Top Story | Deals - Acquisition, Mergers, Divestitures

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push

Occidental Petroleum is in advanced talks to sell its chemical subsidiary, OxyChem, in a transaction that could raise at least $10 billion. According to reuters.

The company has spent the past year underlining a single message to investors: deleveraging remains the top priority.

Debt Burden Still Heavy

At midyear 2025, Occidental reported $23.3 billion in long-term debt, with subsequent repayments in July trimming the principal balance to ~$21.4 billion. The company has consistently told investors it is targeting less than $15 billion in principal debt outstanding as a strategic threshold.

Asset sales and warrant proceeds have been central to this effort. By April, Oxy had already retired $2.3 billion of debt year-to-date, including using $890 million from Berkshire Hathaway warrant exercises. But the balance sheet remains among the heaviest in the sector, and interest expense continues to erode cash flow.

A $10 billion OxyChem divestiture, if largely directed to debt reduction, would bring Oxy within striking distance of its debt goal years ahead of schedule. That could cut annual interest expense by hundreds of millions and reshape its capital allocation flexibility.

What They’d Be Giving Up

OxyChem has been a steady cash generator, contributing $185 million of pre-tax income in Q1 2025 and $213 million in Q2. The unit provides counter-cyclical ballast to Oxy’s upstream-heavy portfolio, smoothing earnings when commodity prices weaken.

Selling it would tilt Oxy even more heavily toward oil and gas E&P earnings, raising cash flow volatility and increasing reliance on Permian performance and commodity pricing. For executives, that’s the trade-off: less diversification, more torque.

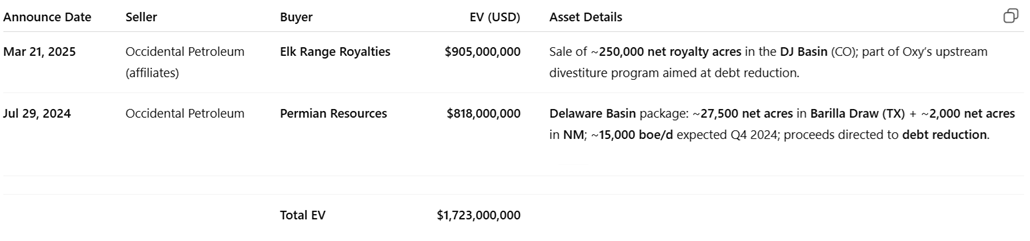

A String of Asset Sales Sets the Stage

The OxyChem sale would follow a series of significant upstream and mineral divestments:

Why This Matters

Oxy’s possible OxyChem divestiture is emblematic of a portfolio discipline trend. Rather than riding out cycles, Occidental is actively reshaping itself:

-

Debt reduction first — Every asset sale has been funneled toward cutting leverage.

-

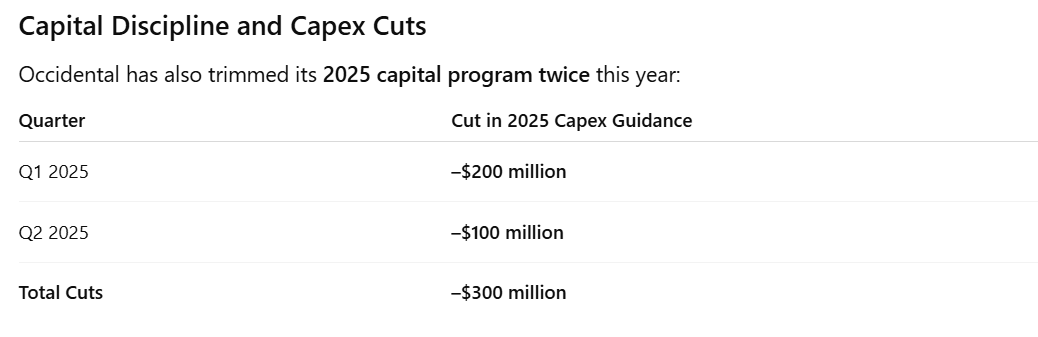

Capital restraint — $300 million trimmed from capex in just two quarters.

-

Portfolio focus — Monetizing chemicals and non-core E&P assets to sharpen exposure to core oil and gas operations.

If the OxyChem deal closes near $10 billion, Occidental could achieve its debt target, slash interest costs, and enter 2026 in a leaner, more E&P-focused posture. The price will be losing a steady, less cyclical source of earnings — but for a company still carrying $21+ billion in debt, the trade-off may be worth it.

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta