General News | Top Story | Private Equity | Capital Markets

Report: Petronas Mulling Buying Permian E&P DoublePoint Energy

Malaysia's Petronas is in talks to possible acquire Permian player DoublePoint Energy, according to a report by Bloomberg.

Citing people familiar with the matter, the report noted that the talks were spurred in part by Chevron's pending multi-billion dollar takeover of Noble Energy (announced on July 20, 2020).

If a deal were to be struck, it would be valued in the billions.

Neither Petronas or DoublePoint would comment on the matter.

This would not be the first time sales rumors have surrounded DoublePoint. Back in February 2019, the company reportedly mulling a potential sale of the company. Ultimately, no deal ever came to fruition.

DoublePoint's Assets / Recent Activity

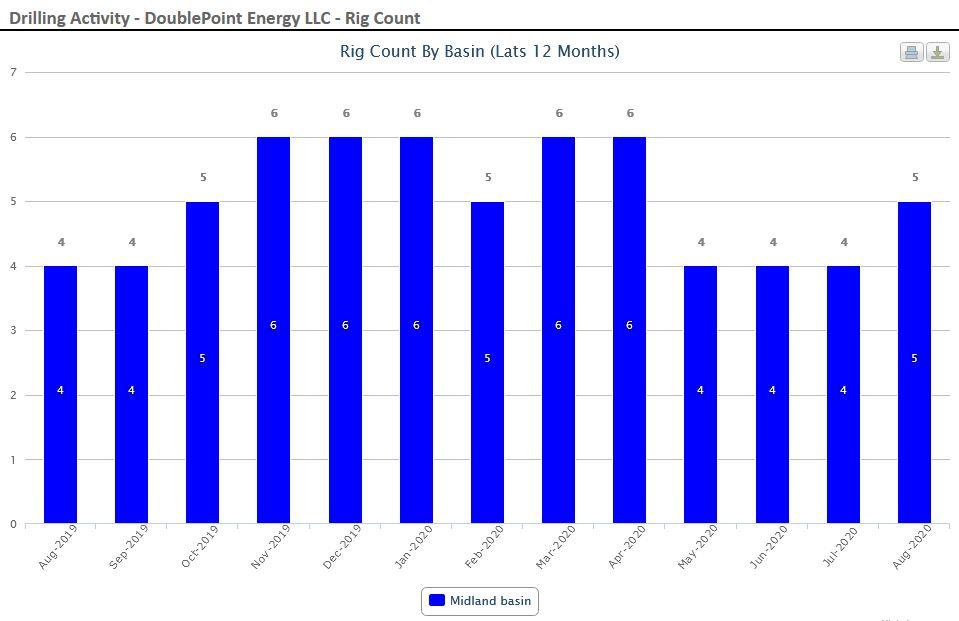

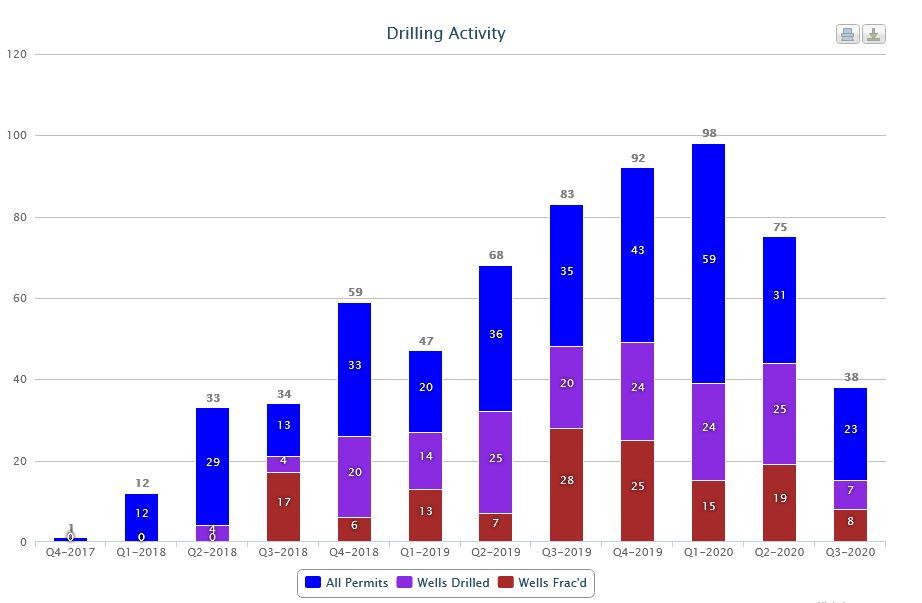

The company's position is concentrated in the Midland Basin area of the Permian.

Recent Rig ActivityRelated Categories :

Deals/ Transaction Update

More Deals/ Transaction Update News

-

PE-Backed Permian E&P to Sell for $4.0 Billion -

-

Shareholders of Arc, 7Gen Approve Pending Merger Deal

-

Ovintiv Looking to Sell Eagle Ford Asset Sale

-

Northern Oil Reports Changes to Marcellus Asset Deal; Adjusts 2021 Outlook

-

Noble Energy Shareholders Approve Merger with Chevron

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian - Midland Basin News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -