Drilling & Completions | Hedging | Capital Markets | Capital Expenditure | Suspended or Reduced Distributions/Dividends | Capex Decrease | Capital Expenditure - 2020 | 2020 Guidance

Surge Energy Suspends 2020 Capital Plan; Curtails Production

Surge Energy Inc. reported a strategy update for 2020 in response to the market instability caused by COVID-19 and and oil price decline.

Suspends 2020 Capital Program

The company has suspended its previously announced 2020 guidance and capital program of $98.5 million. Surge's capital expenditures were approximately $34 million in Q1 2020.

Surge's capital program will be re-guided as commodity prices improve.

Curtails Production; Updates Hedges

Surge has elected to temporarily curtail up to 4,400 boepd of lower margin production in order to maximize corporate cash flows. Surge has the ability to restart this production in short order, as commodity prices increase.

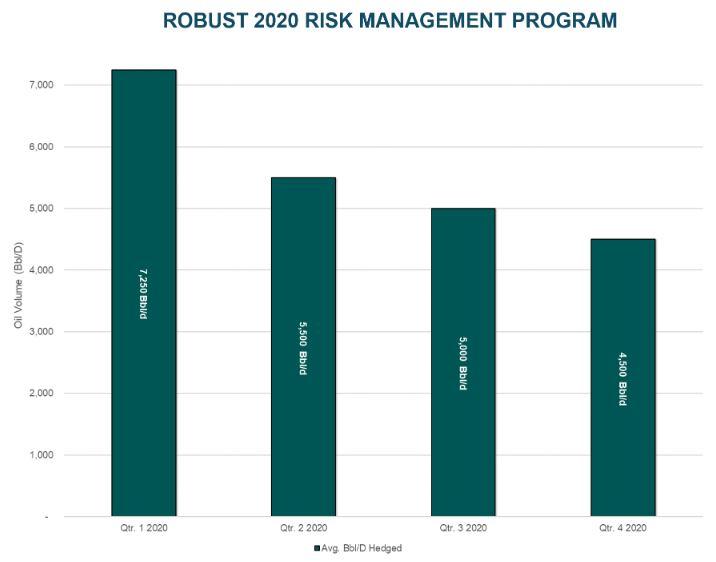

Surge will now have approximately 50% of its net, after royalty Crown oil production hedged through the balance of 2020. Surge's excellent WTI hedge position, depicted below, has an average floor price of approximately CAD$80 per barrel for the first half of 2020.

Current Ops

Currently, 16 of the wells drilled in the quarter are on production, with initial production results performing at or above management's expectations. With these successful drilling results, the Company's production exceeded 21,000 boepd in March (prior to the temporary production curtailments), with three additional Sparky wells to be brought on production as crude oil prices improve.

Hedges

2Surge’songoing risk management program encompasses not onlyWTIcrudeoil price hedges, but also includes very attractiveWCSand MSW oil differentialhedges,as well as AECO and NYMEX natural gas hedgepositions. For example, Surge has now locked in morethan 65 percent of its light oil differentials for Q2 and Q3 2020 at approximately US$5 per barrel.

Suspends Dividend

Subsequent to Surge's March 9th press release, when Surge's management and Board elected to reduce the Company's dividend by 90 percent, crude oil prices have continued to drop precipitously.

In light of this continued volatility in global crude oil markets, as well as the ongoing impacts of the COVID-19 pandemic, the Company is taking further steps to protect shareholder value and corporate cash flow by suspending its dividend (approximately $33.5 million in annualized savings i.e. when combined with the previously announced March 9th dividend reduction) until such time as Surge's management and Board see a sustainable recovery in world crude oil prices.

As such, the last cash dividend payment prior to suspension will be on April 15, 2020 in respect of March 2020 production, for the shareholders on record March 31, 2020 in the amount of $0.000833 per share, as declared on March 16, 2020.

Related Categories :

Capex Decrease

More Capex Decrease News

-

Diamondback Energy Second Quarter 2021 Results

-

Oasis Adjusts 2021 Plans After Permian Asset Sale; Capex Cut 10%

-

Advantage Oil & Gas Adjusts 2021 Outlook as Drilling Outperforms

-

WPX Energy Third Quarter 2020 Results; Merger with Devon on Track

-

Murphy Oil Second Quarter 2020 Results; Trims Another $40MM from Capex

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)