Drilling / Well Results | Quarterly / Earnings Reports | First Quarter (1Q) Update | IP Rates-30-Day | Capital Markets | Capital Expenditure | Drilling Activity | Drilling Program-Rig Count

Noble's Production Only Up +7%; DJ Basin Record Muffled by 38% Eagle Ford Drop

Noble Energy reported its Q1 2019 results. Here are the highlights.

Total Production Growth Meager Despite Record DJ Basin Output

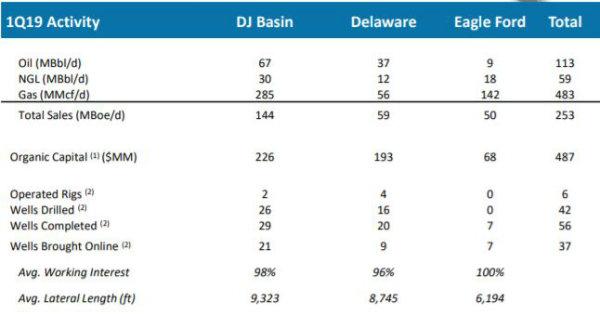

Despite this large increase in DJ Basin output as well as a 30% increase in Delaware Basin production, Noble's total US output was only 253 MBoe/d, an increase of only +7% from 1Q18.

This is likely due to the drop in Eagle Ford output, which was down 30% YOY.

- DJ Basin Production Record: Achieved 144 MBoe/d, an increase of 21% from 1Q18

- Delaware Basin: Achieved 59 MBOEPD - up 30% YOY

- Eagle Ford: 50 MBOEPD - down -38% YOY

Rig Activity Down 33% YOY; Wells TIL Drops 16%

Across the U.S. onshore portfolio, the Company:

- Operated six rigs (2 DJ and 4 Delaware) - down 33% from 9 in 1Q18

- TIL 37 wells (21 DJ, 9 Delaware, 7 Eagle Ford) - down 16% from 1Q18

- Drilled 42 wells (26 DJ and 16 Delaware)

- Completed 56 wells (29 DJ, 20 Delaware, 7 Eagle Ford)

Delaware Well Results

During the first quarter, the Company brought online nine wells to production. The new wells generated an average IP-30 rate of 1,560 Boe/d (68% oil). Excluding two of these wells, which were drilled in the Company's southwest acreage for lease retention purposes, the IP-30 production average was 211 Boe/d per 1,000 lateral feet.

Q1 Spending Down 27% YOY Due to 'Reduced Well Costs'

First quarter 2019 organic capital investments attributable to Noble Energy included $487 million related to U.S. onshore upstream activities.

- This is down a sizable 27% from $671 million spent one year ago in Q1 2018.

The company noted that the lower than anticipated spending is a result of reduced well costs and facility expenditures.

Plans for 2019 Unchanged

The Company's full year capital expenditures guidance and sales volume expectations remain unchanged.

Sales volumes for the second quarter of 2019 are expected to be slightly higher than the first quarter, reflecting increased U.S. onshore production and relatively flat International volumes. The Company's second quarter sales volumes range is 332 to 347 MBoe/d. In the U.S. onshore, total production and oil volumes are expected to increase slightly from the first quarter, driven by an increased turn in-line well count in the DJ and Delaware Basins. The Company's second quarter TILs will drive a substantial increase in third quarter production. As guided earlier in the year, second half U.S. Onshore production is anticipated to be approximately 15% higher than the first half of the year.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

Gulf Coast News >>>

-

Crescent Energy Said to be in Advance Talks to Acquire Pure Play Permian, Vital Energy -

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

Gulf Coast - South Texas News >>>

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD