Transwestern Pipeline Company, LLC (Transwestern), a subsidiary of Energy Transfer LP (NYSE: ET), has announced the launch of a binding open season for its Desert Southwest Expansion Project. The project will deliver Permian Basin natural gas to growing demand centers across New Mexico and Arizona, with an open season running from September 26 to October 25, 2025.

The expansion is designed as a 516-mile, 42-inch pipeline supported by additional compression and metering facilities, creating up to 1.5 Bcf/d of new takeaway capacity. The project is underpinned by long-term commitments from investment-grade shippers, with additional capacity expected to be fully subscribed during the open season.

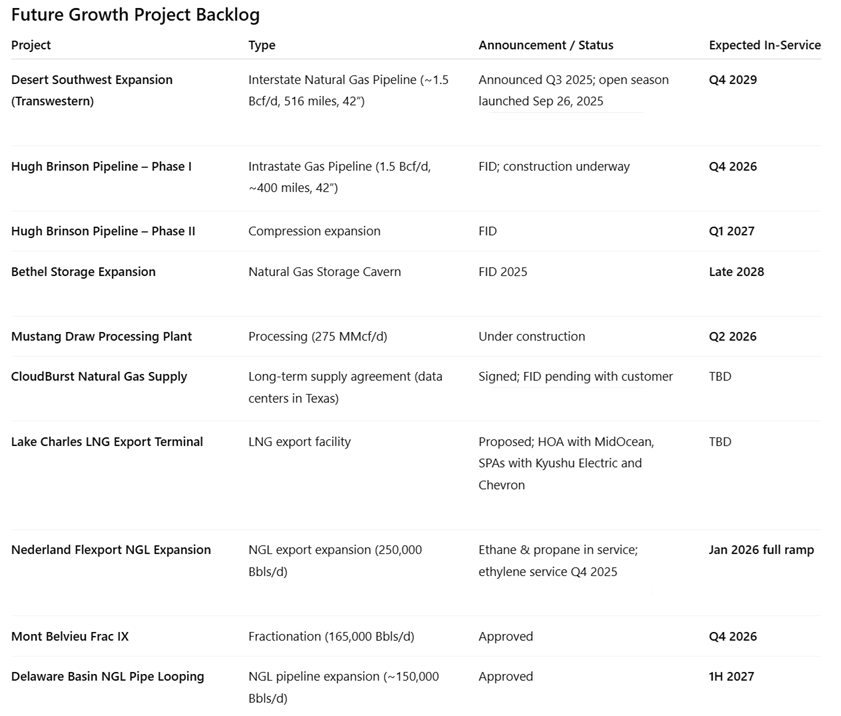

Energy Transfer estimates a $5.3 billion capital investment, with more than 85% of spend occurring in 2027 and beyond. Subject to regulatory approvals and permitting, the Desert Southwest Expansion is expected to be in service by Q4 2029.

Strategic Rationale

The Desert Southwest Expansion provides a new long-haul natural gas corridor, strengthening Energy Transfer’s interstate network while addressing rising power demand, population growth, and data center development in the region. It positions Transwestern as a critical link between Permian supply growth and the energy needs of utilities and industrial consumers in Arizona and New Mexico.

Key Project Highlights

-

Binding open season: September 26 – October 25, 2025

-

Capacity: ~1.5 Bcf/d of firm transportation

-

Scope: 516 miles of 42-inch pipeline, compression, and metering

-

Investment: ~$5.3 billion (including ~$0.6B AFUDC)

-

Status: Supported by binding commitments; additional capacity expected to be fully contracted

-

Target in-service: Q4 2029

Related Categories :

Top Story

More Top Story News

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta