Drilling & Completions | Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Reserves | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

SM Energy Fourth Quarter, Full Year 2021 Results

SM Energy Company announced certain fourth quarter and full year 2021 operating and financial results and year-end 2021 estimated proved reserves.

Highlights include:

- Proved reserves growth. Estimated proved reserves at year-end 2021 totaled 492 MMBoe, up 22% from year-end 2020 driven predominantly by reserve additions and performance revisions, including 83 MMBoe of reserve additions from the Austin Chalk in South Texas. The ratio of estimated proved reserves at year-end 2021 to 2021 production is 9.6 years. The standardized measure of discounted future net cash flows from estimated proved reserves was $6.96 billion, up 160% from year-end 2020.

- Capital efficiency and discipline. Capital expenditures in the fourth quarter 2021 were $124.6 million, which adjusted for decreased capital accruals of $19.7 million totaled $104.9 million(1) and was slightly better than guidance of $111.0-$116.0 million. For the full year 2021, capital expenditures of $674.8 million adjusted for decreased capital accruals of $10.8 million totaled $664.0 million.(1)

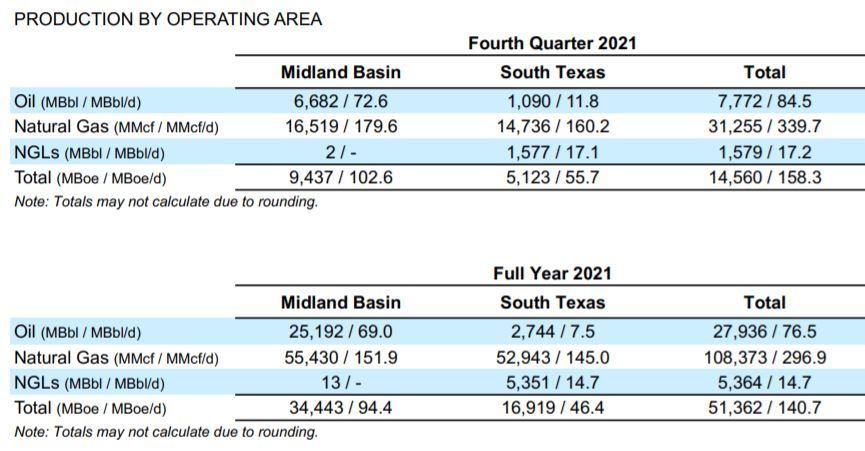

- Well performance above expectations. Production in the fourth quarter 2021 was 14.6 MMBoe (158.3 MBoe/d) and was 53% oil, and production for the full year 2021 was 51.4 MMBoe (140.7 MBoe/d) and was 54% oil. Production volumes in 2021 benefited from larger fracture stimulations in the Midland Basin, better than expected performance from new Austin Chalk wells and reduced flaring. Average net daily oil production volumes for 2021 were the highest in Company history, up 22% from 2020.

- Significant cash flow generation. For the full year 2021, net cash provided by operating activities of $1.16 billion before net change in working capital of $(117.4) million totaled $1.04 billion.(1) Fourth quarter net cash provided by operating activities of $429.6 million before net change in working capital of $(65.2) million was $364.4 million.(1) For the full year 2021, the Company generated free cash flow(1) of $378.3 million, including fourth quarter free cash flow(1) of $259.5 million.

- Strengthened balance sheet. Cash and cash equivalents at year-end 2021 were $332.7 million, up from $29.8 million at the end of the third quarter. As a result of cash generated in the fourth quarter and in support of the Company's objective to reduce absolute debt, on February 14, 2022, the Company redeemed its 5.00% Senior Notes due 2024. The redemption price was equal to 100.0% of the aggregate principal amount outstanding of approximately $104.8 million, plus accrued and unpaid interest.

- Stewardship targets. In December 2021, the Company set targets for Scope 1 and 2 emissions reductions. These targets included zero routine flaring at all SM Energy operations and non-routine flaring not to exceed 1% of natural gas production by full year 2023. Full year 2021 flaring is estimated at less than 1%.

Chief Executive Officer Herb Vogel comments: "2021 was an exceptional year. Production outperformance, strong commodity prices and capital discipline all contributed to a reduction in net debt(1) of more than $475 million and a year-end leverage ratio at 1.47 times.(1) Estimated proved reserves increased 22%, underscoring our high-quality asset base and long runway of low breakeven production. We believe we enter 2022 exceptionally well positioned to generate significant cash flows with low single digit production growth, meet our leverage targets with an estimated reinvestment rate(1) of approximately 50%, and continue to demonstrate the value of our high-quality asset base with increased investment in South Texas."

