Exploration & Production | Top Story | Bankruptcy / Restructure Update | Capital Markets

Quicksilver Resources Files Chapter 11

Quicksilver Resources Inc. has announced that the Company and its U.S. subsidiaries Barnett Shale Operating LLC, Cowtown Drilling, Inc., Cowtown Gas Processing L.P., Cowtown Pipeline Funding, Inc., Cowtown Pipeline L.P., Cowtown Pipeline Management, Inc., Makarios Resources International Holdings LLC, Makarios Resources International Inc., QPP Holdings LLC, QPP Parent LLC, Quicksilver Production Partners GP LLC, Quicksilver Production Partners LP, and Silver Stream Pipeline Company LLC each filed a voluntary petition under chapter 11 of title 11 of the United States Code in the United States Bankruptcy Court for the District of Delaware.

Quicksilver's Canadian subsidiaries were not included in the chapter 11 filing and will not be subject to the requirements of the U.S. Bankruptcy Code. Quicksilver Resources Canada Inc. has reached an agreement with its first lien secured lenders regarding a forbearance for a period up to and including June 16, 2015 of any default under QRCI's first lien credit agreement arising due to the chapter 11 filing. The company does not anticipate that U.S. and Canadian operations will be interrupted as a result of the chapter 11 filing.

Glenn Darden, Quicksilver's Chief Executive Officer said: "Quicksilver's strategic marketing process has not produced viable options for asset sales or other alternatives to fully address the company's liquidity and capital structure issues. We believe that chapter 11 provides the flexibility to accomplish an effective restructuring of Quicksilver for its stakeholders."

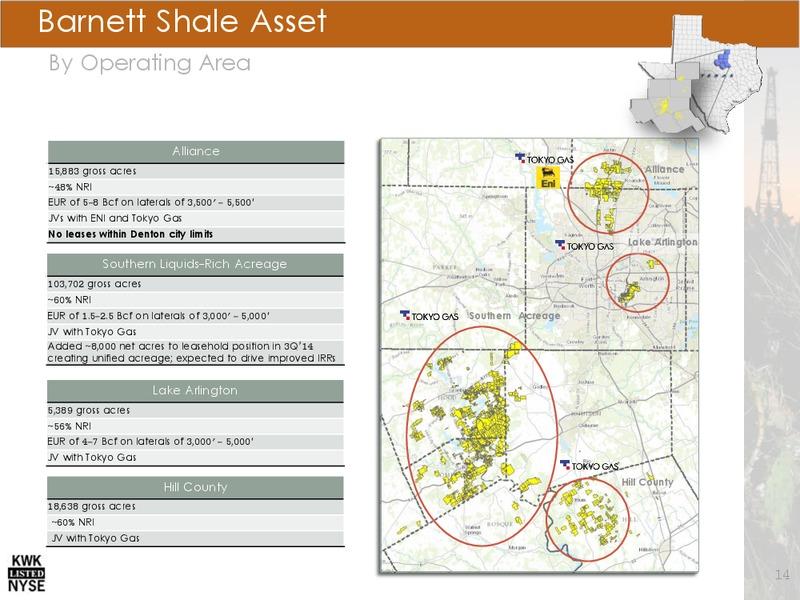

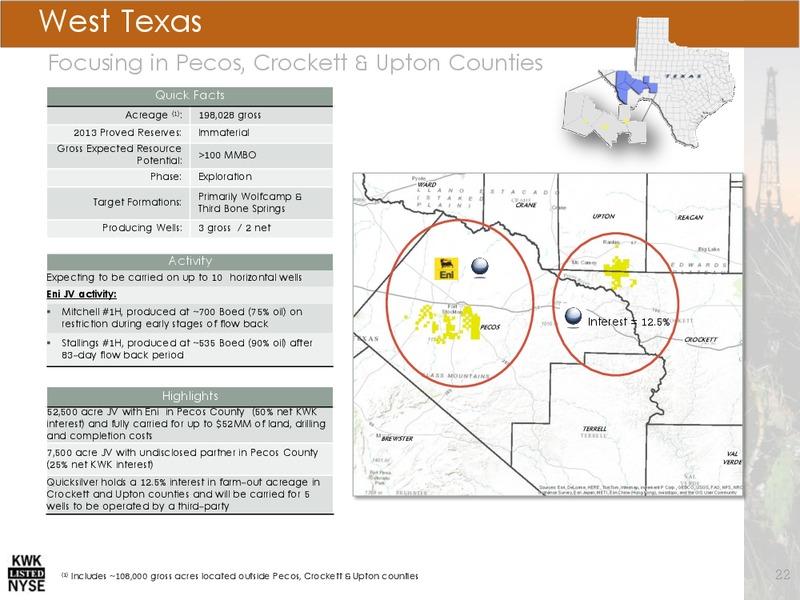

Quicksilver's Assets:

US Assets:

Canada:

Quicksilver has filed a series of motions with the Court to ensure the continuation of normal operations, including requesting Court approval to continue paying employee wages and salaries and providing employee benefits without interruption.

The Company has also asked for authority to continue honoring royalty obligations, working interest obligations, and other obligations related to oil and gas leases. The Company expects that the Court will approve these requests.

During the chapter 11 process, suppliers will be paid in full for all goods and services provided after the filing date as required by the Bankruptcy Code.

Related Categories :

Bankruptcy / Restructure Update

More Bankruptcy / Restructure Update News

-

ION Geophysical Files for Bankruptcy

-

Vista Proppants Emerges from Bankruptcy; Rebrands as V SandCo LLC

-

Gulfport Energy Emerges from Bankruptcy

-

HighPoint Resources' Bankruptcy Plan Approved by the Courts

-

HighPoint Files Chapter 11 Ahead of Merger with Bonanza Creek

Canada News >>>

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

Permian News >>>

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -