PDC $150 Million Tack-on Senior Notes Offering 5.75%

PDC Energy plans to offer a tack-on $150 million debt transaction to its already Senior notes due 2026 which carries at 5.75 % interest rate.

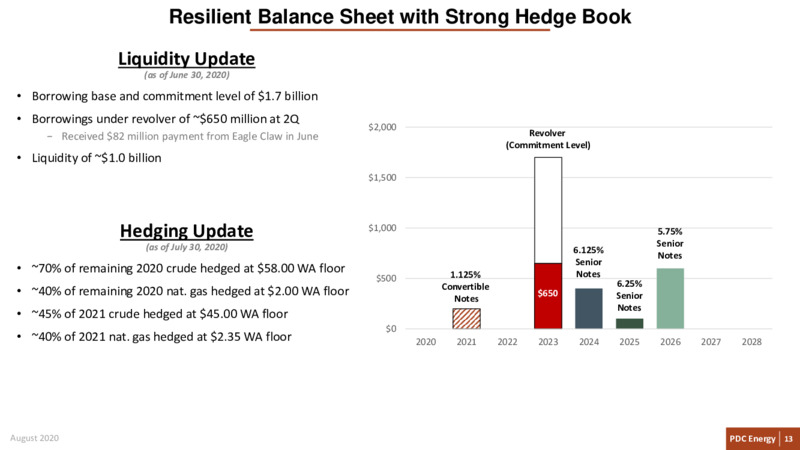

PDC does have $100 million in convertible coming due in 2021

The Company intends to use the net proceeds from the offering for general corporate purposes, which may initially include repayment of amounts outstanding under its revolving credit facility.

Announced Date

September 10,2020

Value ( $MM )

150

Type

Debt

Use of Fund

General Purpose

Company

PDC Energy, Inc.

Regions

Rockies

Country

United States,United States

Play

Niobrara - DJ Basin

Rockies Related Financings

| Announced Date | Title | Company | Value($MM) | Financing Type |

|---|---|---|---|---|

| 2021-11-10 | Northern Oil Launches $200MM Private Debt Offering | Northern Oil and Gas, Inc. | 200 | Debt |

| 2021-05-25 | Oasis Prices $400 Million Private Debt Offering | Oasis Petroleum Inc. | 400 | Debt |

| 2021-03-22 | Oasis Midstream Taps Debt Markets for $450 Million | Oasis Midstream Partners LP | 450 | Debt |

| 2020-11-11 | Continental Prices $1.5B Private Debt Offering | Continental Resources, Inc. | 1,500 | Debt |