Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets

Bonanza Creek Energy Third Quarter 2020 Results

Bonanza Creek Energy, Inc. announced its third quarter 2020 financial results and operating outlook.

Highlights:

- Average sales volumes up 6% over second quarter to 26.2 thousand barrels of oil equivalent per day ("MBoe/d"), with oil representing 53% of total volumes

- Increasing annual production guidance to a range of 25.0 to 25.5 MBoe/d, and tightening oil mix guidance to a range of 54% to 56%

- Capital expenditures of $1.8 million for the third quarter bringing YTD capital expenditures to $64.6 million; reiterating annual capex guidance range of $60 to $70 million

- Lease operating expense ("LOE") of $2.23 per Boe for the third quarter; down 13% from second quarter 2020, bringing the YTD metric to $2.43 per Boe

- Lowering annual LOE guidance to a range of $2.40 to $2.60 per Boe

- Recurring cash general and administrative ("G&A")(1) expense, which excludes stock-based compensation, cash severance costs and other non-recurring expenses, was $6.2 million for the quarter, or $2.56 per Boe, down 6% from second quarter 2020

- Lowering annual recurring cash G&A expense guidance to a range of $26 to $28 million

- Rocky Mountain Infrastructure ("RMI") third quarter 2020 net effective cost(1) was $1.07 per Boe, which consists of approximately $1.64 per Boe of RMI operating expense offset by $0.57 per Boe of RMI operating revenue from working interest partners

- Exited the quarter with $20.0 million drawn on the revolving facility and a leverage ratio of 0.1x

- GAAP net income of $3.3 million, or $0.16 per diluted share, including a $0.92 non-cash loss on derivatives

- Adjusted EBITDAX(1) of $41.5 million, or $1.98 per diluted share.

Eric Greager, President and Chief Executive Officer of Bonanza Creek, commented, "Total production has remained resilient despite lower new well activity since the first quarter. Asset quality and the skill of our operations team have resulted in continued strong quarterly performance."

Greager continued, "The free cash generated during the quarter allowed us to reduce our revolver debt by another $38 million, and prior to filing our third quarter 10-Q, we paid down our revolver to $10 million. We plan to start completing DUCs from inventory in early January 2021, and we'll provide additional color on our 2021 plan following year end."

Third Quarter 2020 Results

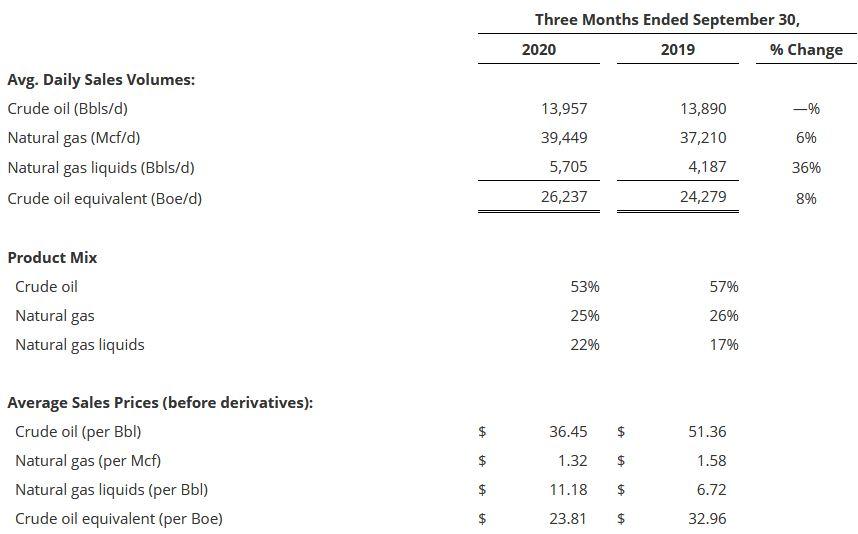

During the third quarter of 2020, the Company reported average daily sales of 26.2 MBoe/d, up 6% over second quarter volumes. Product mix for the quarter was 53% oil, 22% NGLs, and 25% residue natural gas. Oil volumes were flat from second quarter to third quarter 2020, but the oil mix of 53% for the third quarter was down from 56% in the previous quarter. The oil mix fluctuates due to the timing and thermal maturity of wells turned to sales in recent quarters. The table below provides sales volumes, product mix, and average sales prices for the third quarter 2020 and 2019.

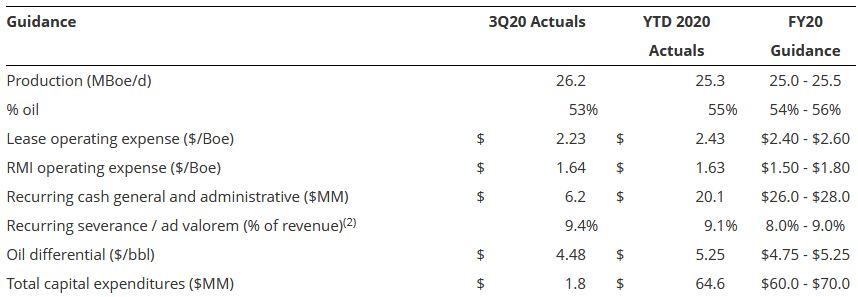

Capital expenditures were $1.8 million for the third quarter of 2020. During the quarter, the Company turned to sales 2 gross (1.6 net) wells, one of which was a standard reach lateral ("SRL") well. Capital expenditures for the fourth quarter are expected to be minimal, and the Company reiterates its annual guidance of $60 to $70 million, with $64.6 million invested YTD.

Net oil and gas revenue for the third quarter of 2020 was $58.9 million compared to $36.2 million for the second quarter of 2020. The increase was a result of a partial recovery of oil, natural gas, and NGL realized prices. Crude oil accounted for approximately 80% of total revenue for the quarter. Differentials for the Company's oil production improved during the quarter to approximately $4.48 per barrel off NYMEX WTI versus approximately $5.53 per barrel during the second quarter. The YTD oil differential was approximately $5.25 per barrel off WTI, and the Company expects its full-year 2020 oil differential to average between $4.75 and $5.25 per barrel.

LOE for the third quarter of 2020 on a per-unit basis decreased 13% to $2.23 per Boe from $2.56 per Boe in the second quarter of 2020, bringing YTD LOE per Boe to $2.43 per Boe. The Company has lowered its annual LOE guidance to $2.40 to $2.60 per Boe, down from $2.50 to $2.90 per Boe.

RMI third quarter 2020 net effective cost was $1.07 per Boe, which consists of approximately $1.64 per Boe of RMI operating expense offset by $0.57 per Boe of RMI operating revenue from working interest partners. RMI operating revenue from working interest partners is based on production volumes, and the fees are not tied to oil or natural gas prices. The Company has lowered its annual RMI operating expense guidance to a range of $1.50 to $1.80 per Boe, down from $1.50 to $1.85 per Boe.

The Company's general and administrative ("G&A") expenses were $8.9 million for the third quarter of 2020, which included $1.7 million in non-cash stock-based compensation, $0.9 million in non-recurring advisor fees, and $0.1 million related to one-time cash severance costs. Recurring cash G&A, which excludes non-recurring and non-cash items, of $6.2 million for the third quarter of 2020 remained flat compared to second quarter 2020. On a per-unit basis, the Company's recurring cash G&A decreased 6% to $2.56 per Boe in the third quarter of 2020 from $2.72 per Boe in the second quarter of 2020. The Company lowered its annual recurring cash G&A guidance to $26 to $28 million, down from $27 to $29 million.

RMI net effective cost and recurring cash G&A are non-GAAP measures. Please see Schedule 7 and Schedule 8 at the end of this release for a reconciliation to the most comparable GAAP measure.

The Company's severance and ad valorem taxes were a credit of $7.1 million for the third quarter of 2020, which included a one-time true-up of accrued severance and ad valorem taxes as a result of a refinement to our tax estimate based on current mill levies, taxing districts, and company and industry results. Excluding this adjustment, recurring severance and ad valorem taxes were $5.5 million, or 9.4% of revenue, for the third quarter of 2020. The Company expects its fourth quarter severance and ad valorem taxes to be approximately 8 to 9% of revenue.

Guidance Summary

The table below provides YTD and third quarter results for 2020 guidance metrics:

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Rockies News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

Rockies - DJ Basin News >>>

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Civitas Provides Update on Current Rigs & Frac Crews -