Service & Supply | Oilfield Services | Second Quarter (2Q) Update

Schlumberger Shows Steady Resilience Amid Market Volatility

SLB has reported its financial results for the second quarter of 2025, reflecting stable sequential performance and resilience in the face of macroeconomic and industry-wide challenges. Despite a year-over-year revenue decline, the company demonstrated operational discipline and strategic execution that supported improved profitability and earnings momentum.

Macro Outlook:

-

Stable commodity prices despite geopolitical and economic uncertainty.

-

Customers are cautious but prioritizing key, capital-efficient projects, especially in deepwater.

SLB Strategy Highlights:

-

Diversified portfolio helped weather regional slowdowns.

-

International strength in Middle East, Asia, Europe, and North Africa offset regional declines.

-

Digital business steady—platform/app growth was offset by lower exploration data sales.

-

Production Systems is a strategic growth lever (17th consecutive YoY increase), reflecting customers’ shift toward asset recovery and efficiency.

Strategic and Market Context

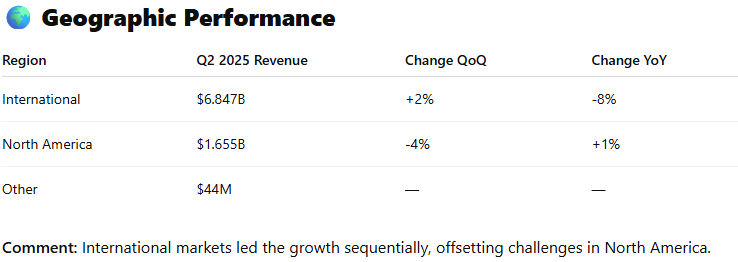

CEO Olivier Le Peuch attributed the results to SLB’s diversified business model and wide geographical footprint. International revenue grew 2% sequentially, helping to offset a 4% dip in North America. SLB’s Production Systems segment, in particular, posted its 17th consecutive quarter of year-over-year growth, signaling rising demand in production and recovery solutions.

The recently completed acquisition of ChampionX is expected to further strengthen SLB’s presence in this less cyclical, growth-oriented segment.

Looking Ahead

SLB expects to maintain solid performance in the second half of 2025, provided commodity prices remain stable. The combination of strong international presence, expanding production services, and increasing digital platform adoption positions the company to deliver continued shareholder value despite global uncertainty.

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -