Exploration & Production | Top Story | Exclusives / Features

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

Record Output: The Power of Scale

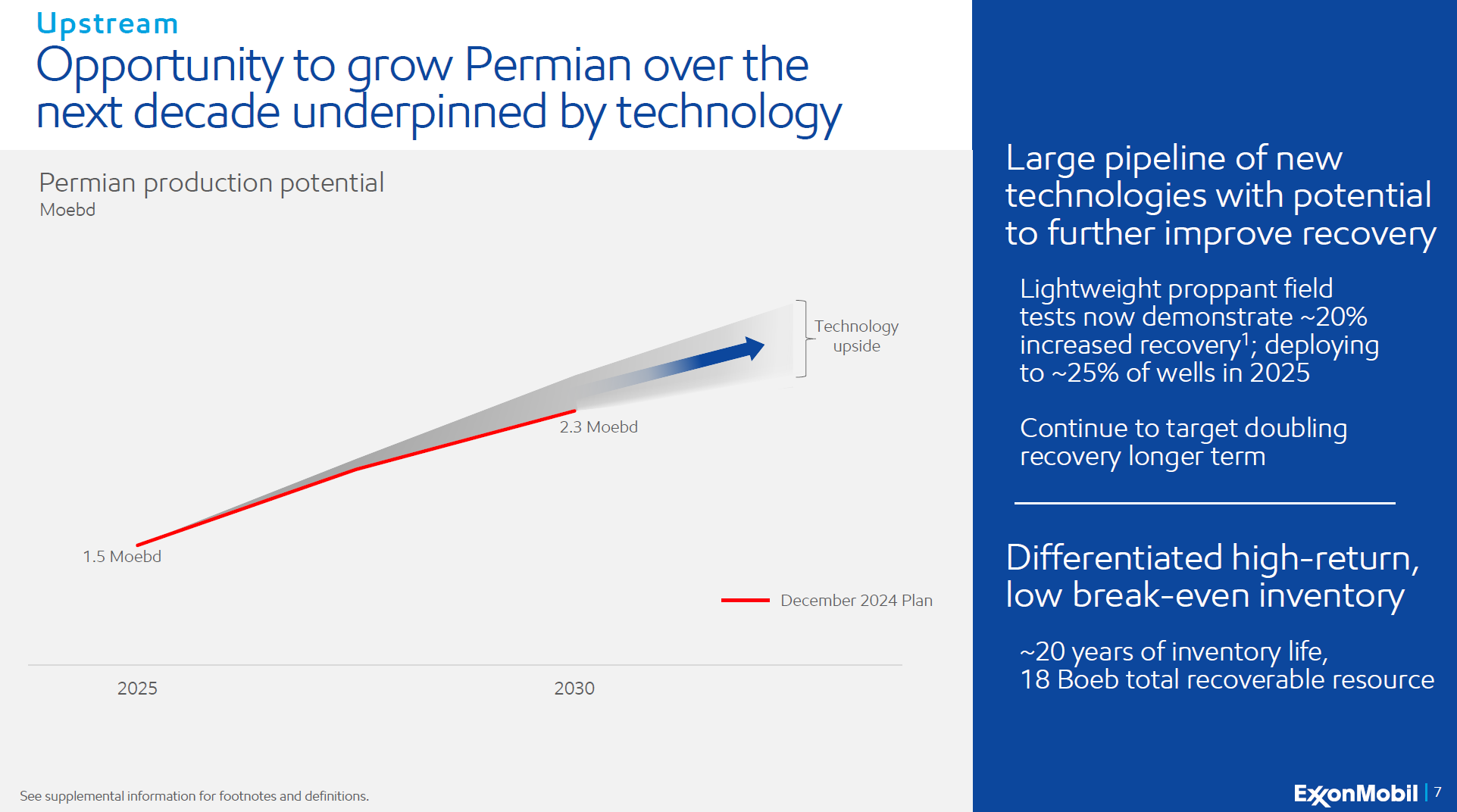

In Q2 2025, ExxonMobil delivered its highest-ever quarterly Permian production: 1.6 million oil-equivalent barrels per day. That’s not just a number—it’s a signal. A signal that scale, when matched with operational excellence, becomes an engine for outsized returns.

While others scale back, Exxon plans to grow Permian output another 44% to 2.3 million boe/d by 2030. Backed by 20 years of inventory and a pipeline of proprietary technologies, the company is pushing beyond the perceived production ceiling.

Tech-Led Frac Strategy: More Oil, Same Rock

The biggest story in the basin isn’t volume. It’s efficiency. And Exxon is delivering a quiet revolution in well productivity.

At the center is a breakthrough material: a lightweight proppant, derived from petroleum coke at Exxon’s own refineries. It's being deployed across hundreds of wells and has already shown 20% uplift in recovery. This isn’t just innovation for its own sake—it’s a structural reset of the productivity curve.

By pairing this with 4-mile laterals—enabled by Exxon’s contiguous acreage—each well punches deeper into the reservoir while holding capital efficiency steady. Where others drill short, expensive wells, Exxon drills longer, cheaper, smarter ones.

Permian Basin: Record Production and Future Growth

-

Q2 2025 Production: Reached a record 1.6 million oil-equivalent barrels per day (moebd) from the Permian—the highest ever for Exxon in the region

-

2030 Outlook: Exxon plans to grow Permian output by 44%, targeting 2.3 moebd by 2030

-

Inventory Life: The company has a 20-year inventory at current well development rates. Darren Woods emphasized this isn't just a treadmill strategy—they aim to expand inventory and resource base through technology and potential M&A

CapEx with a Purpose

Exxon’s 2025 CapEx will land between $27–$29 billion, with more than $12 billion already deployed through mid-year. That spending isn’t scattershot—it’s focused.

The Permian soaks up a large slice, not just to hold flat, but to build for tomorrow: funding technology pilots, extending laterals, and integrating the Pioneer acquisition—a deal that’s already producing synergies above original expectations.

Importantly, the capital is working hard. With unit upstream earnings at $13 per boe and structural cost savings now totaling $13.5 billion since 2019, Exxon is outpacing peers on both output and return.

The Deep Tech Engine Behind the Barrels

Permian output isn’t just about sand, pipe, and pumps anymore. Exxon has elevated shale into a digital frontier.

With a challenge issued directly from leadership to double recovery rates, its tech org is firing on all cylinders. AI is increasingly used to optimize frac placement. Sensor data drives real-time decisions on choke management. And across more than 100 pilot wells, new designs are unlocking barrels that would’ve stayed buried in the rock.

The Permian, in Exxon’s hands, is no longer just a shale play—it’s a technology platform.

Looking Ahead: From Production to Platform

While other operators eye peak production curves, Exxon sees a launchpad.

By leveraging its global-scale projects org, advanced materials pipeline, and unmatched digital data systems, Exxon is turning the Permian into something far more durable than a boom-and-bust basin.

It’s becoming a self-reinforcing flywheel: technology improves recovery → recovery improves capital efficiency → capital fuels more innovation → production and margins grow, even as others decline.

As Darren Woods put it plainly, “We’re not looking to buy volumes—we’re building value.”

And in the Permian, that value is just beginning to surface.

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020