Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | Drilling Activity | 2020 Guidance

Northern Oil & Gas Second Quarter 2020 Results

Northern Oil and Gas, Inc. reported its Q2 2020 results.

Highlights:

- Total debt reduced by $52.2 million in the second quarter, resulting in over $3 million in interest savings per annum

- Strong risk management drove realized commodity hedge gains of $77.4 million in the second quarter

- Cash flow from operations totaled $53.1 million, excluding $48.5 million received from changes in working capital

- Total capital expenditures were $34.5 million in the second quarter

- Wells in process remain near record levels at 26.7 net wells

- Production averaged 23,804 barrels of oil equivalent ("Boe") per day, driven by material curtailments and shut-ins

- Approximately 26,500 barrels per day of remaining 2020 oil hedged at over $58 per barrel ("Bbl") average prices

- Approximately 21,500 barrels per day of 2021 oil hedged at over $54.50 per Bbl average prices

Nick O'Grady, Northern's Chief Executive Officer, said: "In one of the most challenging quarters for the oil industry in decades, Northern's unique, actively managed working-interest business model continues to deliver. Hedges protected cash flows despite the turmoil, and capital spending reductions were instituted rapidly. We continued to reduce our debt levels, and carefully and methodically have added to our portfolio to build for future growth and returns."

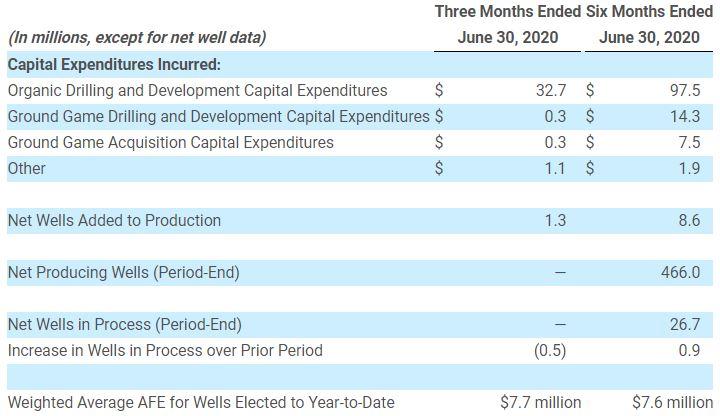

Capital Expenditures & Drilling

Capitalized costs are a function of the number of net well additions during the period, and changes in wells in process from the prior year-end. Capital expenditures attributable to the increase of 0.9 in net wells in process during the six months ended June 30, 2020 are reflected in the amounts incurred year-to-date for drilling and development capital expenditures.

Q2 Financials

Second quarter Adjusted Net Income was $10.7 million or $0.02 per diluted share. Second quarter GAAP net loss was $899.2 million or $2.17 per diluted share, driven in large part by non-cash items: a $762.7 million impairment expense and a $150.1 million mark-to-market loss on unsettled commodity derivatives. Cash flow from operations was $53.1 million in the second quarter, excluding $48.5 million received from changes in working capital. Adjusted EBITDA in the second quarter was $66.1 million.

