Exploration & Production | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Production Rates | Forecast - Production | Hedging | Capital Markets | Capital Expenditure | Drilling Program

Manitok Hedged in 2015, Reducing Debt

Manitok Energy Inc. has announced its financial and operating results for the third quarter of 2014 and an operational and 2014 guidance update.

All dollar figures are in Canadian dollars unless otherwise noted.

Third Quarter 2014 Operational & Financial Highlights:

- Production averaged 3,962 boe/d (54% light oil and liquids), which is a 4% increase over production of 3,819 boe/d (49% light oil and liquids) in the third quarter of 2013.

- Increased light oil production by 16%, which increased Manitok’s light oil production weighting to 52% of total production as compared to 47% of total production in the third quarter of 2013.

- Increased average production per diluted share by 7% when compared to the third quarter of 2013.

- Manitok drilled 7 (5.0 net) wells in the quarter with none being placed on production in the quarter. Subsequent to the end of the quarter, Manitok has drilled 6 (3.9 net) additional wells. The 13 (8.9 net) wells will be placed on production in the fourth quarter of 2014 or in the first quarter of 2015.

- Recorded funds from operations of $8.6 million ($0.12 per diluted share), which is consistent with funds from operations of $8.3 million ($0.12 per diluted share) in the third quarter of 2013.

- Realized a 2% increase in operating netback (excluding the realized loss on financial instruments) with $33.36/boe in the third quarter 2014 as compared to $32.57/boe in the third quarter of 2013.

- Capital expenditures were approximately $22.8 million, which included drilling for about $17.6 million and $3.4 million on equipment and facilities. Of the 7 (5.0 net) wells drilled, 3 (1.0 net) were in the Stolberg area and 4 (4.0 net) were in the Entice area.

- At September 30, 2014, net debt was approximately $59.1 million and unused credit facilities were $56.9 million.

- Reduced the outstanding common shares of Manitok (Manitok Shares) by 3% to 66,996,440 as compared to June 30, 2014. Subsequent to the third quarter and up to November 14, 2014, the number of issued and outstanding Manitok Shares decreased to 65,750,107 due to Manitok’s normal course issuer bid program.

Operations Update

Cordel-Stolberg

- Manitok has successfully drilled the 103/13-21-42-15W5 well (33% working interest), which targeted the forelimb of the Cardium structure offsetting the recently drilled 4-22-42-15W5 well that tested at 600 boe/d (180 boe/d net) as previously press released on August 28, 2014. Production testing will begin on the 103/13-21-42-15W5 well as soon as the drilling rig is released from the Cordel-Stolberg area.

- The one remaining rig is currently drilling the 13-11-42-15W5 well (30% working interest), which is targeting the backlimb of the Cardium structure offsetting the recently drilled 10-15-42-15W5 well that tested at 1,103 boe/d (331 boe/d net) as previously press released on August 28, 2014. Together with the already drilled and tested 5-14-42-15W4 well, Manitok anticipates these 3 (0.93 net) wells to be placed on production prior to year-end.

- Once the 13-11-42-15W5 well has been drilled, the rig will move to the section 15 lease in order to drill 2 (0.6 net) additional Cardium oil wells. The first is anticipated to be drilled in December and the second well will be drilled in January 2015. Both wells are anticipated to be placed on production prior to the end of the first quarter of 2015.

Entice

- Since mid-July 2014, Manitok has successfully drilled four horizontal wells in the Lithic Glauconitic (“Glauc“) formation and four horizontal wells in the Basal Quartz (BQ) formation at a 100% working interest. By year-end Manitok will drill one additional 100% working interest well targeting the BQ formation. At this time, none of these horizontal wells are tied-in, however, facility work relating to the battery setup and pipeline tie-in to a third party gas plant is well underway.

- Manitok anticipates that three horizontal Glauc wells will be placed on production during December 2014. Two of the three Glauc wells have tested at a combined flowing rate of 1,565 boe/d (649 bbls/d of oil), as press released on August 28, 2014 and November 10, 2014, and the third well is currently being production tested. Of the remaining 6 wells, two BQ wells have tested at a combined flowing rate of 572 boe/d (312 bbls/d of oil), as press released on September 18, 2014 and October 9, 2014, and the other four wells will be completed and production tested through the remainder of the fourth quarter of 2014. It is anticipated the six wells will be placed on production over the course of the first and second quarters of 2015. The drilling, completion, equipping and facilities relating to the nine horizontal wells are reflected in Manitok’s anticipated 2014 capital expenditures.

- Manitok anticipates that two additional horizontal wells will be drilled on existing Entice leases in the first quarter of 2015 prior to spring break-up, with at least one being a Glauc well. That will bring the total horizontal wells drilled in the Entice area since mid-July 2014 to 11 wells. Other than the drilling, completions and equipping costs of these two wells, Manitok anticipates minimal additional capital spending in the Entice area until drilling resumes after spring break-up which is expected to be in mid to late July 2015.

Capital Strategy

- The majority of the anticipated capital required for the battery facility and pipeline tie-in to the third party gas plant in Entice will be incurred in the fourth quarter of 2014. Manitok utilized its credit facilities to drill a sufficient number of horizontal wells at Entice in advance of spring break-up 2015 in order to maximize its production and funds from operations in the first two quarters of 2015, and to better evaluate the production from both the Glauc and BQ formations at the south end of Manitok’s Entice area.

- Manitok anticipates that its funds from operations in the first half of 2015 will exceed its capital spending requirements in the same period and up to 30% to 40% of first half 2015 funds from operations will be applied towards paying down its credit facilities.

- As a result of the oil price hedging in place for all of 2015, and the mitigating impact of a lower Canadian dollar on realized oil and natural gas prices, Manitok is well insulated to the possible volatility of oil prices in 2015.

- Currently, Manitok has 1,800 bbls/d of oil hedged for the remainder of 2014 at CAD$97.48 WTI oil, which represents about 66% to 70% of anticipated fourth quarter 2014 oil production.

- The oil price hedges in place for 2014 have mitigated a large portion of the recent oil price weakness in the fourth quarter.

- Manitok also has 1,500 bbls/d of its oil hedged at CAD$93.67 WTI oil for 2015, which represent approximately 42% to 45% of its 2014 exit oil production rate.

- Given that Manitok’s average oil royalty is approximately 30% of production that represents about 60% to 64% of Manitok’s anticipated production exit rate after royalties. The level of hedging combined with the anticipated production additions from Manitok’s successful drilling results over the last two quarters, will allow Manitok to execute its plan to reduce its net debt over the first half of 2015 with relatively low risk while waiting on production results to determine the level of capital spending in the second half of 2015.

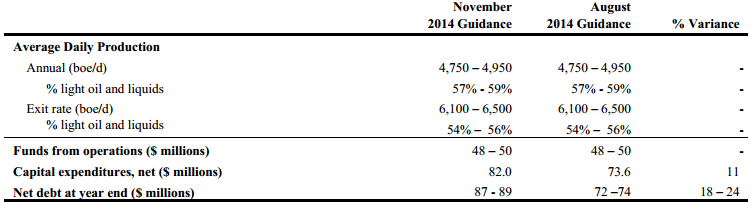

2014 Guidance

The increase in capital expenditures from previous guidance relates to the asset acquisition in Stolberg for total cash consideration of $7.5 million before final closing adjustments, as disclosed on the press release dated November 10, 2014. Net debt has increased from previous guidance due to the above-noted acquisition and activity in the normal course issuer bid program.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)