Occidental Petroleum is shopping around its Uinta Basin asset as part of its initiative aimed to cut debt following its $B mega-acquisition of Anadarko Petroleum Corp., according to a report by Reuters.

The Uinta Basin property being sold was one of the assets Oxy acquired in the Anadarko deal. A sale of the asset could fetch up to $240 million, according to the report.

Asset Details

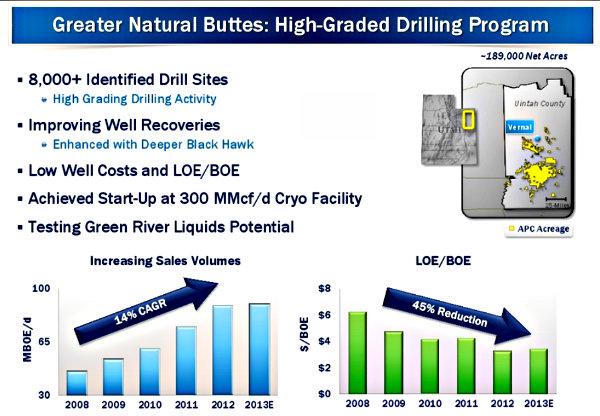

The asset is located in Uintah County, Utah and spans ~189,000 net acres.

Activity on the acreage has been quiet in recent years (the asset has not seen any drilling activity since 2016).

Oxy declined to comment on the report.

Related Categories :

Deals - Property For Sale

More Deals - Property For Sale News

-

PE-Backed Permian E&P to Sell for $4.0 Billion -

-

E&P Sells Eagle Ford Property for $100 Million; 22,000 Net Acres -

-

PE-Backed Haynesville E&P Mulling Asset Sale Worth $2.0 Billion -

-

Chevron Looking to Sell Eagle Ford For Billions: Map Inside -

-

Eagle Ford Operator with 71,000 Net Acres Looking for Buyer; Map Inside -

Rockies News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

Rockies - Piceance/Uinta News >>>

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Civitas Provides Update on Current Rigs & Frac Crews -