Quarterly / Earnings Reports | Exploration & Appraisals | Deals - Acquisition, Mergers, Divestitures | Drilling Activity

BHP's Production Flat as Asset Sell-Off Continues; Talks Latest GOM Activity

BHP Billiton reported its results for the quarter ended September 30, 2018.

- As previously announced, the company is in the process of selling off its onshore US assets. So far two deals have been struck including:

E&P / Production Update

Total Conventional petroleum production was broadly flat at 33 MMboe. Guidance for the 2019 financial year remains unchanged at between 113 and 118 MMboe.

- Crude oil, condensate and natural gas liquids production declined by 7% to 14 MMboe

- Natural gas production increased by 5% to 112 bcf

GOM Ops - Further Appraisal at Samurai 2 Well

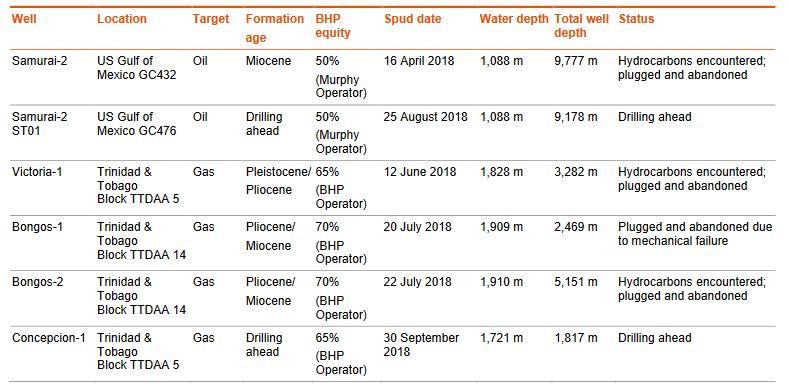

In the US Gulf of Mexico, the Samurai-2 exploration well encountered hydrocarbons in multiple horizons not previously observed by the Wildling-2 exploration well and was plugged and abandoned on 23 August 2018. A sidetrack of the Samurai-2 well commenced on 25 August 2018 to further appraise the discovery and is currently drilling ahead. In the Western US Gulf of Mexico, we commenced the acquisition of an Ocean Bottom Node seismic survey.

In Trinidad and Tobago, we continued with Phase 2 of our deepwater exploration drilling campaign. The Victoria-1 exploration well, which further assessed the commercial potential of the Magellan play in our Southern licence area in Trinidad and Tobago, encountered gas and was plugged and abandoned on 18 July 2018. Following the Victoria-1 well, the Bongos-1 exploration well was spud on 20 July 2018 and experienced mechanical difficulty shortly after spud. The Bongos-2 exploration well was spud on 22 July 2018 and encountered hydrocarbons. The Bongos-2 and Bongos-1 wells were plugged and abandoned on 23 September 2018 and 26 September 2018 respectively. Following the Bongos-2 well, the Concepcion-1 well was spud on 30 September 2018 to further test the Magellan play and is currently drilling ahead.

In Mexico, we expect to begin drilling the first appraisal well at Trion in the December 2018 quarter. In Australia, the final processed data of the Exmouth sub-basin 3D seismic data has been received.

A US$750 million exploration and appraisal program is being executed for the 2019 financial year. Petroleum exploration expenditure for the September 2018 quarter was US$133 million, of which US$55 million was expensed.

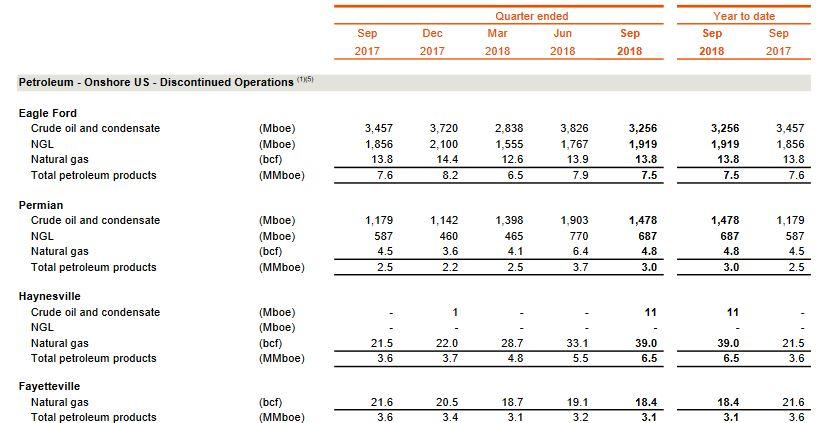

Onshore US – Discontinued operations

Following BHP’s sale of the Onshore US assets, as announced on 27 July 2018, these assets have been presented as discontinued operations. The effective date at which the right to economic profits transfers to the purchasers is 1 July 2018.

Onshore US production for the September 2018 quarter increased by 16 per cent to 20 MMboe as a result of additional wells put online in Haynesville, Permian and Eagle Ford. Drilling and development expenditure for the September 2018 quarter was US$299 million. Our operated rig count remained unchanged at five, with two rigs at Eagle Ford, two rigs at Permian and one at Haynesville. No annual guidance for the 2019 financial year for these assets will be provided; however until sale completion, we expect a production run rate broadly consistent with the second half of the 2018 financial year.

On 29 September 2018, BHP announced the completion of the sale of its Fayetteville Onshore US gas assets to a wholly owned subsidiary of Merit Energy Company. Completion of the sale of BHP’s interests in the Eagle Ford, Haynesville and Permian Onshore US oil and gas assets to BP America Production Company, a subsidiary of BP Plc, is expected to occur by the end of October 2018.

Related Categories :

Quarterly / Earnings Reports

More Quarterly / Earnings Reports News

-

EOG Resources Reports Third Quarter 2023 Results

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

Ark-La-Tex News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -