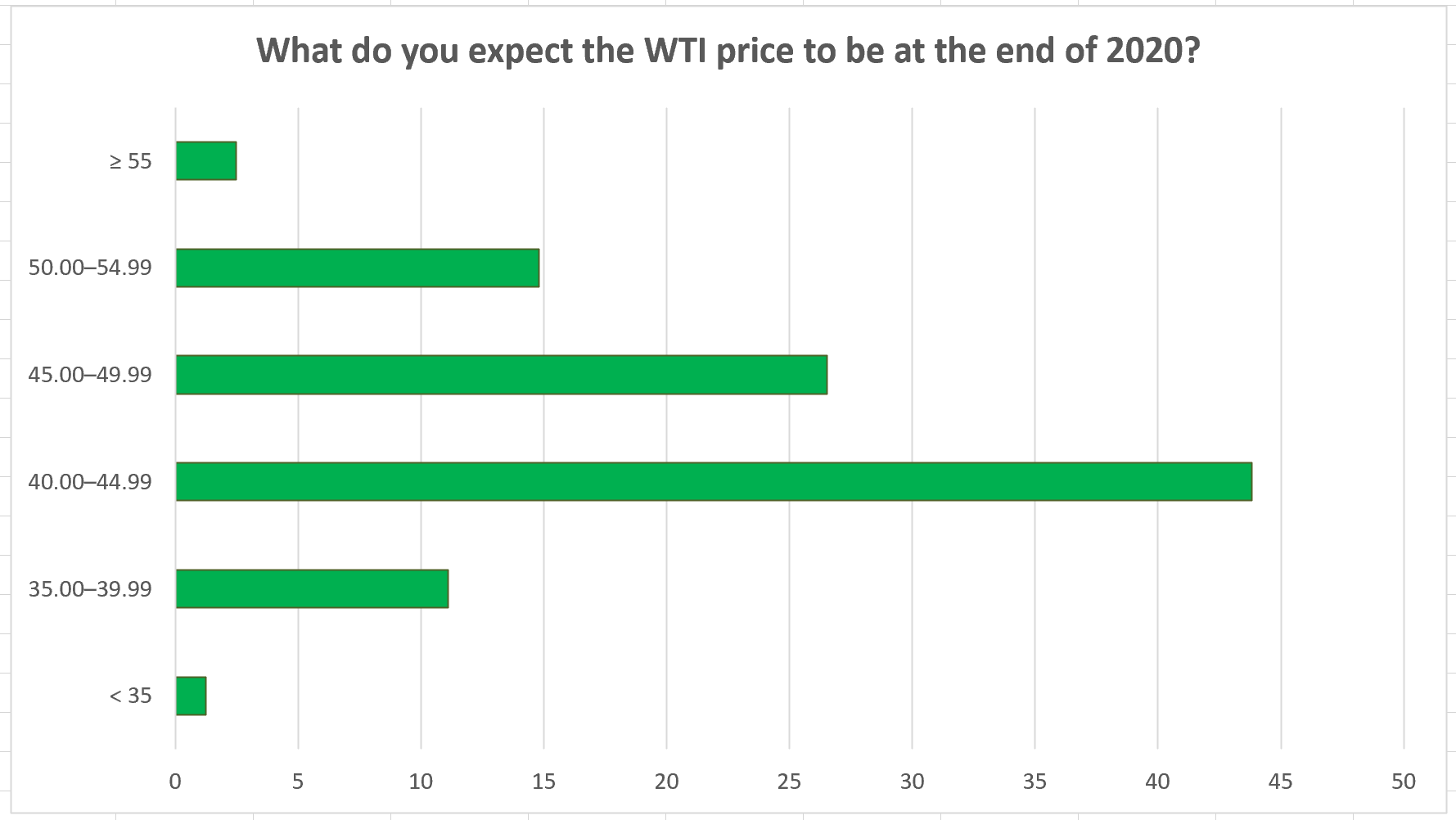

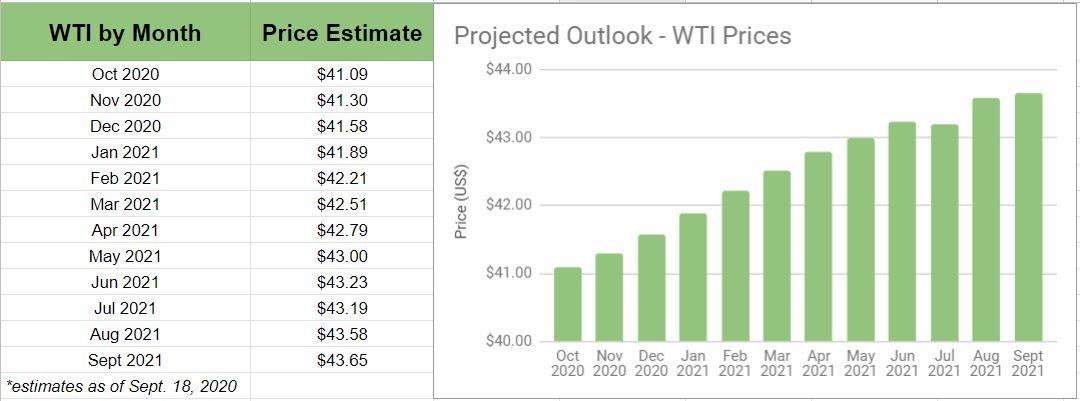

WTI Price Outlook

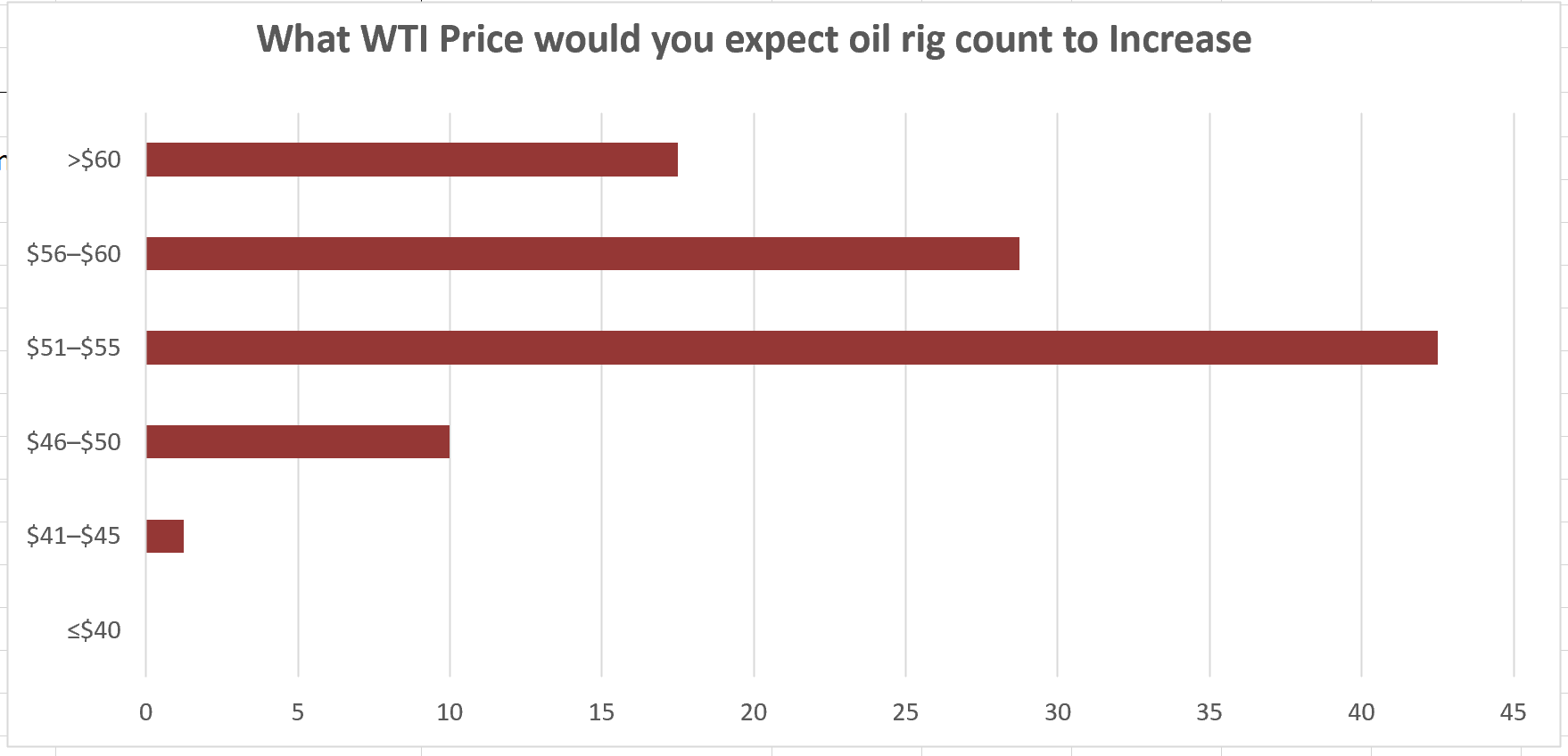

Rig Outlook: Majority Predict Increase at $50+/Barrel

As for rig count, 43% of executives believe rig counts will increase substantially if oil prices were $51–$55 per barrel.

Per the commodity price outlook charts further below, projections through September 2021 are hovering between $41-$43/barrel.

However, 29% executives anticipate growth at a higher $56–$60 per barrel and 18% at above $60/barrel.

Only 11% percent believe the rig count would rise with prices at or below $50.

