Drilling & Completions | Quarterly / Earnings Reports | First Quarter (1Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity | Capital Expenditure - 2021

PetroShale First Quarter 2021 Results

PetroShale Inc. reported its Q1 2021 results.

Highlights:

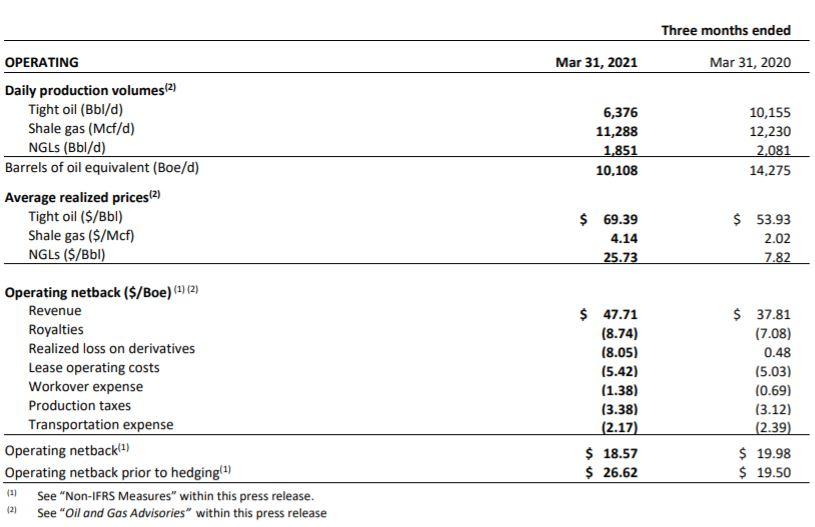

- PetroShale's first quarter 2021 production averaged 10,108 BOEPD, 17% lower than the previous quarter, reflecting the impact of natural declines, limited capital investment in the fourth quarter of 2020 and temporary shut-ins following operated and non-operated well workover activity.

- Revenue from petroleum and natural gas sales totaled $43.4 million during the period, representing a 16% increase over the fourth quarter of 2020. Stronger revenue was supported by meaningfully higher price realizations across all product types, including a quarter-over-quarter price increase of 29% for crude oil, 59% for natural gas and 97% for natural gas liquids.

- Adjusted EBITDA1 totaled $15.1 million ($0.08 per fully diluted share) in the first quarter of 2021, in-line with the preceding quarter, while cash provided by operating activities of $15.9 million was 19% higher than in the fourth quarter 2020.

- Operating netback prior to hedging1 was $26.62 per Boe in the first quarter of 2021, an increase of 50% over the prior quarter and 37% higher than the comparable period of 2020, with the year-over-year change due primarily to higher revenue per Boe, partially offset by higher royalties and a realized hedging loss.

- Net debt1 was reduced by approximately $8.6 million in the first quarter of 2021 relative to year end 2020, exiting the quarter at $318.3 million at March 31, 2021. Subsequent to quarter end, PetroShale closed a transformative transaction which reduced net debt by $133.1 million to $185.2 million (pro forma to March 31, 2021) and enhances its financial flexibility, as described more fully below.

- Net capital expenditures in the period were $2.1 million, fully funded from operating cash flows, and largely directed to operated and non-operated well workover activities as well as facilities expansion. The Company's focus remains on maintaining and optimizing production, and generating free cash flow to reduce debt, thereby preserving long-term value and balance sheet strength in continued volatile market conditions.

- Operating expenses per Boe remained low at $10.18, compared to $8.84 in the comparable period in 2020. Transportation expenses of $2.17 per Boe declined over the first quarter of 2020 due to lower production volumes.

- Net loss totaled $42.6 million ($0.23 per fully diluted share) in the first quarter, reflecting lower total revenue year-over-year, realized and unrealized losses on financial derivatives and a one-time non-cash loss on the modification of preferred shares related to the transformative transaction, described more fully below.

Recent Events

- On April 8, 2021, the Company closed its previously announced transformative recapitalization which included a rights offering, a private placement and the conversion of the Company's Preferred Shares to common equity, which have significantly improved PetroShale's sustainability and financial flexibility while simplifying the balance sheet. The transaction was comprised of the following key components:

- A rights offering to all shareholders, affording the right to acquire additional common shares at $0.20 per share, along with a private placement of common shares also at $0.20 per share to significant shareholders of PetroShale, collectively raising $30.0 million of new equity;

- The conversion to common shares of all preferred shares outstanding at a price of $0.60 per share, resulting in annual cash savings of approximately US$7.8 million of Preferred Share dividend payments; and

- PetroShale's senior lenders agreed to maintain the current borrowing base at US$177.5 million until May 2022 and to extend the credit facility maturity to June 2023, subject to certain conditions.

The company commented: "Although the economic impacts of the COVID-19 pandemic continue, optimism has started to return to the markets as vaccinations increase globally. In concert, positive momentum has been exhibited in the short and longer-term fundamentals for both crude oil and natural gas prices as the world begins to restart following what is believed to be the worst of the COVID-19 pandemic. Relative to the previous quarter, stronger benchmark prices positively impacted first quarter revenue, operating netbacks before hedging2, and cash provided by operating activities which were somewhat offset by lower production volumes given natural declines and wells being shut in for workovers. PetroShale's first quarter 2021 production averaged 10,108 Boe/d, 17% lower than the previous quarter and indicative of the low level of capital invested in the first quarter.

"With the lower activity levels and lower production, absolute operating expenses and transportation expenses were lower in the first quarter compared to the previous quarter and the same period of the prior year. Operating expenses per Boe (not including workover and production taxes) were moderately higher, reflecting fixed costs on lower volumes, and transportation costs per Boe are moderately lower. We invested $2.1 million in a limited capital program during the period which was funded with internal cash flows and directed to operated and non-operated well workover activities and facilities expansion. Going forward, we will continue prioritizing the management of capital expenditures in accordance with the broader commodity price environment. As a result of the more constructive pricing environment, PetroShale expects to prudently increase our capital activity levels for the balance of the year, developing several of our high return assets to fulfill our objective of maintaining our average annual production levels while generating free cash flow to continue to reduce net borrowings.

"Through our transformative transaction, PetroShale has successfully simplified our balance sheet, and set the stage for significant cash savings going forward, which are estimated at approximately US$8.9 million per year from Preferred Share dividends and loan interest.

"While timing for a full recovery from the COVID-19 pandemic remains uncertain, PetroShale's highest priority remains on ensuring the health and safety of employees and stakeholders. The Company's adherence with sound environmental, social and governance ("ESG") practices remains intact, driving our commitment to conduct operations safely, efficiently and in a manner designed to minimize environmental impact wherever possible. In addition, we have implemented several operational and financial improvements along with continued risk mitigation strategies to support the Company through this period of volatility. These initiatives include a reduction in discretionary capital expenditures, streamlining operating costs and lowering general and administrative expenses, in addition to actively hedging commodity prices through 2021 and 2022. "

Capex & Production Outlook

For calendar year 2021, we are forecasting total capital investment of approximately $50 to $60 million, with the majority allocated approximately equally through the latter part of the second quarter and the third quarters of 2021. As a result, we expect an associated production response to be realized commencing in the third quarter of 2021. Based on our 2021 capital program, PetroShale expects to maintain production volumes between 10,500 Boe/d and 11,500 Boe/d[2] on average during the year, and forecasts generating free cash flow at current market commodity prices.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

Canada News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -