Service & Supply | Top Story | Oilfield Services | Frac Markets - Pressure Pumping | Special Reports | Exclusives / Features

Frac Market Update : As Weatherford Shifts Its Focus; Halliburton & FTS To Gain Share

In its fourth quarter 2015 conference call, Weatherford International Chairman, President & CEO Bernard J. Duroc-Danner discussed how the company is continuing to focus less on the pressure pumping market. Earlier this year, the company also noted that it was reducing its frac fleet.

Duroc-Danner commented: "[There are] two product lines that we personally will only play if we can make a living, which is pressure pumping and drilling tools. We will pull out of certain regions on certain product lines [and] at the same time we will push much harder on others."

The majority of Weatherford's revenue decline in North America was due to the decline in pressure pumping activity.

These planned operational reductions are in addition to the cuts Weatherford announced in April 2015, when it cut its frac fleet by 50%.

Shale Experts' Frac Database Shows:

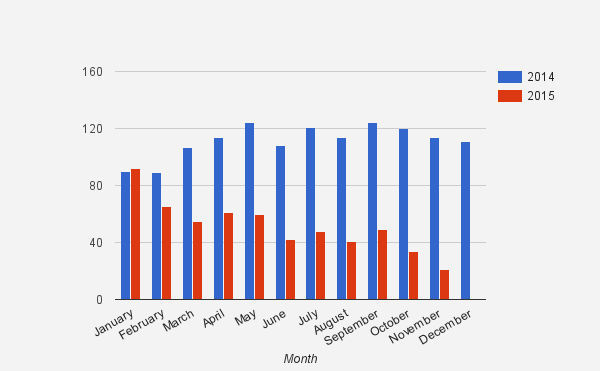

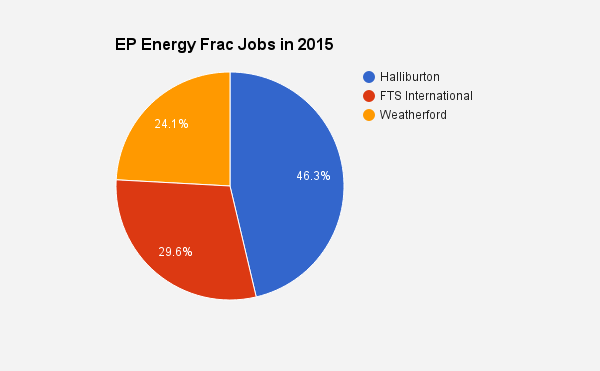

Weatherford's completion jobs have dropped off over the last year, as the market adjusts to lower prices. Meanwhile, some of Weatherford's biggest clients stand to be divided between Halliburton and FTS. Looking at one company, EP Energy, shows that a quarter of the volume of business in Frac jobs was directed toward Weatherford.

Weatherford's YOY completion activity 2014/2015

Source: Shale Experts Q1 2016 Frac Report

Weatherford List of Customers

1.png)

Source: Shale Experts Q1 2016 Frac Report

A look at one of weatherford's top customer, EP Energy shows that Halliburton and FTS International is set to gain +- 29% as the company shifts its focus away from the frac market.

Source: Shale Experts Q1 2016 Frac Report

Going forward.

We think the best course of action for the company is to either find a buyer for the completions business/assets or partner with a pure play pressure pumper. The latter might seem like a less likely option as most pure play pumpers are having liquidity problems with depresssed oil prices and massive debts on their books to service.

Related Categories :

Frac Markets - Pressure Pumping

More Frac Markets - Pressure Pumping News

-

Frac Sand Providers Rush to Add Capacity as Demand Jumps -

-

Private Equity Ready to Add Frac Capacity in Sold Out Market -

-

Large Oilfield Service Provider Talks D&C Activity, E&P Capex Increase; DUCs -

-

U.S. E&Ps; Added +9 Frac Fleets This Week; The 2nd Largest Weekly Change -

-

Operators Added +5 Frac Fleets: Week Ending August 27, 2021 -

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results