Exploration & Production | Quarterly / Earnings Reports | Debt | Second Quarter (2Q) Update | Bankruptcy / Restructure Update | Hedging | Capital Markets

Uncertain Future for New Source Energy Partners

New Source Energy Partners L.P. has announced financial and operating results for the quarter ended June 30, 2015.

Going Concern

- The Partnership's financial statements have been prepared assuming that it will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. As a result of the substantial drop in oil, natural gas and NGL prices, our revenue, profitability and cash flow have been significantly affected.

- Additionally, the Partnership has violated debt covenants on certain of its oilfield service related debt, which results in this debt being classified as current and could require us to have to pay amounts outstanding sooner than anticipated based on the original maturity.

- While we are evaluating strategic alternatives, there can be no assurance that the Partnership will be successful in these efforts or that it will have sufficient funds to cover its operational and financial obligations over the next twelve months, which raises substantial doubt as to its ability to continue as a going concern.

Second Quarter and Year to Date 2015 Results Summary

- Total revenue of approximately $24.1 million in the second quarter 2015 and approximately $62.2 million for the six months ended June 30, 2015

- Impairment of oil and natural gas properties of $32.9 million in the second quarter of 2015 and $76.0 million for the six months ended June 30, 2015

- Impairment of Oilfield Services goodwill and intangible assets of $66.8 million in the second quarter of 2015 and the six months ended June 30, 2015

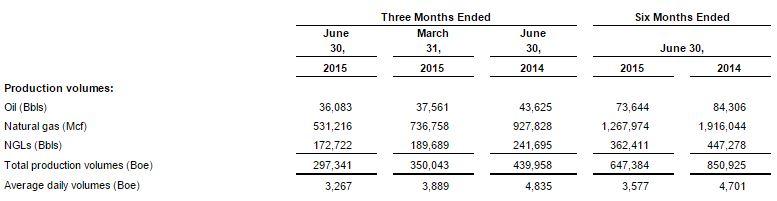

Exploration and Production Operational Results

The following table reflects production, pricing and cost for the Exploration and Production division for the periods presented below.

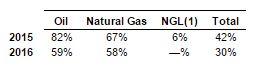

Derivative Position

Credit Facility

- In the second quarter of 2015, our borrowing base on our senior secured revolving credit facility was lowered from $90.0 million to $60.0 million based on our estimated oil, natural gas and NGL reserves using commodity pricing reflective of the current market conditions. On May 29, 2015, the borrowing base was reduced further to $57.0 million in response to the settlement of a portion of our derivative contracts prior to their contractual maturity. Additionally, we anticipate that the borrowing base will be reduced at the October 2015 redetermination due to continued declines in oil, natural gas and NGL prices and the resulting impact on our reserves. As of June 30, 2015, the Partnership had $49.0 million outstanding under the credit facility.

Oilfield Services Results

- Revenue was approximately $18.8 million for the second quarter of 2015 with an average weekly rig count of 557 compared to approximately $31.6 million in the first quarter of 2015 with an average weekly rig count of 867.

- The decline in revenue and adjusted EBITDA reflects the continued reduction in drilling activity as a result of lower commodity prices and the discounts we have offered our customers in the first half of 2015.

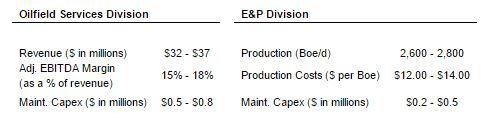

2H2015 Guidance

- The Partnership is revising its guidance for the second half of 2015 to reflect the current commodity price environment. The Oilfield Services Division's guidance reflects a decrease in revenue and margins based on the current rig count and discounts provided to contract operators for who we provide services. The Exploration and Production Division's guidance reflects our drilling program continued curtailment and continued increased production costs from our contract operator.

Related Categories :

Bankruptcy / Restructure Update

More Bankruptcy / Restructure Update News

-

ION Geophysical Files for Bankruptcy

-

Vista Proppants Emerges from Bankruptcy; Rebrands as V SandCo LLC

-

Gulfport Energy Emerges from Bankruptcy

-

HighPoint Resources' Bankruptcy Plan Approved by the Courts

-

HighPoint Files Chapter 11 Ahead of Merger with Bonanza Creek

North America News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Bonterra Eneergy Corporation First Quarter 2023 Results

-

Hammerhead Energy Inc. First Quarter 2023 Results

-

Spartan Delta Corp. First Quarter 2023 Results -

-

Baytex Energy Corp. First Quarter 2023 Results