Drilling & Completions | Rig Count | Top Story | Production | Exclusives / Features

What Drives Production: Rig Count or Well Completions?

Much as has been said over the years about the link between rig counts and production. The industry watches the rig count weekly and refer to it as a proxy for production growth. We also have companies who in most of their investor materials tout the link between production and rig count. Now we would like to debunk that myth.

While rig count is a great metric to measure "commited capital", it has become apparent that it has limited use when trying to understand/forecast production growth (negative or positive).

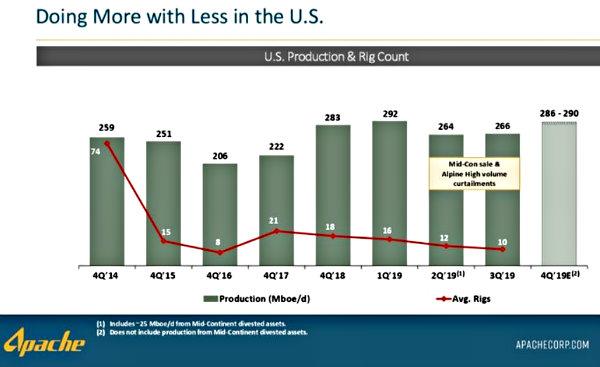

Earlier last week, a subscriber asked us the following "How can Apache keep production growing amidst such a drastic drop in rig count." our response was, don't let the chart fool you.

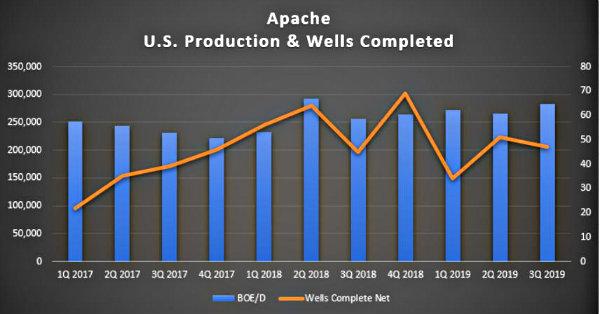

Below is the slide from Apache's November 2019 investor presentation, where the company touts "Doing More with Less in the U.S. While it is true, the company has lowered its rig count over the year, what it did leave out was the well count. As you can see from the chart below "U.S. Production vs Wells Completed", Apache's production grew as a result of the number of wells completed and in no way was linked to its rig count.

The relationship between well count is even more apparent when you look at 4Q18 when the well count fell, 2 quarters later, production fell as well.

Production vs. Rigs

Source : Apache November 2019 Investor Presentation

Apache's reported Production vs. Well Completions

Source : Shale Experts Operator Database, Apache Quarterly Supplements

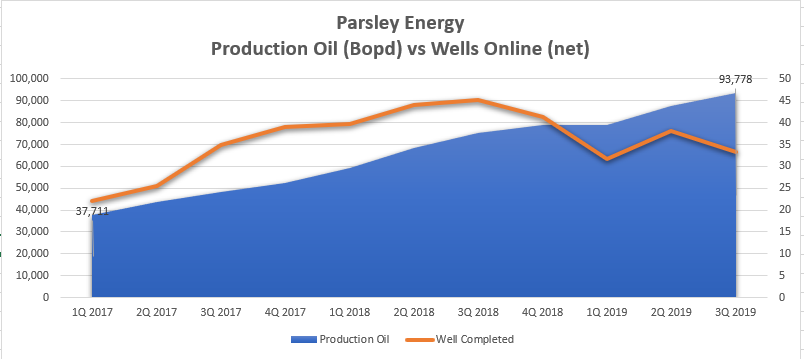

Parsley Energy

Parsley Energy also reported a similar outcome in rig count vs. production totals.

Source : Parsley Energy November 2019 Investor Presentation

Parsley Energy also touted a similar slide, so we took at a look at its well count vs oil production (bopd). As you can see from the chart below the same applies for Parsley, quite frankly, this applies to all companies.

We should instead, focus on well count when talking about production growth (- or +). I am sure the next time you see a investor presentation touting "doing more with less" and it links rigs to production, you will simply smile and ask, "I would like to see your well count as well".

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024 -

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Capex Plans Jump After 2Q: Nearly 30 E&P Companies Raise 2022 Budgets -

-

HAL, SLB 2Q: Double-Digit Revenue Gains, Strengthened Outlooks -

-

2022 Guidance Growth: Several Operators Bolster Capex, Production Outlook -

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

United States News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?