Bankruptcy / Restructure Update | Financial Trouble | Capital Markets

Halcon Restructure Agreement; Equity Holders Wiped Out

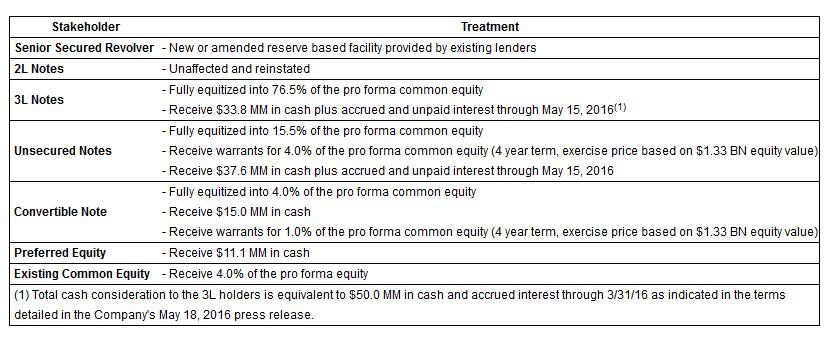

Halcón Resources Corporation today announced the Company has executed a restructuring support agreement (the "RSA") with select holders of its 13.0% 3rd Lien Notes due 2022 ("3L Notes"), its three tranches of senior unsecured notes comprised of its 9.75% Senior Notes due 2020, its 8.875% Senior Notes due 2021, and its 9.25% Senior Notes due 2022 (together, the "Unsecured Notes"), its 8.0% Convertible Note due 2020 (the "Convertible Note") and its 5.75% Perpetual Convertible Preferred Stock (the "Preferred Equity", and together with the 3L Notes, Unsecured Notes and Convertible Note, the "Affected Stakeholders").

As previously announced, the restructuring plan, if implemented, will result in the elimination of approximately $1.8 billion of net debt and approximately $222 million of Preferred Equity, and will reduce the Company's ongoing annual interest burden by more than $200 million. Under the terms of the RSA, all current stakeholders, including common equity holders, will receive cash and/or common equity in the restructured Company.

Related Categories :

Financial Trouble

More Financial Trouble News

-

Silverbow Resources Board Adopts 'Poison Pill' Strategy

-

Hess Corp. Second Quarter 2022 Results

-

Basic Energy Services Files for Bankruptcy; Inks Stalking Horse Deals

-

Amplify Energy Regains Compliance with NYSE

-

Report: Chesapeake Poised to Emerge from Bankruptcy

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus