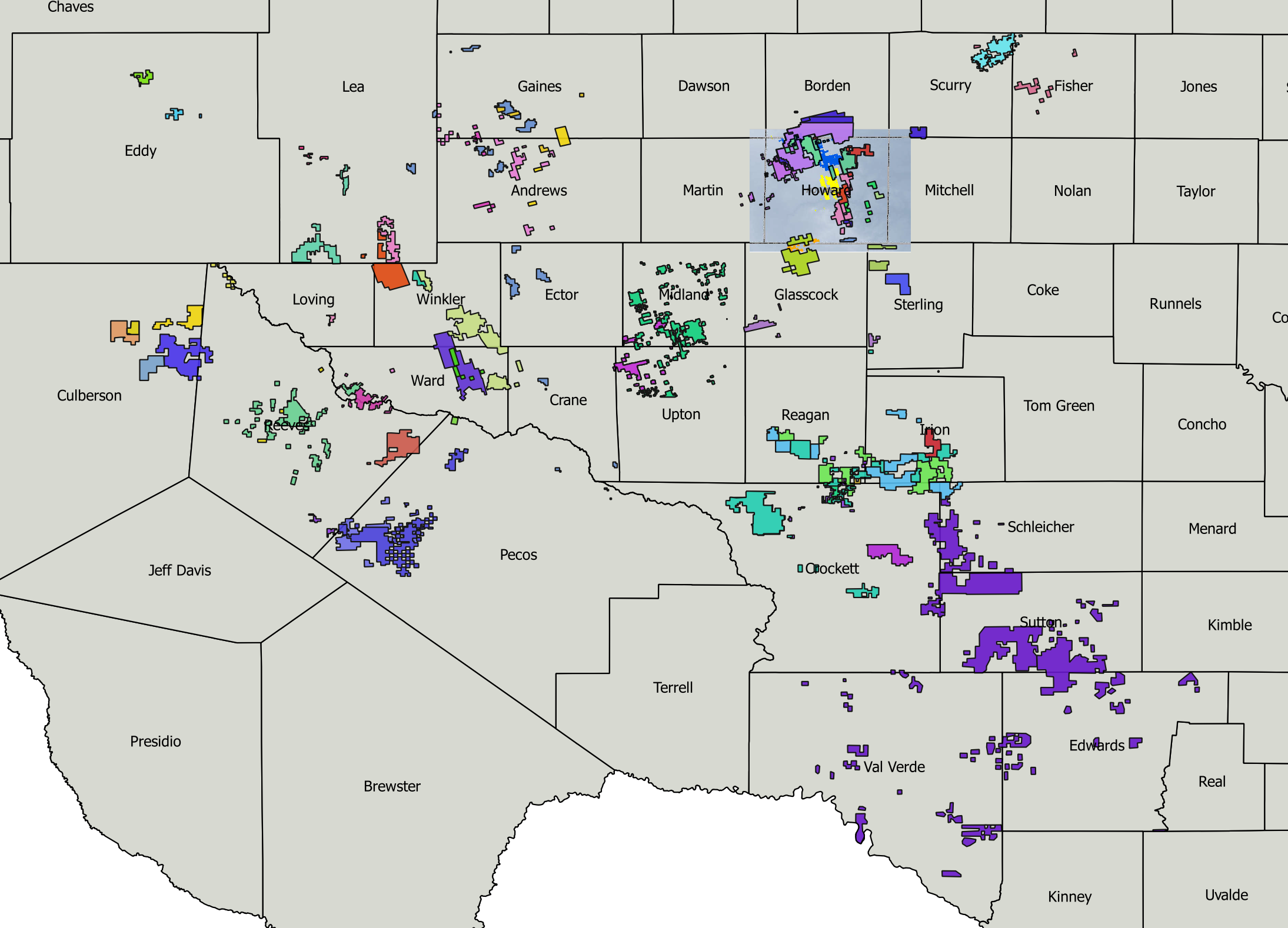

Map - Operator Asset | Deals - Acquisition, Mergers, Divestitures

Private Equity E&Ps;: Whose Permian Portfolio Will Attract the Next Big Deal?

We have seen a huge upswing in Permian deals over the last couple of months, with many of them involving PE-backed E&Ps.

Below, we have mapped the assets held by these private E&Ps.

It is likely that one or more of these areas will attract companies who are looking to make near-term acquisitions.

For more maps, click here to access Shale Experts Mapping Database

Related Categories :

Map - Operator Asset

More Map - Operator Asset News

-

Canadian Spirit Mulling Strategic Alternatives for Montney Asset

-

EOG Touts New Permian Land Zone; Wolfcamp, Third Bone Spring -

-

Roan Resources Receives 'Multiple' Buyout Offers

-

EOG 1Q 2018 Eagle Ford Shale Highlights; EOR, More Rigs; Frac Design -

-

Delaware Basin E&P To Add 3 Rigs By October 2016 -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020