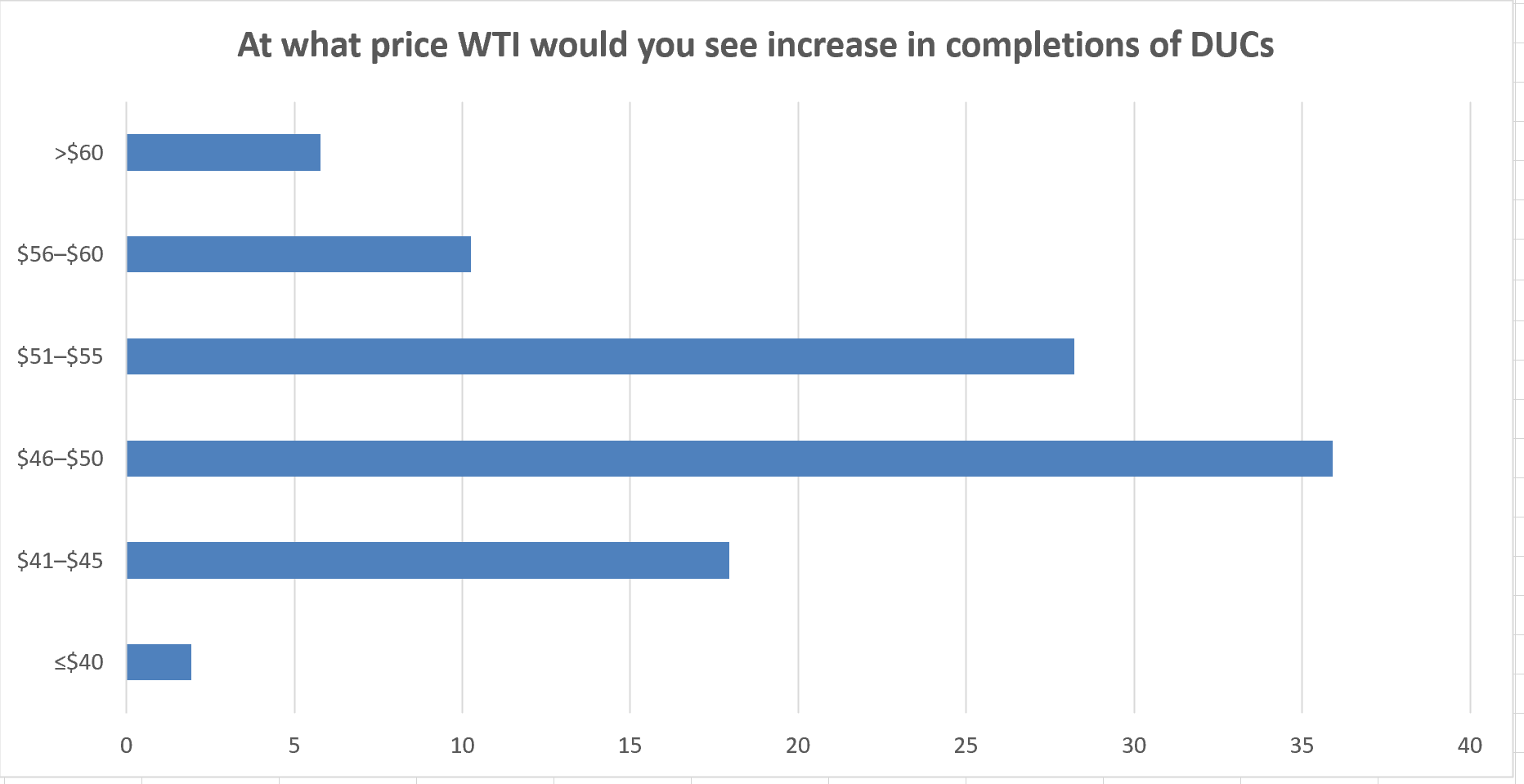

Completions & DUCs

A 36% majority expect an increase in DUC completion activity at $46–$50 per barrel. The next most popular option was $51-55/barrel, with 28% choosing that metric.

In the middle group, 18% predicted $41–$45 a barrel and 16% responded at or above $56/barrel. Only two percent expect a substantial increase at below $40 a barrel.

We are already seeing signs of this with the weekly increase of the US. frac fleets.

Commodity Pricing Key Factor

The survey also shed light on what commodity price points will be needed to fuel an increase in rig deployment and D&C activity (including DUCs) - see charts further below.

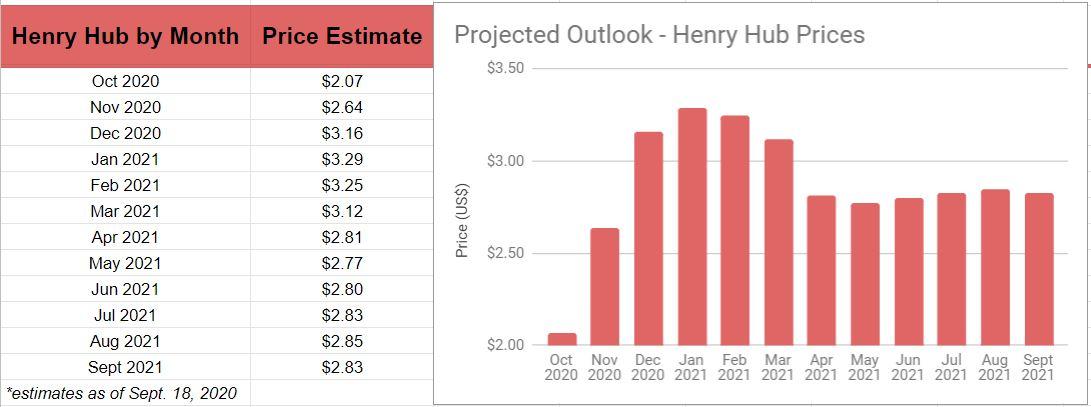

Below is the outlook for WTI and Henry Hub prices through September 2021:

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Gulf Coast - South Texas News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020