Drilling & Completions | Well Lateral Length | Quarterly / Earnings Reports | First Quarter (1Q) Update | Financial Results | Capital Markets | Drilling Activity

Southwestern Q1: Trims 2020 Capex by $60MM; $1.5B Impairment Charge, Cash Flow Drop

Southwestern Energy Co. reported its Q1 2020 results.

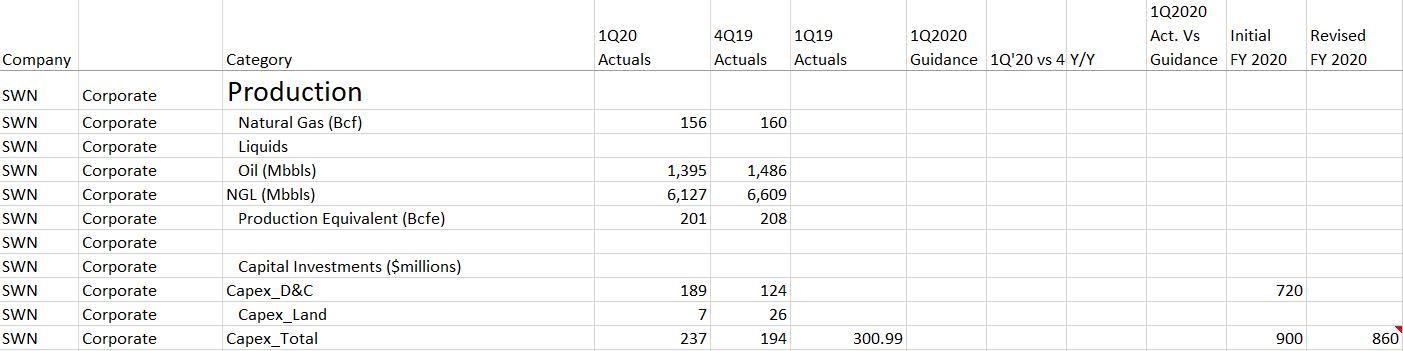

Q1 Key Financial Developments & Production

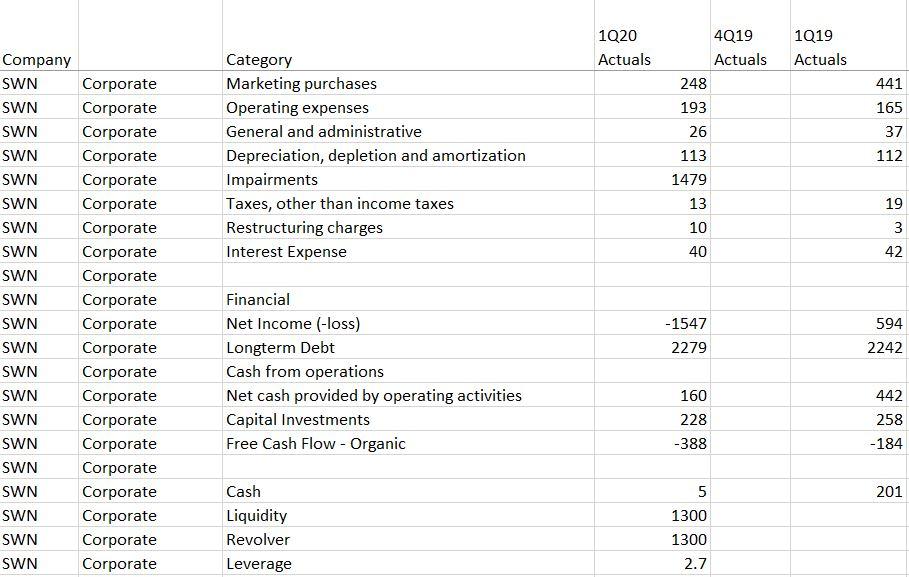

- Free Cash Flow of -$388MM in Q1: Southwestern's free cash flow went even further into the negatives compared to the prior year (up from -$184 million in free cash flow in 1Q19)

- Impairment Charge: Reported an impairment charge of $1.5 billion during quarter

- Debt/Cash on Hand: At Q1 end, Southwestern had total debt of $2.3 billion and a cash balance of $5 million

- Q1 Production Declines 3% from Prior Quarter: Net production averaged 201 Bcfe during quarter, a 3% drop over the 4Q19

2020 Capex Trimmed

SWN has reduced its spending and operating plans for 2020, including:

- Capex Cut - Down 7% (or $60MM) from Original Plan: New plan calls for $840 in 2020 spending (down from $900 million). With $237 million spent in Q1, that leaves ~$600 million for the rest of the year.

- Rigs: Currently has six rigs running

- Frac Crews: Completion crew count is at three

Q1 Snapshot

Q1 2020 Press Release

Highlights:

- Completed semi-annual borrowing base redetermination and revolving credit facility commitment at $1.8 billion with no other changes in terms

- Repurchased $80 million in senior notes at an average 36% discount

- Received weighted average realized price (excluding transportation) of $2.56 per Mcfe, including $93 million settled hedging gains, a $0.47 per Mcfe benefit

- Reported total production of 201 Bcfe, including 1.7 Bcf per day of gas and 83 MBbls per day of liquids

- Reduced cost structure by a total of $60 million in 2020 across all expense categories, with additional savings measures in progress

- Responding to current commodity price and COVID-19 demand impact:

- Second quarter total production expected to be largely unaffected, with a higher percentage of production from natural gas due to improved well performance and ethane rejection; minimal condensate curtailments expected

- Full year capital investment currently expected to be $860 million, use of earmarked proceeds will not exceed $300 million

CEO Bill Way said: "Again this quarter, the Company delivered operational and financial performance that exceeded expectations. These results, combined with ample liquidity, a long debt maturity runway, rigorous capital discipline and proactive risk management, demonstrate a strong foundation to navigate today's ever-changing environment. Given the Company's operational agility and portfolio flexibility, we have shifted capital investment to high-rate, high-value natural gas as fundamentals indicate support for higher prices going forward.

"Clearly, current market conditions resulting from the COVID-19 pandemic can affect some of our operating and financial metrics. In response we are reducing capital, and we continue to find ways to mitigate the impacts. Throughout, we remain committed to protecting our balance sheet, returning to free cash flow and maximizing shareholder value," continued Way.

Financial Results

For the quarter ended March 31, 2020, Southwestern Energy recorded a net loss of $1.5 billion, or $2.86 per diluted share, which includes a $1.48 billion non-cash full cost ceiling test impairment, $408 million related to tax valuation allowance, a $246 million gain from unsettled derivatives and other one-time items. This compares to net income of $594 million, or $1.10 per diluted share in the first quarter of 2019. Adjusted net income, which excludes the items noted above, was $56 million, or $0.10 per diluted share, in the first quarter of 2020, compared to $145 million, or $0.27 per diluted share, for the prior year period. The decrease was primarily related to lower commodity prices compared to 2019, partially offset by a $93 million gain in settled derivatives in 2020, compared to a $10 million loss in 2019. Adjusted EBITDA (non-GAAP) was $206 million, net cash provided by operating activities was $160 million and net cash flow (non-GAAP) was $191 million.

As indicated in the table below, first quarter 2020 weighted average realized price (including transportation) was $1.69 per Mcfe excluding the impact of derivatives. Including derivatives, weighted average realized price (including transportation) for the quarter was down 26% from $2.92 per Mcfe in 2019 to $2.16 per Mcfe in 2020, as settled derivative gains did not fully offset the 38% decrease in NYMEX Henry Hub.

During the first quarter, $93 million was realized from cash-settled hedging gains. At quarter end, the Company had hedges for 87% of its remaining natural gas production, 57% of its natural gas liquids (NGLs) production and approximately 100% of its oil production, all at prices well above current strip pricing for the remainder of 2020. As of March 31, 2020, the fair value of the hedge portfolio for the remainder of 2020 was $353 million. The Company's three-year rolling hedging program spans across a range of commodities including natural gas, oil, ethane, propane and basis.

At quarter-end, the Company had total debt of $2.3 billion and a cash balance of $5 million, with a leverage ratio of 2.7x. During the first quarter of 2020, $80 million of senior notes were repurchased at a discount of 36%, with $2.15 billion of senior notes outstanding, including $210 million due before 2025.

As of March 31, 2020, Southwestern Energy had $149 million in revolver borrowings and $172 million in letters of credit. Subsequent to quarter end, the Company's borrowing base related to the revolving credit facility was set at $1.8 billion following a scheduled semi-annual redetermination. On a pro-forma basis, the Company has approximately $1.3 billion in liquidity available under its revolving credit facility after adjusting for quarter-end borrowings and an additional $150 million in letters of credit issued subsequent to quarter-end.

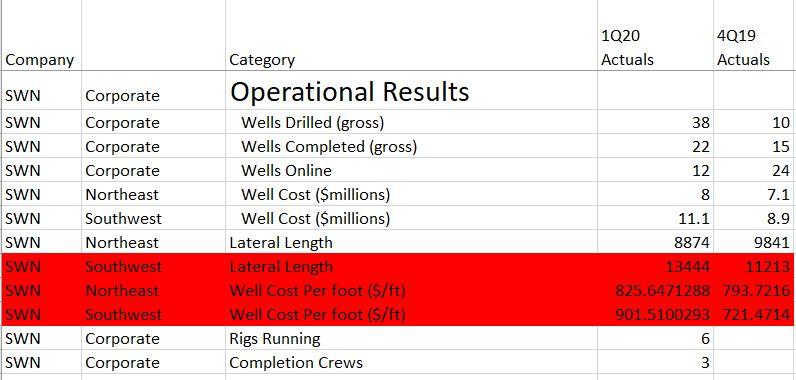

Operational Results

Total production for the quarter ended March 31, 2020 was 201 Bcfe, of which 78% was natural gas, 18% NGLs and 4% oil. Capital investments totaled $237 million for the first quarter, with 38 wells drilled, 22 wells completed and 12 wells placed to sales.

Southwest Appalachia - In the first quarter, total production was 87 Bcfe, approximately half of which was liquids. The Company drilled 23 wells, completed 12 wells and placed seven wells to sales, four in the rich acreage and three in the super rich, with an average lateral length of 13,444 feet. The 3 super rich wells were online for at least 30 days and had an average 30-day rate of 11 MMcfe per day, including 68% liquids.

Part of the shift to high-rate natural gas producing wells will include increased development in the Company's rich acreage in West Virginia. A four-well pad placed to sales in the rich acreage mid-March exceeded expectations, with a combined peak production rate of approximately 170 MMcfe per day, a new Company record and a 20% improvement over the previous record. This represents a continuation of the performance improvement the Company has seen in this area utilizing latest generation completion designs. A typical well in the rich acreage produces approximately 60% natural gas and 40% liquids, with a small contribution from condensate.

Northeast Appalachia - First quarter 2020 production was 114 Bcf. There were 15 wells drilled, 10 wells completed and five wells put to sales with an average lateral length of 8,874 feet. Four of the five wells were online for at least 30 days and had an average 30-day rate of 24 MMcf per day, a 60% increase compared to prior year quarter. This outperformance was driven by lateral length, completion design enhancement and well mix.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?