Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | Capital Expenditure - 2021

Black Stone Minerals 2021 Plan; Fourth Quarter, Full Year 2020 Results

Black Stone Minerals reported its financial and operating results for the fourth quarter and full year of 2020 and provides guidance for 2021.

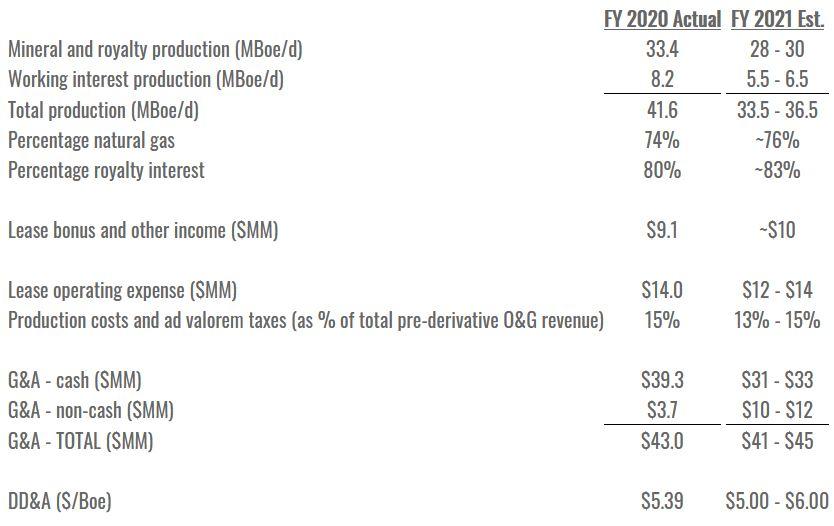

Summary 2021 Guidance

Following are the key assumptions in Black Stone Minerals' 2021 guidance, as well as comparable results for 2020:

Production

Black Stone expects royalty production to decline by approximately 13% in 2021, primarily due to continued lower levels of drilling activity across its acreage. This expectation assumes: (i) the rig count in the Permian Basin stays relatively flat to the depressed levels of 2020, (ii) the natural decline in producing wells in the Shelby Trough with limited new production volumes in advance of the expected ramp in activity from the 2020 development agreement with Aethon, (iii) little new drilling activity on the Company’s Bakken Three Forks acreage, and (iv) a continuation of the low activity levels across Black Stone’s remaining plays. The production guidance also incorporates the full-year impact from the Permian properties sold in July of 2020.

Working interest production is expected to decline by approximately 27% in 2021 as a result of Black Stone's decision to farm-out participation in its working interest opportunities.

Distributions

Under the current outlook for commodity prices and drilling activity, management anticipates recommending quarterly distributions for 2021 of approximately $0.175 per unit, or $0.70 per unit for the full year, consistent with the distribution announced with respect to the fourth quarter of 2020.

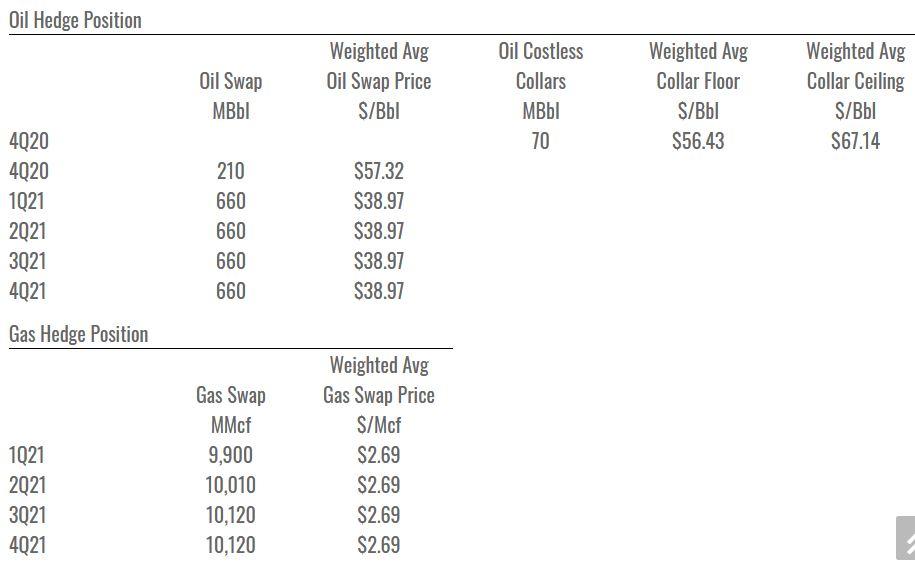

Hedge Position

Black Stone has commodity derivative contracts in place covering portions of its anticipated production for 2021. The Company's hedge position as of December 31, 2020, is summarized in the following tables:

Fourth Quarter 2020 Highlights

- Mineral and royalty production for the fourth quarter of 2020 equaled 32.0 MBoe/d, an increase of 3% over the prior quarter; total production, including working interest volumes, was 39.0 MBoe/d for the quarter.

- Net income and Adjusted EBITDA for the quarter was $30.3 million and $72.3 million, respectively.

- Distributable cash flow was $65.9 million for the fourth quarter, resulting in distribution coverage for all units of 1.8x based on the announced cash distribution of $0.175 per unit.

- Total debt at the end of the quarter was $121 million; total debt to trailing twelve-month Adjusted EBITDA was 0.4x at year-end.

Full Year Financial and Operational Highlights

- Achieved full year 2020 production of 41.6 MBoe/d; mineral and royalty volumes in 2020 decreased 8% over the prior year to average 33.4 MBoe/d.

- Reported 2020 net income and Adjusted EBITDA of $121.8 million and $281.3 million, respectively.

- Lowered total general and administrative expenses in 2020 by 32% over prior-year levels

- Reduced total debt outstanding by $273 million in 2020 through a combination of retained cash flows and proceeds from asset sales

Thomas L. Carter, Jr., Black Stone Minerals' Chief Executive Officer and Chairman commented, "We navigated unprecedented challenges in 2020 and have emerged as a leaner, more focused company with even greater financial flexibility. We made significant progress in our strategic priorities to attract additional activity onto our existing acreage footprint and to strengthen our balance sheet, both of which will drive long-term value for our unitholders."

Quarterly Financial and Operating Results

Production

Black Stone Minerals reported mineral and royalty volume was 32.0 MBoe/d (71% natural gas) for the fourth quarter of 2020, compared to 31.1 MBoe/d for the third quarter of 2020. Royalty production was 35.1 MBoe/d for the fourth quarter of 2019.

Working interest production for the fourth quarter of 2020 was 7.0 MBoe/d, and represents an increase of 1% from the 6.9 MBoe/d for the quarter ended September 30, 2020 and a decrease of 37% from the 11.1 MBoe/d for the quarter ended December 31, 2019. The year-over-year decline in working interest volumes is consistent with the Company's decision to farm out its working-interest participation to third-party capital providers.

Total reported production averaged 39.0 MBoe/d (82% mineral and royalty, 75% natural gas) for the fourth quarter of 2020. Total production was 37.9 MBoe/d and 46.2 MBoe/d for the quarters ended September 30, 2020 and December 31, 2019, respectively.

Realized Prices, Revenues, and Net Income

The Company's average realized price per Boe, excluding the effect of derivative settlements, was $22.21 for the quarter ended December 31, 2020. This is an increase of 22% from $18.18 per Boe from the third quarter of 2020 and a 11% decrease compared to $25.02 for the fourth quarter of 2019. Realized oil prices as a percentage of the WTI benchmark price improved to 94% in the fourth quarter of 2020 from 88% in the third quarter of 2020.

Black Stone reported oil and gas revenue of $79.7 million (46% oil and condensate) for the fourth quarter of 2020, an increase of 26% from $63.4 million in the third quarter of 2020. Oil and gas revenue in the fourth quarter of 2019 was $106.3 million.

The Company reported a loss on commodity derivative instruments of $3.6 million for the fourth quarter of 2020, composed of a $14.6 million gain from realized settlements and a non-cash $18.2 million unrealized loss due to the change in value of Black Stone's derivative positions during the quarter. Black Stone reported a loss on commodity derivative instruments of $21.1 million and $17.2 million for the quarters ended September 30, 2020 and December 31, 2019, respectively.

Lease bonus and other income was $1.4 million for the fourth quarter of 2020, primarily related to leasing activity in the Haynesville and Permian plays. Lease bonus and other income for the quarters ended September 30, 2020 and December 31, 2019 was $1.4 million and $14.0 million, respectively.

There was no impairment for the quarters ended December 31, 2020 and December 31, 2019.

The Company reported net income of $30.3 million for the quarter ended December 31, 2020, compared to net income of $23.7 million in the preceding quarter. For the quarter ended December 31, 2019, net income was $40.0 million.

