Service & Supply | Quarterly / Earnings Reports | Oilfield Services | Third Quarter (3Q) Update | Exclusives / Features | Financial Results | Capital Markets

SLB Q3: North America Slows, International Grows; CEO Talks $12B Write-Down, New Strategy

Schlumberger has reported its Q3 2019 results and below we talk about a few key points from its report:

- Domestic to International Shift: The company's revenues signal International growth while North America falters

- The $12B Hit to its Asset Value as New CEO Switches Up Strategy - Schlumberger's new CEO Olivier Le Peuch commented that he has new plans for the company and will be strategically reviewing its asset base - particularly in North America

Revenues - International Picks Up Steam / Domestic Tapers

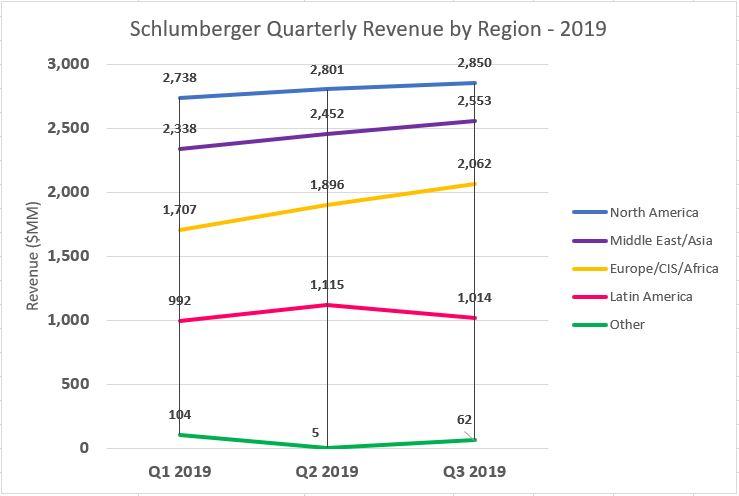

We took a look at Schlumberger's revenues by quarter for 2019 and noticed a trend.

As you can see from the chart below, North American activity is tapering off as operators halt completions due to low commodity prices.

However, International activity is picking up momentum, which has helped to offset the loss in revenue from domestic operations. The company's Europe/CIS/Africa sector saw the most sizable gain from the prior quarter.

Third-quarter revenue of $8.5 billion increased 3% sequentially. North America revenue of $2.8 billion increased 2%, while international revenue of $5.6 billion increased 3%.

Schlumberger Sees $12B Write-Down Hit

Schlumberger's new CEO Olivier Le Peuch initiated a $12B write-down of the company's assets, which he said is a key component to the vision he has for the company.

In early 2018, the company paid $430 million to buy Weatherford out of OneStim, the pressure pumping JV the two formed in March 2017. The assets it gained in the deal are now worth pennies on the dollar.

New Strategy, Strategic Review of North American Assets

As for strategy, CEO Le Peuch is looking to shrink the company's physical asset base while ramping up its service offerings and "digital" presence.

Le Peuch commented: “The third quarter results reflect a $12.7 billion pretax charge driven by market conditions. This charge is almost entirely noncash and primarily relates to goodwill, intangible assets, and fixed assets.

“Last month, we presented four key elements of our new strategy: leading and driving digital transformation; developing fit-for-basin solutions; capturing value from the performance impact for our customers; and fostering capital stewardship. The latter involves more stringent capex allocation and a strategic review of our portfolio—particularly in North America—through the lens of fit-for-basin attributes, customer performance, and return on investment."

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024 -

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Capex Plans Jump After 2Q: Nearly 30 E&P Companies Raise 2022 Budgets -

-

HAL, SLB 2Q: Double-Digit Revenue Gains, Strengthened Outlooks -

-

2022 Guidance Growth: Several Operators Bolster Capex, Production Outlook -

International News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Touchstone Exploration, Inc., First Quarter 2023 Results -

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

.jpg&new_width=60&new_height=60&imgsize=false)