SM Energy Co. has amended its pending offers to exchange its outstanding notes listed in the table below for newly issued 10.00% senior secured notes due 2025 after reaching an agreement with certain holders of the Old Notes.

The maximum principal amount of New Notes to be issued in the Exchange Offers is $532.9 million, which, together with the New Notes to be issued in the private exchanges with certain holders of Old Notes referred to below, would amount to a maximum of $800 million principal amount of New Notes.

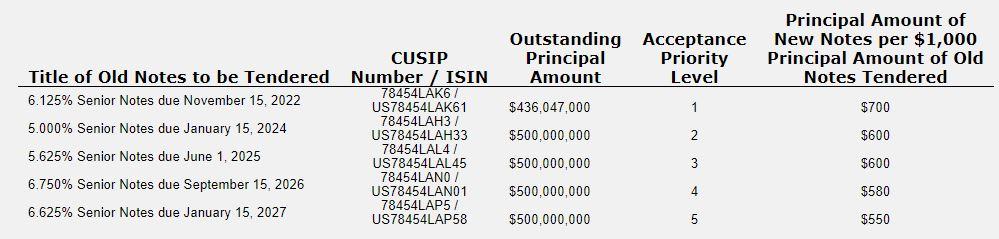

The following table sets forth the new terms to be offered to eligible holders of the Old Notes in the Exchange Offers, as amended:

Related Categories :

Debt Exchange/Swaps

More Debt Exchange/Swaps News

-

Hedge Fund Buys $33MM Debt Load from Bakken-Focused E&P

-

Centennial Finalizes $450MM Debt Swap Transaction

-

Diamondback Subsidiary Energen Launches $400MM Debt Exchange

-

Centennial Resources Offering Debt Swap -

-

Private Equity Firm Rescues Haynesville Driller -

Permian News >>>

-

Crescent Energy Said to be in Advance Talks to Acquire Pure Play Permian, Vital Energy -

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

Permian - Midland Basin News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -