Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

Whiting Petroleum Second Quarter 2021 Results

Whiting Petroleum Corp. announced second quarter 2021 results.

Second Quarter 2021 Highlights:

- Revenue was $352 million for the quarter ending June 30, 2021

- Net loss (GAAP) was $62 million or $1.57 per diluted share

- Adjusted net income (non-GAAP) was $118 million or $3.01 per diluted share

- Adjusted EBITDAX (non-GAAP) was $176 million

- June 30, 2021 net debt of $98 million (non-GAAP)

Lynn A. Peterson, President and CEO commented, "Our team is delivering positive results and the economic conditions continue to be in our favor. We generated net cash provided by operating activities of $183 million and $111 million in adjusted free cash flow during the quarter and over $200 million through six months. We have reinvested approximately a third of our EBITDAX back into our operations with the balance used to rapidly reduce our debt position. Subsequent to the quarter, the Company announced the purchase of assets within our Sanish field in North Dakota and the divestiture of our Redtail assets in Colorado. These transactions will increase our inventory life with higher return locations and will better focus our asset portfolio. These transactions show the flexibility provided by Whiting's balance sheet, liquidity and cash flow generation. With our operating results to date and our improving outlook for the year, we are updating our guidance for 2021 as discussed below. We have increased our expectations for production and cash flows, while maintaining our capex investments in 2021 at the higher end of our previous guidance."

Second Quarter 2021 Results

Revenue for the second quarter of 2021 increased $44 million to $352 million when compared to the first quarter of 2021, primarily due to increased commodity prices between periods.

Net loss for the second quarter of 2021 was $62 million, or $1.57 per share, as compared to a net loss of $0.9 million, or $0.02 per share, for the first quarter of 2021. Adjusted net income (non-GAAP) for the second quarter of 2021 was $118 million, or $3.01 per share, as compared to $108 million, or $2.79 per share, for the first quarter of 2021. The primary difference between net loss and adjusted net income for both periods is non-cash expense related to the change in the value of the Company's hedging portfolio.

The Company's adjusted EBITDAX (non-GAAP) for the second quarter of 2021 was $176 million compared to $170 million for the first quarter of 2021. This resulted in net cash provided by operating activities of $183 million and adjusted free cash flow (non-GAAP) of $111 million.

Adjusted net income, adjusted net income per share, adjusted EBITDAX and adjusted free cash flow are non-GAAP financial measures. Please refer to the end of this release for disclosures and reconciliations regarding these measures.

Production averaged 92.6 thousand barrels of oil equivalent per day (MBOE/d) and oil production averaged 53.4 thousand barrels of oil per day (MBO/d). Total production benefited from better than forecasted well performance and increased ethane recoveries from our processed natural gas.

Capital expenditures in the second quarter of 2021 were $58 million compared to the first quarter 2021 spend of $56 million. During the quarter, the Company drilled 9 gross/5.6 net operated wells and turned in line 9 gross/5.4 net operated wells. The Company currently has one drilling rig and one completion crew operating in its Sanish Field in North Dakota.

Lease operating expense (LOE) for the second quarter of 2021 was $64 million compared to $59 million in the first quarter of 2021. The increase was primarily due to an increase in well workover costs and certain variable expenses associated with increased activity and production. General and administrative expenses in the second quarter of 2021 of $12 million was a slight increase from the first quarter of 2021 of $10 million. Both quarters included approximately $2.4 million of non-cash stock compensation costs.

During the second quarter, oil differentials improved reflecting a more certain expectation of continued DAPL operations during the EIS. Additionally, as basin total production levels remained relatively flat, there was decreased utilization of pipeline capacity further supporting narrowed differentials.

Full-Year 2021 Guidance

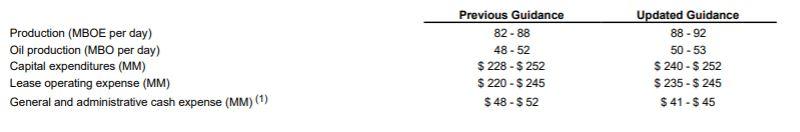

Based on the Company's increased expectations for the remainder of the year along with the outperformance in the first half of 2021, Whiting adjusted its guidance parameters as shown in the following table. This guidance includes the effect of its previously announced acquisition and divestiture.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Rockies News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

Williston Basin News >>>

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Intel Bits : E&P Operators Cut Frac Crews/ Rigs For Remainder of 2025; A Detailed Look