Service & Supply | Oilfield Services | Frac Markets - Pressure Pumping | Frac Markets - Frac Trends

Pressure Pumper Keane Optimistic, Insulated by Blue Chip Customers

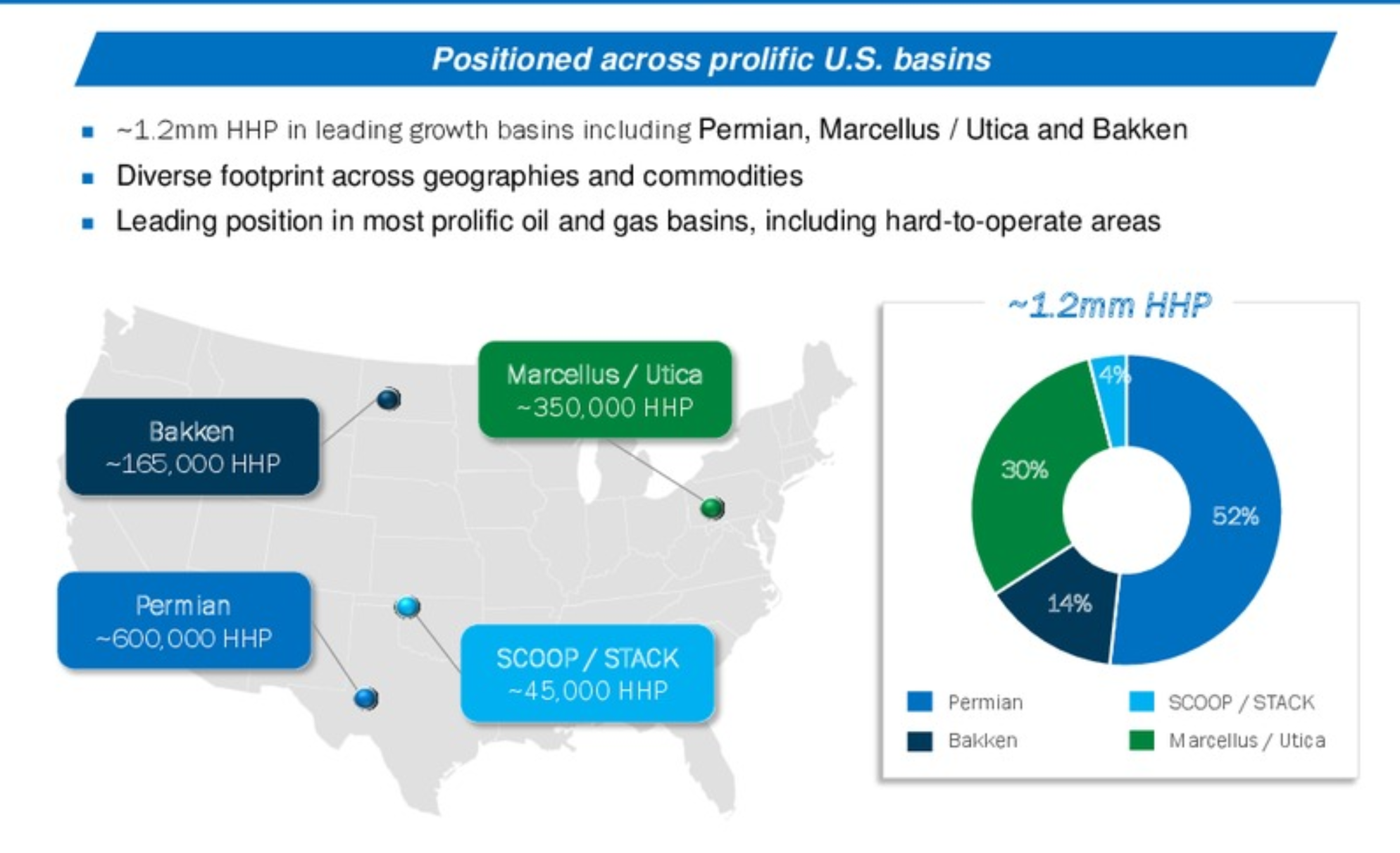

Keane Group, which operates frac fleets in the Marcellus/Utica, Anadarko Basin, Permian and Bakken, reported its 2Q 2018 operational updates.

Unlike others, Keane was rather upbeat about the company activity throughout this year. Here is what the company had to say.

"While we’ve heard a lot about potential takeaway issues, we’re yet see them manifest into any current or no material impact to our business and our customers. We remain in active dialogue with each of our customers and we’re hearing consistent message and response. They have not changed plans and have communicated to us that they have adequate takeaway capacity in place. So that’s what we’re seeing and hearing today.

"Turning now to our feet overview, we averaged 26.3 hydraulic fracturing fleets during the second quarter of 2018, maintaining full utilization throughout the quarter and exiting the period with 27 deployed fleets. We continue to be pleased with how we're positioned from an operating footprint perspective. Today, approximately 50% of our horsepower is deployed in the Permian; roughly 35% of our fleet is working in the Marcellus/Utica; with the remaining 15% operating in the Bakken and Eagle Ford."

Acquisition

"Turning now to M&A. We acquired approximately 90,000 hydraulic horsepower from Refinery Specialties in a deal that we closed last week. Total consideration for the transaction was $34.6 million or roughly 400 hours per horsepower. This equipment is high quality, well-maintained, fit for duty across Keane's operating footprint and has been operating at low utilization levels in the North Eagle Ford. The acquired equipment will be deployed in three strategic ways."

Guidance

"Turning now to our outlook. For the third quarter, we expect deployed hydraulic fracturing fleets to average 27 fleets, while we work to integrate the newly acquired assets and enable the reactivation of the partially damaged fleet, targeted for the end of the third quarter.

"Looking ahead, we acknowledge there could be a period in which the Permian faces a temporary shortage in takeaway capacity, resulting in what we have describe as an air pocket for the broader U.S. energy market. The key questions in this potential scenario are, what is the magnitude of the shortfall and how long does it last? Complicating the discussion are the many factors and influence the ultimate impact to the industry and its timing, including alternative methods of transportation like potential reallocation of activity to other basins, company-specific completion decisions and other factors. At the same time new pipeline capacity is underdevelopment and is expected to come online throughout 2019 and 2020. We believe it is important to consider the situation in the context to these many variables. In all scenarios, we view this Permian takeaway situation, like the others we've faced, to be transitory. We remain bullish on the market overall, and are optimistic about how Keane is positioned for both the near and long term.

Sample list of Customers (Source: Shale Experts FRAC Database)

- Hess (bakken focused)

- Encana

- Cabot

- EQT

- Marathon

- Chevron

To get a Full list of Customers, contact us about our FRAC Database

Areas of operations

Related Categories :

Frac Markets

More Frac Markets News

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Halliburton Warns of Deepening U.S. Frac Slowdown

-

Intel Bits : E&P Operators Cut Frac Crews/ Rigs For Remainder of 2025; A Detailed Look -

-

Liberty Energy Reducing Frac Fleets As Market Activity Slows; Talks 2025 -

-

Service Companies Talk Bleak Outlook for Remainder of 2024 -

Mid-Continent News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -