Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets

Viper Energy Partners Third Quarter 2020 Results

Viper Energy Partners LP reported its Q3 2020 results.

Highlights:

- Q3 2020 consolidated net income (including non-controlling interest) of $16.2 million; adjusted net income (as defined and reconciled below) of $7.1 million

- Consolidated Adjusted EBITDA (as defined and reconciled below) of $40.4 million and cash available for distribution to Viper's common limited partner units (as reconciled below) of $13.9 million

- Previously announced Q3 2020 average production of 15,829 bo/d (26,409 boe/d), an increase of 10% from Q2 2020 average daily oil production and 16% year over year

- Q3 2020 cash distribution of $0.10 per common unit, representing approximately 50% of cash available for distribution; $0.21 per unit of cash available for distribution implies a 12.0% annualized distributable cash flow yield based on the October 30, 2020 unit closing price of $7.01

- Ended the third quarter with net debt of $599.1 million; total debt down $67.1 million since March 31, 2020, or a 10% reduction over the past six months

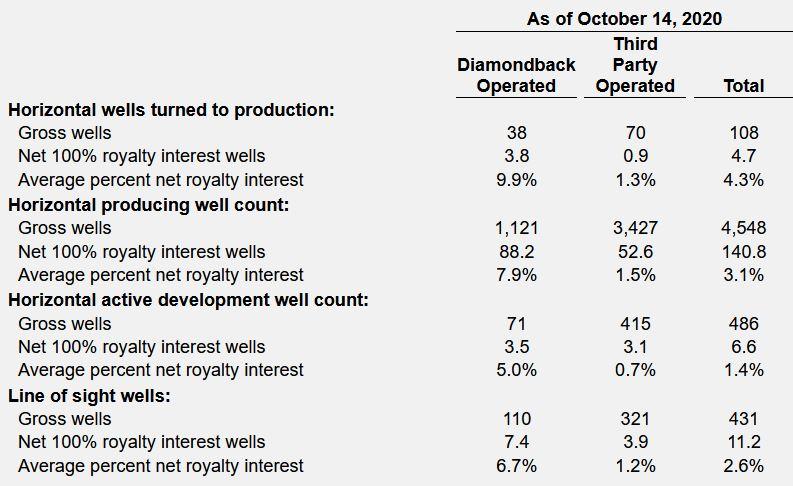

- 108 total gross (4.7 net 100% royalty interest) horizontal wells turned to production on Viper's acreage during Q3 2020 with an average lateral length of 10,022 feet

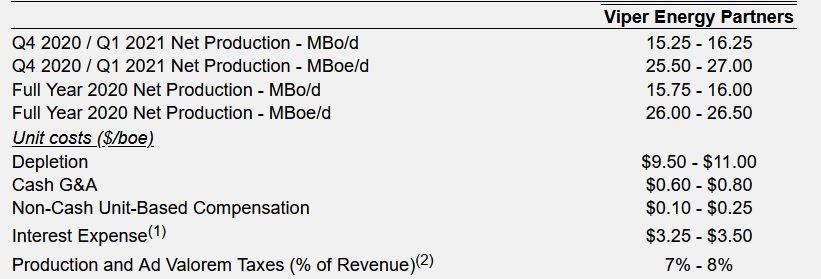

- Initiating average daily production guidance for Q4 2020 and Q1 2021 of 15,250 to 16,250 bo/d (25,500 to 27,000 boe/d)

- Narrowing full year 2020 average production guidance to 15,750 to 16,000 bo/d (26,000 to 26,500 boe/d)

- As of October 14, 2020, there were approximately 486 gross horizontal wells in the process of active development on Viper's acreage, in which Viper expects to own an average 1.4% net royalty interest (6.6 net 100% royalty interest wells)

- Approximately 431 gross (11.2 net 100% royalty interest) line-of-sight wells that are not currently in the process of active development, but for which Viper has visibility to the potential of future development in coming quarters, based on Diamondback's current completion schedule and third party operators' permits

- Q2 2020 and Q3 2020 distributions reasonably estimated to not constitute dividends for U.S. federal income tax purposes; instead should generally constitute non-taxable reductions to the tax basis

Travis Stice, CEO of Viper's General Partner Diamondback, said: "Viper's 10% increase in oil production during the third quarter of 2020 was driven primarily by 38 of Diamondback's 41 completions in the quarter having a roughly 10% average royalty interest net to Viper, as third-party activity remained minimal, again showcasing the differentiated relationship between Diamondback and Viper. With production already within the high end of our previously guided range, we are confident we will exit 2020 with a strong production rate, positioning Viper well to deliver robust free cash flow in 2021.

Mr. Stice continued, "The advantaged nature of the royalty business model with no required capital expenditures and only minimal operating expenditures, further enhanced by Viper's best-in-class cost structure, has been highlighted during this severe industry downturn as Viper has been able to reduce total debt by 10% in just the past six months. As a direct result of this, and because of our confidence in the expected free cash flow to be generated in our forward outlook, the Board has elected to increase our distribution for the third quarter to 50% of our total cash available for distribution, up from 25% previously. With a currently anticipated forward free cash flow yield of greater than 15%, due primarily to Diamondback's expected development plan and benefiting from punitive hedges rolling off in 2021, we look forward to continuing to increase our return of capital to unitholders over the coming quarters."

Financials

Viper's third quarter 2020 average unhedged realized prices were $36.80 per barrel of oil, $1.07 per Mcf of natural gas and $12.44 per barrel of natural gas liquids, resulting in a total equivalent realized price of $25.76/boe.

During the third quarter of 2020, the Company recorded total operating income of $62.9 million and consolidated net income (including non-controlling interest) of $16.2 million.

As of September 30, 2020, the Company had a cash balance of $7.4 million and $453.5 million available under its revolving credit facility. During the third quarter of 2020, the Company repurchased $6.0 million of the outstanding principal of its 5.375% Senior Notes due 2027 (the "Notes) at a 1.5% discount to par value. Additionally, during the third quarter, Viper repaid $27.0 million in outstanding borrowings under its revolving credit facility, resulting in total debt reduction of $33.0 million. Since the end of the first quarter of 2020, Viper has now reduced total debt by $67.1 million, or a 10% reduction over this time period.

In connection with its Fall redetermination, expected to close in November 2020, Viper's lead bank has recommended maintaining the borrowing base at $580.0 million. As a result, Viper is expected to maintain its elected commitment at $580.0 million.

Q3 Cash Distribution

The Board of Directors of Viper's General Partner declared a cash distribution for the three months ended September 30, 2020 of $0.10 per common unit. The distribution is payable on November 19, 2020 to eligible common unitholders of record at the close of business on November 12, 2020. This distribution represents approximately 50% of total cash available for distribution.

On August 20, 2020, Viper made a cash distribution to its unitholders and subsequently has reasonably estimated that such distribution, as well as the distribution payable on November 19, 2020, should not constitute dividends for U.S. federal income tax purposes. Rather, these distributions should generally constitute non-taxable reductions to the tax basis of each distribution recipient's ownership interest in Viper. The Form 8937 containing additional information may be found on www.viperenergy.com under the "Investor Relations" section of the site.

Ops and Acquisitions Update

During the third quarter 2020, there was a resumption of completion activity on our mineral and royalty acreage as commodity prices improved from historic lows witnessed during the second quarter of 2020. As a result, during the third quarter, Viper estimates that 108 gross (4.7 net 100% royalty interest) horizontal wells with an average royalty interest of 4.3% were turned to production on its existing acreage position with an average lateral length of 10,022 feet. Of these 108 gross wells, Diamondback is the operator of 38 with an average royalty interest of 9.9%, and the remaining 70 gross wells, with an average royalty interest of 1.3%, are operated by third parties.

During the third quarter of 2020, Viper did not complete any acquisitions. However, during the third quarter, the Company sold 18 net royalty acres in the Permian Basin for an aggregate of approximately $2.1 million, subject to post-closing adjustments. As a result of the divestitures, Viper's footprint of mineral and royalty interests as of September 30, 2020 was 24,696 net royalty acres.

The following table summarizes Viper's gross well information as of October 14, 2020:

Despite the continued depressed commodity price environment, there continues to be active development across Viper's asset base, however, near-term activity is expected to be driven primarily by Diamondback operations. The 486 gross wells currently in the process of active development are those wells that have been spud and are expected to be turned to production within approximately the next six to eight months. The 431 line-of-sight wells are those that are not currently in the process of active development, but for which Viper has reason to believe that they will be turned to production within approximately the next 15 to 18 months. The expected timing of these line-of-sight wells is based primarily on permitting by third party operators or Diamondback's current expected completion schedule. Existing permits or active development of our royalty acreage does not ensure that those wells will be turned to production given the current depressed oil prices.

Guidance Update

Below is Viper's revised guidance for the full year 2020, as well as average production guidance for Q4 2020 and Q1 2021.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian - Midland Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?