Quarterly / Earnings Reports | Second Quarter (2Q) Update | Production Rates | Forecast - Production | Hedging | Capital Markets | Capital Expenditure

Breitburn's Production Safely Hedged into 2017

Breitburn Energy Partners LP has announced financial and operating results for the second quarter 2015, and provided second half 2015 guidance.

Highlights

- Closed the $1 billion strategic investment led by EIG Global Energy Partners on April 8th, resulting in approximately $500 million of current available liquidity.

- Reported total production of 5.0 MMBoe, in-line with Breitburn's 2015 guidance.

- Based on Breitburn's current commodity hedge portfolio and assuming second half 2015 guidance production rate as set forth below, Breitburn's total production is 77% hedged for the remainder of 2015, 65% in 2016, and 41% in 2017 at attractive prices. The mark-to-market value of Breitburn's commodity hedge portfolio was approximately $544 million as of June 30th and approximately $670 million as of July 31st.

Second Quarter 2015 Operating and Financial Results Compared to First Quarter 2015

- strong>Total production was 5,015 MBoe in the second quarter of 2015 compared to 5,051 MBoe in the first quarter of 2015. Average daily production was 55.1 MBoe/day in the second quarter of 2015 compared to 56.1 MBoe/day in the first quarter of 2015.

- Oil production decreased to 2,822 MBbl compared to 2,890 MBbl in the first quarter of 2015.

- NGL production increased to 483 MBbl compared to 459 MBbl in the first quarter of 2015.

- Natural gas production increased to 10,264 MMcf compared to 10,211 MMcf in the first quarter of 2015.

- Losses on commodity derivative instruments were $93.4 million in the second quarter of 2015 compared to gains of $137.2 million in the first quarter of 2015, primarily due to an increase in oil and natural gas futures prices during the second quarter of 2015. Derivative instrument settlement receipts were $100.6 million in the second quarter of 2015 compared to receipts of $126.4 million in the first quarter of 2015, primarily due to higher oil prices.

- NYMEX WTI oil spot prices averaged $57.85 per Bbl and Brent oil spot prices averaged $61.65 per Bbl in the second quarter of 2015 compared to $48.49 per Bbl and $53.98 per Bbl, respectively, in the first quarter of 2015. Henry Hub natural gas spot prices averaged $2.75 per Mcf in the second quarter of 2015 compared to $2.90 per Mcf in the first quarter of 2015.

- Average realized crude oil, NGL and natural gas prices, excluding the effects of commodity derivative settlements, were $53.29 per Bbl, $18.35 per Bbl and $2.57 per Mcf, respectively, in the second quarter of 2015 compared to $43.62 per Bbl, $16.54 per Bbl and $3.05 per Mcf, respectively, in the first quarter of 2015.

- Oil, NGL and natural gas capital expenditures were $58 million in the second quarter of 2015, compared to $73 million in the first quarter of 2015.

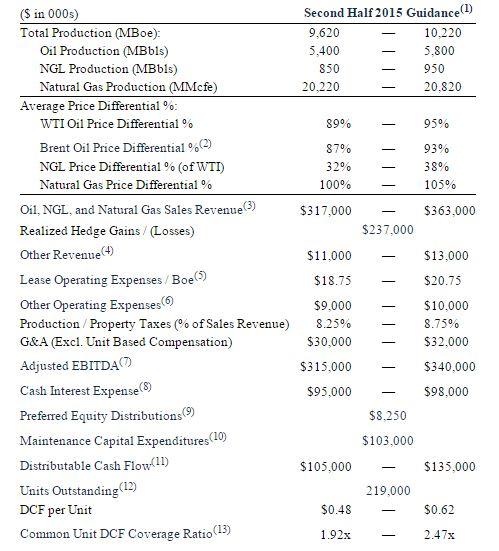

Second Half 2015 Guidance (Assuming No Acquisitions)

Management Commentary

Halbert S. Washburn, Breitburn's Chief Executive Officer, said: "We are very pleased to report another solid quarter with production, cost reductions, and Adjusted EBITDA in-line with our guidance for the first half of the year. We have completed the integration of the QR Energy assets and our diverse portfolio continues to perform as expected in this challenging environment. Earlier this year, we announced a number of steps to address what we thought could be an extended period of weak commodity pricing. Those steps included dramatically reducing our capital budget, implementing an aggressive program to reduce operating costs and completing a significant workforce reduction plan. In addition, in April we raised almost $1 billion in external capital and reset our borrowing base to $1.8 billion, without a scheduled redetermination until April of 2016. We also reset our common unit distribution to $0.50 per unit. As a result of these actions, we currently have approximately $500 million of available liquidity under our credit facility, are on track to reduce bank debt throughout the year and have an excellent distribution coverage ratio of 2.16 times this quarter.

In addition, we continue to evaluate the most attractive alternatives for maximizing the value of our substantial acreage position in the Midland Basin. With over 22,000 gross surface acres and approximately 360 net identified locations, we have the ability to add meaningful production and reserves to our base business over the course of the next few years. This acreage provides us with significant strategic and operating flexibility particularly in the current commodity price environment."

Related Categories :

Hedging

More Hedging News

-

Earthstone Energy Talks 2022 Results; Plans Five-Rig Program for 2023

-

Vermilion Energy Inc. Second Quarter 2022 Results

-

Crescent Energy Co. Second Quarter 2022 Results

-

Murphy Oil Second Quarter 2022 Results

-

Silverbow Resources Second Quarter 2022 Results

North America News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Bonterra Eneergy Corporation First Quarter 2023 Results

-

Hammerhead Energy Inc. First Quarter 2023 Results

-

Spartan Delta Corp. First Quarter 2023 Results -

-

Baytex Energy Corp. First Quarter 2023 Results