Year-End 2021 Proved Reserves

Estimated proved reserves at year-end 2021 were 492 MMBoe. Estimated proved reserves were 51% in the Midland Basin and 49% in South Texas, and were comprised of 41% oil, 42% natural gas and 17% NGLs. Reserves were 61% proved developed and 39% proved undeveloped.

- The ratio of estimated proved reserves at year-end 2021 to 2021 production is 9.6 years.

- Proved reserve additions through drilling and net performance revisions were 142.6 MMBoe, replacing 2021 production by 277%.

- Estimated proved reserves were adjusted downward by 40.6 MMBoe as a result of the SEC's "five-year rule" requirement to develop PUD reserves within five years of their original booking. These economic reserves were removed from the proved category but remain in the Company's 3P reserves development plan.

- 2021 SEC pricing was $66.56 Bbl oil, $3.60 Mcf natural gas and $36.60 Bbl NGLs, up 68%, 81% and 107%, respectively, compared to 2020 SEC pricing.

- PDP reserves of 297 MMBoe surpassed the Company's previous peak of 270 MMBoe, set at the end of 2014.

Standardized Measure

The standardized measure of discounted future net cash flows from estimated proved reserves was $6.96 billion at year-end 2021, up from $2.68 billion at year-end 2020. The 160% increase in the standardized measure compared with year-end 2020 is predominantly due to the increase in reserves and increase in SEC pricing across commodities used in the calculation. Pre-tax PV-10(1) was $8.16 billion, the highest value in Company history.

4Q21 and Full Year 2021 Results

- Production volumes are approximately two-thirds from the Midland Basin and one-third from South Texas.

- Fourth quarter production volumes of 14.6 MMBoe (158.3 MBoe/d) were up 29% compared with the prior year period and up 2% sequentially. Production was 53% oil. Oil volumes from South Texas reflect a 147% increase over the prior year period as the Company successfully initiated development drilling of the Austin Chalk on its 155,000-acre South Texas position.

- Midland Basin production volumes exceeded Company expectations for the fourth quarter. Down time related to offset operator fracture stimulation activity was significantly less than projected and the Company continued to minimize natural gas flaring.

- South Texas production volumes benefited from the accelerated turn-in-line of nine wells as well as strong performance from new Austin Chalk wells that ramped up faster and delivered higher than expected oil in the commodity mix

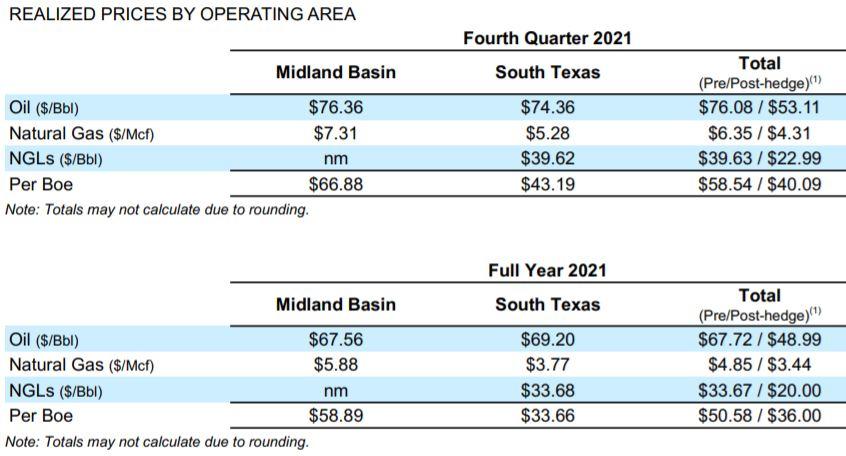

- In the fourth quarter, the average realized price before the effect of hedges was $58.54 per Boe and the average realized price after the effect of hedges was $40.09 per Boe.(1) For the full year, the average realized price before the effect of hedges was $50.58 per Boe and the average realized price after the effect of hedges was $36.00 per Boe.(1)

- Benchmark pricing for the quarter included NYMEX WTI at $77.19/Bbl, NYMEX Henry Hub natural gas at $5.83/MMBtu and Hart Composite NGLs at $44.21/Bbl. Benchmark pricing for the full year included NYMEX WTI at $67.92/Bbl, NYMEX Henry Hub natural gas at $3.84/MMBtu and Hart Composite NGLs at $36.65/Bbl.

- The effect of commodity derivative settlements for the fourth quarter and full year was a loss of $18.45 per Boe, or $268.7 million, and $14.58 per Boe, or $749.0 million, respectively.

For additional operating metrics and regional detail, please see the Financial Highlights section below and the accompanying slide deck.

Financials

Fourth quarter 2021 net income was $424.9 million, or $3.43 per diluted common share, compared with a net loss of $(165.2) million, or $(1.44) per diluted common share, for the same period in 2020. The current year period included a 167% increase in operating revenues and other income as well as a $22.5 million net derivative gain versus the prior year period that had a $152.7 million net derivative loss. For the full year 2021, net income was $36.2 million, or $0.29 per diluted common share, compared with a net loss of $(764.6) million, or $(6.72) per diluted common share, in the same period in 2020. In 2020, the Company recorded impairment charges of $1.02 billion.

Fourth quarter 2021 net cash provided by operating activities of $429.6 million before net change in working capital of $(65.2) million totaled $364.4 million,(1) which was up $159.5 million, or 78%, from $204.9 million(1) in the same period in 2020. For the full year 2021, net cash provided by operating activities of $1.16 billion before net changes in working capital of $(117.4) million totaled $1.04 billion,(1) which was up $236.0 million, or 34%, from $779.4 million(1) in 2020. For the fourth quarter and full year 2021, the increase in net cash provided by operating activities before net change in working capital was primarily due to the increase in production and realized prices after the effect of hedges.

EBITDAX

Fourth quarter 2021 Adjusted EBITDAX(1) was $406.9 million, up $151.5 million, or 59%, from $255.4 million in the same period in 2020. The increase in Adjusted EBITDAX(1) was due to the increase in production and realized price after the effect of hedges. For the full year 2021, Adjusted EBITDAX(1) was $1.23 billion, compared with $975.4 million in 2020.

Fourth quarter 2021 adjusted net income(1) was $141.5 million, or $1.14 per diluted common share, which compares with adjusted net income(1) of $2.7 million, or $0.02 per diluted common share, for the same period in 2020. For the full year 2021, adjusted net income(1) was $228.3 million, or $1.85 per diluted common share, compared with an adjusted net loss(1) of $(25.7) million, or $(0.23) per diluted common share, in 2020.

At December 31, 2021, Net debt-to-Adjusted EBITDAX(1) was 1.47 times.

Financial Position, Liquidity & Capital Expenditures

At year-end 2021, the outstanding principal amount of the Company's long-term debt was $2.14 billion with zero drawn on the Company's senior secured revolving credit facility. At year-end 2021, cash and cash equivalents were $332.7 million and net debt(1) was $1.80 billion, down $475.9 million from year-end 2020. As of December 31, 2021, the Company's borrowing base and commitments under its senior secured revolving credit facility were $1.10 billion providing more than $1.43 billion in available liquidity. Subsequent to year-end 2021, the Company redeemed its 5.00% Senior Notes due 2024. The redemption price was equal to 100.0% of the aggregate principal amount outstanding of approximately $104.8 million, plus accrued and unpaid interest.

In the fourth quarter 2021, capital expenditures of $124.6 million adjusted for decreased capital accruals of $19.7 million were $104.9 million.(1) During the fourth quarter of 2021, the Company drilled 17 net wells and added 12 net flowing completions. For the full year 2021, capital expenditures of $674.8 million adjusted for decreased capital accruals totaled $664.0 million(1) and the Company drilled 81 net wells and added 109 net flowing completions.

Hedges

Commodity hedge positions through February 24, 2022:

- Oil: Approximately 50% of expected 2022 oil production is hedged to WTI at an average price of $51.35 (weighted-average of collar floors and swaps).

- Oil, Midland Basin differential: Approximately 9,500 MBbls is hedged to the local price point at a positive $1.15/Bbl basis.

- Natural gas: Less than 50% of expected 2022 natural gas production is hedged. Approximately 28,932 BBtu is hedged to HSC at an average price of $2.52/MMBtu and approximately 14,087 BBtu is hedged to WAHA at an average price of $2.32/MMBtu.

- NGLs are hedged by individual product and include propane swaps and collars.

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020