Top Story | Deals - On The Market | Deals - Acquisition, Mergers, Divestitures

Supermajor Mulling Sale of Permian Basin Portfolio; Could Fetch Up to $10B

Shell is considering selling off its Permian Basin portfolio, according to multiple reports.

If a deal is struck, this would only add to the huge upswing in deals seen over the last couple of months. A large swath of them have been focused in the Permian Basin.

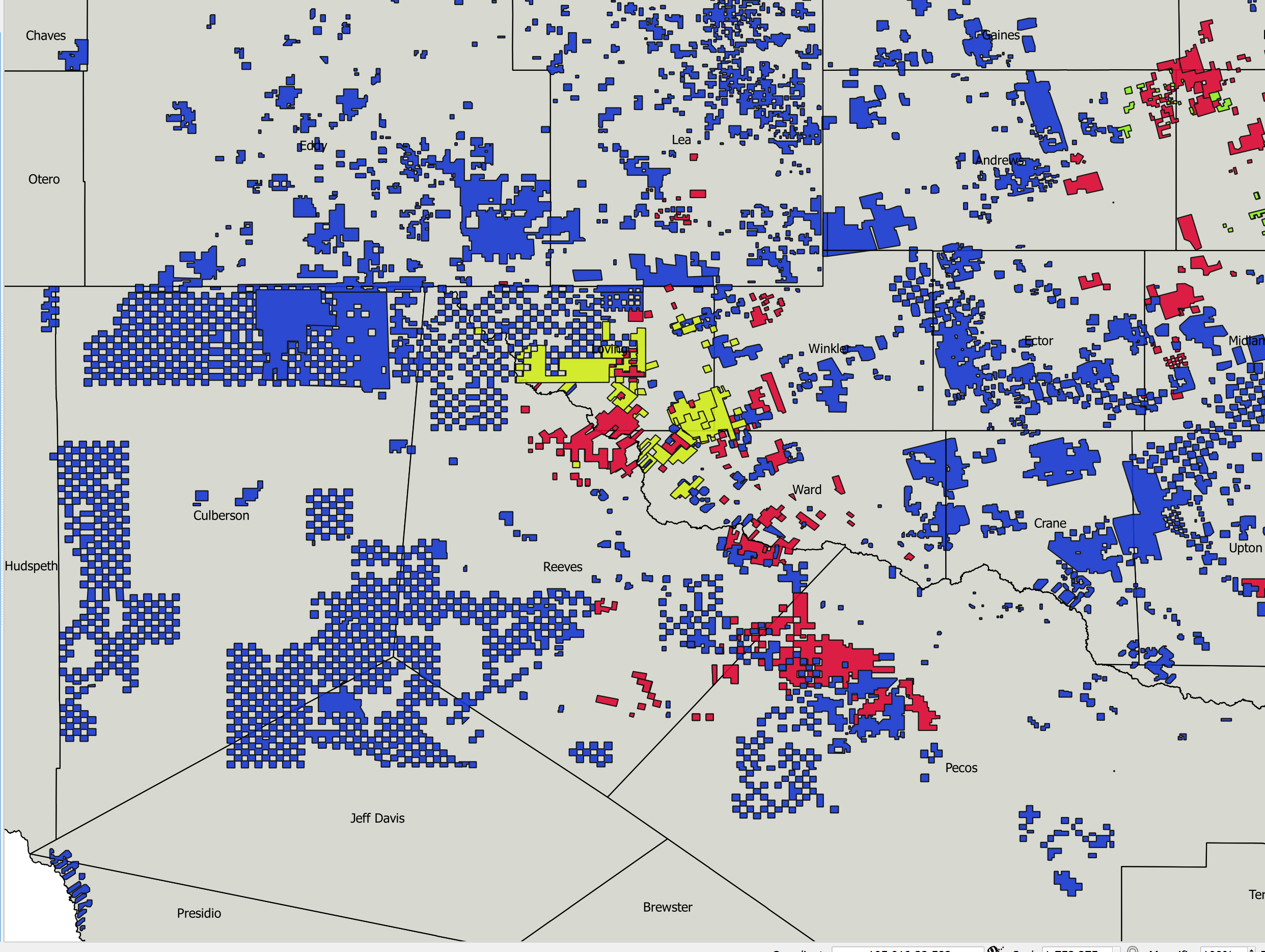

It remains to be seen if the company will opt to divest its entire asset base in the Permian (see map below) or just a select portion of it, as the potential sale is in the early stages.

According to sources, Shell's Permian portfolio could fetch a purchase price of up to $10 billion. The company acquired the assets from Chesapeake Energy Corp. back in September 2012 for a purchase price of $1.9 billion.

This move comes shortly after investors amped up pressure on Shell to reduce its carbon emissions and begin increasing investments in renewable energy sources. The supermajor has indicated that by 2025, approximately 25% of its capital budget will be devoted to such projects.

Shell's Permian Assets

Shell currently has 260,000 net acres in the Permian. Current production is just below 200,000 BOEPD.

MapShell's assets are in yellow.

Related Categories :

Deals - On The Market

More Deals - On The Market News

-

Chesapeake Engages Evercore to Market Eagle Ford Portfolio

-

Exxon Puts Gas-Heavy Appalachian Assets Up for Sale

-

Large PE-Backed Permian E&P Looking for Buyer; Deal Value Could Top $2.0B -

-

Bakken Operators Looking to Divest 36,000 Barrels Per Day -

-

Report: Ovintiv Looking to Sell Eagle Ford Assets

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020