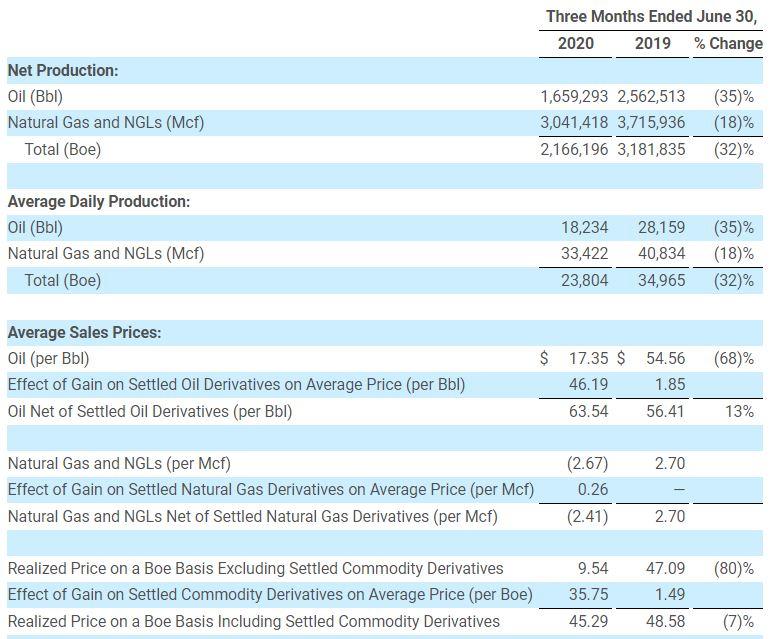

Production

Second quarter production was 23,804 Boe per day. Oil production represented 77% of total production at 18,234 Bbls per day. Production declined due to decisions by many of Northern's operating partners to shut-in or curtail production and defer development plans as a result of the low commodity price environment. Northern estimates that curtailments, shut-ins and delayed well completions reduced the Company's average daily production by approximately 16,800 Boe per day in the second quarter. Northern had only 1.3 net wells turned online during the second quarter, compared to 7.3 net wells turned online in the first quarter of 2020.

Pricing

During the second quarter, NYMEX West Texas Intermediate ("WTI") crude oil averaged $27.95 per Bbl, and NYMEX natural gas at Henry Hub averaged $1.70 per million cubic feet ("Mcf"). Northern's unhedged net realized oil price in the second quarter was $17.35, representing a $10.60 differential to WTI prices. Oil differentials were extremely wide in the month of May, but improved significantly in June. Northern's second quarter unhedged net realized gas price was $(2.67) per Mcf, representing approximately (157)% realizations compared with Henry Hub pricing. The dislocation in natural gas and NGL prices was due to physical storage constraints, which created negative pricing for NGL products as demand collapsed due primarily to the COVID-19 pandemic. Higher compression, gathering, and processing charges that were in excess of natural gas and NGL sales prices additionally contributed to negative realized pricing.

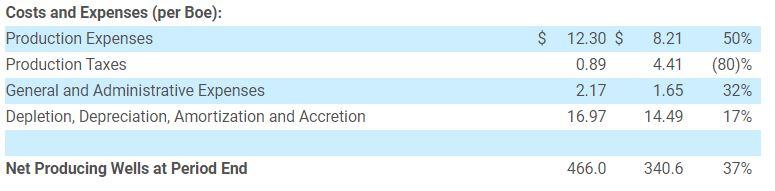

Operating Costs

Lease operating costs were $26.6 million in the second quarter of 2020 compared to $37.3 million in the first quarter of 2020 driven by a 46% reduction in production volumes, partially offset by increased processing and salt water disposal costs. Northern expects further cost reductions will be realized in the third quarter. Second quarter general and administrative ("G&A") costs totaled $4.7 million, which includes non-cash stock-based compensation. Cash G&A expense totaled $3.5 million or $1.61 per Boe in the second quarter versus $3.8 million in the first quarter of 2020, primarily due to lower professional fees.

Capital Expenditures & Acquisitions

Capital spending for the second quarter was $34.5 million, made up of $32.7 million of organic D&C capital and $1.8 million of total acquisition spending and other, inclusive of ground game D&C spending. As mentioned above, Northern added 1.3 net wells to production in the second quarter, and wells in process ended at 26.7 net wells. On the ground game acquisition front, Northern closed on three transactions during the second quarter totaling 0.2 net wells and 124 net mineral acres.

Northern has previously announced several third quarter acquisitions. Subsequent to the closing of the second quarter, Northern has agreed to acquire or acquired 0.7 net producing wells, 3.9 net wells in process, and approximately 763 net acres for a total consideration of $4.6 million and 2.95 million shares of common stock, with an additional 0.45 million shares contingent on continued operation of the Dakota Access Pipeline. Pro forma for the closing of these transactions, Northern anticipates wells in process as of July 31, 2020, to total 30.3 net wells. Year to date, Northern's ground game acquisitions that have been committed to or closed have contributed a total of 8.4 net wells that are either producing or in process, and added 1,852 net acres.

Liquidity & Capital

As of June 30, 2020, Northern had $1.8 million in cash and $568.0 million outstanding on its revolving credit facility. As previously announced, Northern completed a semi-annual borrowing base redetermination under its revolving credit facility on July 8, 2020, with the borrowing base set at $660.0 million. Pro forma for the new borrowing base, Northern had total liquidity of $93.8 million as of June 30, 2020, consisting of cash and borrowing availability under the revolving credit facility.

As of June 30, 2020, Northern had additional debt outstanding consisting of a $130.0 million 6% Senior Unsecured Note and $297.3 million of 8.5% Senior Secured Notes. During the second quarter, Northern strengthened its balance sheet through several agreements with noteholders, which resulted in $30.2 million in principal amount of the 8.5% Senior Secured Notes being retired.

Since the end of the second quarter, Northern has entered into additional agreements that, when closed, will reduce the principal amount of the 8.5% Senior Secured Notes by an additional $4.0 million and reduce the liquidation value of its outstanding Preferred Stock by $7.6 million.

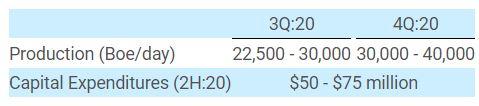

2020 Guidance

Northern is beginning to see a slow but steady return of curtailed and shut-in production to sales since the end of the second quarter. Northern projects production of 22,500 - 30,000 Boe per day in the third quarter and 30,000 - 40,000 Boe per day in the fourth quarter. Total capital expenditures are currently expected to be approximately $50 - 75 million in the second half of 2020, inclusive of ground game and acquisitions. This guidance assumes only 3.6 net wells turned in line in the second half of 2020. Northern reiterates its previous guidance for total 2020 capital spending of $175 - 200 million, with a reserve completion budget of $50 million.

2021 Outlook

Looking out to 2021, Northern expects to benefit from carrying a near record number of wells in process ("WIP"). As of July 31, 2020, Northern had 28.6 net WIPs including approximately 6 net wells completed but not turned in line, and management projects its WIP count to exceed 30 net wells by year-end 2020. Northern's ability as a non-operator to continue to build high quality inventory, despite an 80% reduction in the Williston rig count, is a testament to the active management of its capital development program.

Northern's base case for 2021 presupposes that production curtailments will continue to subside and that completion activity will steadily increase starting late in the fourth quarter of 2020. Under this scenario, Northern expects to see production approaching 40,000 Boe per day by early 2021, nearing volume levels seen in early 2020. Furthermore, given the Company's continued success on the ground game front, which continues to build the number of wells in process to near record levels, Northern forecasts that this level of production should be maintained throughout the remainder of 2021 on a capital budget of approximately $190 - 240 million. Under this scenario, Northern sees both Adjusted EBITDA and free cash flow at similar or higher levels to 2020, despite lower hedge values at recent strip prices.

Given the volatility in the sector, significant uncertainty remains and actual results will be driven by the timing of curtailments and shut-ins returning to sales, completed wells turned to sales and wells in process being completed and producing. Northern's downside case, which assumes a slower WIP completion pace and little new drilling activity, would be expected to drive $40 - $60 million of lower capital spending but still generate production in excess of 35,000 Boe per day for 2021.

Hedging

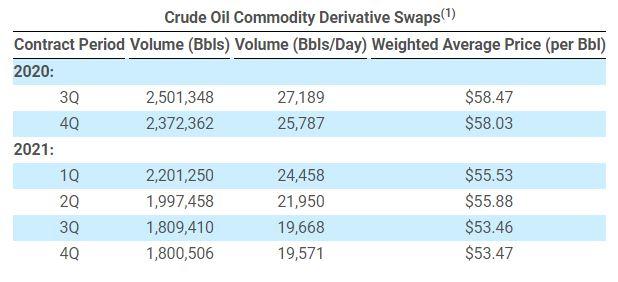

Northern hedges portions of its expected production volumes to increase the predictability of its cash flow and to help maintain a strong financial position. The following table summarizes Northern's open crude oil commodity derivative contracts scheduled to settle after June 30, 2020.

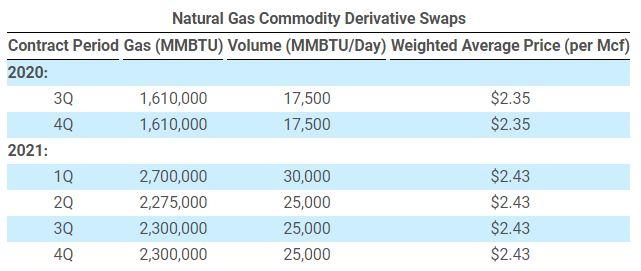

The following table summarizes Northern's open natural gas commodity derivative contracts scheduled to settle after June 30, 2020.

Acreage

As of June 30, 2020, Northern controlled leasehold of approximately 182,899 net acres targeting the Bakken and Three Forks formations of the Williston Basin, and approximately 90% of this total acreage position was developed, held by production, or held by operations.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Rockies News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

Williston Basin News >>>

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Civitas Provides Update on Current Rigs & Frac Crews -