Adjusted EBITDA and Distributable Cash Flow

Adjusted EBITDA for the fourth quarter of 2020 was $72.3 million, which compares to $65.5 million in the third quarter of 2020 and $100.0 million in the fourth quarter of 2019. Distributable cash flow for the quarter ended December 31, 2020 was $65.9 million. For the quarters ended September 30, 2020 and December 31, 2019, distributable cash flow was $58.8 million and $90.2 million, respectively.

2020 Proved Reserves

Estimated proved oil and natural gas reserves at year-end 2020 were 56.0 MMBoe, a decrease of 18% from 68.5 MMBoe at year-end 2019, and were approximately 72% natural gas and 97% proved developed producing. The standardized measure of discounted future net cash flows was $493.5 million at the end of 2020 as compared to $847.9 million at year-end 2019.

Netherland, Sewell and Associates, Inc., an independent, third-party petroleum engineering firm, evaluated Black Stone Minerals' estimate of its proved reserves and PV-10 at December 31, 2020. These estimates were prepared using reference prices of $39.54 per barrel of oil and $1.99 per MMBTU of natural gas in accordance with the applicable rules of the Securities and Exchange Commission (as compared to prompt month prices of $59.24 per barrel of oil and $3.07 per MMBTU of natural gas as of February 19, 2021). These prices were adjusted for quality and market differentials, transportation fees, and in the case of natural gas, the value of natural gas liquids. A reconciliation of proved reserves is presented in the summary financial tables following this press release.

Financial Position and Activities

As of December 31, 2020, Black Stone Minerals had $1.8 million in cash and $121.0 million outstanding under its credit facility. The Company paid down $26 million of debt during the fourth quarter of 2020 and $273 million of debt during the full year. The ratio of total debt at year-end to 2020 Adjusted EBITDA was 0.4x. The Company's borrowing base at December 31, 2020 was $400 million, and the Company's next regularly scheduled borrowing base redetermination is set for April 2021. Black Stone is in compliance with all financial covenants associated with its credit facility.

As of February 19, 2021, $99.0 million was outstanding under the credit facility and the Company had $4.6 million in cash.

During the fourth quarter of 2020, the Company made no repurchases of units under the Board-approved $75 million unit repurchase program and issued no units under its at-the-market offering program.

Fourth Quarter 2020 Distributions

As previously announced, the Board approved a cash distribution of $0.175 for each common unit attributable to the fourth quarter of 2020. The quarterly distribution coverage ratio attributable to the fourth quarter of 2020 was approximately 1.8x. These distributions will be paid on February 23, 2021 to unitholders of record as of the close of business on February 16, 2021.

Activity Update

Rig Activity

As of December 31, 2020, Black Stone had 38 rigs operating across its acreage position, a 31% increase to rig activity on the Company's acreage as of September 30, 2020 and below the 95 rigs operating on the Company's acreage as of December 31, 2019.

Shelby Trough Development Update

As announced in June 2020, Black Stone entered into an incentive agreement with XTO Energy Inc. ("XTO"). The agreement allowed for royalty relief on 13 existing drilled but uncompleted wells ("DUCs") in San Augustine County, Texas provided the wells were turned to sales by March 31, 2021. As of January 18, 2021, XTO had turned all 13 DUCs to sales. Black Stone is also working with XTO on a mutually beneficial agreement that will help facilitate Black Stone attracting another operator to develop its acreage in San Augustine.

In Angelina County, Texas, Aethon Energy ("Aethon") has successfully spud the initial two program wells under the development agreement signed in May of 2020. Under the terms of that agreement, Aethon will drill a minimum of four wells on Black Stone acreage in the first program year ending in September 2021, escalating to a minimum of 15 wells per program year starting with the third program year.

Austin Chalk Update

Black Stone is currently working with several operators to test and develop areas of the Austin Chalk in East Texas where the Company has significant acreage positions. Recent drilling results have shown that advances in fracturing and other completion techniques can dramatically improve well performance from the Austin Chalk formation. In February of 2021, Black Stone entered into an agreement with a large, publicly traded independent operator by which the operator will undertake a program to drill, test, and complete wells in the Austin Chalk formation on certain of the Company's acreage in East Texas. If successful, the operator has the option to expand its drilling program over a significant acreage position owned and controlled by the Company.

Black Stone is also working with existing operators across its East Texas Austin Chalk position to encourage new development utilizing current completion techniques.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results