Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Forecast - Production | Hedging | Capital Markets | Capital Expenditure | Drilling Activity

CNX Resources Second Quarter 2020 Results

CNX Resources Corp. reported its Q2 2020 results.

Q2 Highlights:

- Reported a net loss attributable to CNX shareholders of $146 million, or a loss of $0.78 per diluted share, including an unrealized loss on commodity derivative instruments of $206 million.

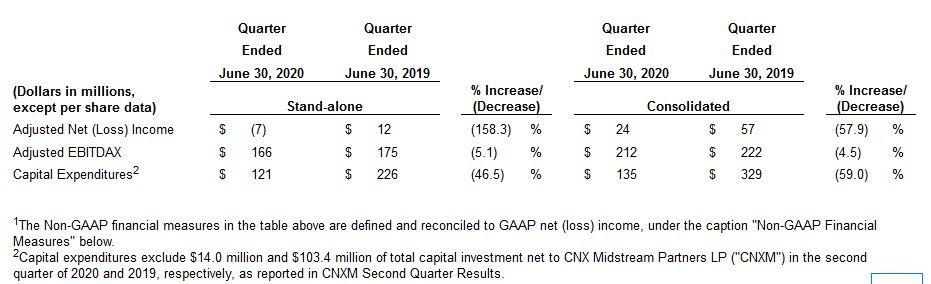

- Adjusted net income (a non-GAAP measure)(1) was $24 million.

- Adjusted EBITDAX (a non-GAAP measure)(1) was $212 million.

- Net cash provided by operating activities was $144 million and capital expenditures were $135 million.

- Proceeds from asset sales were $12 million.

- Consolidated free cash flow (FCF) (a non-GAAP measure)(1) was $21 million.

- Received $29 million in net proceeds from monetizing and terminating approximately 39 million MMBtus of NYMEX natural gas hedges and a similar quantity of financial basis hedges that were to settle at various times from May through November of 2020.

- Completed private offering of $345 million aggregate principal amount of 2.25% convertible senior notes due 2026.

- Used net proceeds of convertible debt offering to pay down 5.875% notes due in 2022. CNX has paid down the aggregate principal amount of its 2022 notes by approximately $482 million year-to-date.

Nicholas J. DeIuliis, president and CEO, said: "The second quarter highlights our philosophy in action with lower quarterly production cash costs, positive free cash flow, a balance sheet strengthening convertible notes offering, and navigating a challenging commodity price environment by efficiently deferring volumes to higher price periods. We remain committed to making capital allocation decisions to maximize the long-term intrinsic value per share of the company.

"There are three main tenets that underlay our plan. First, we generate free cash flow on a day in, and day out basis. Our programmatic hedging helps drive our free cash flow generation and will continue to be a key tactic in the future. There are various other considerations that drive the free cash flow generation of the company such as low lease operating expense and low capital intensity; our blending strategy to avoid expensive processing fees; and our ability to reuse frac water to maintain a healthy water balance, to name a few. Second, we take the organic free cash flow that we generate and roll in a very modest amount of assets sales, which produce our cumulative free cash flow. Over our 7-year plan, we expect to generate over $3 billion of cumulative free cash flow(a), which leads to the third and last tenet: allocate that free cash flow into the right places at the right times. We are constantly evaluating redeploying capital back into the drill-bit, reducing debt, share buybacks, and M&A. We want to allocate capital to the right places, while maintaining great liquidity. Given the continued weakness in gas macro, our focus remains on debt reduction, which we feel is the best way to maximize the long-term intrinsic value per share of the company at this time."

Financial Results

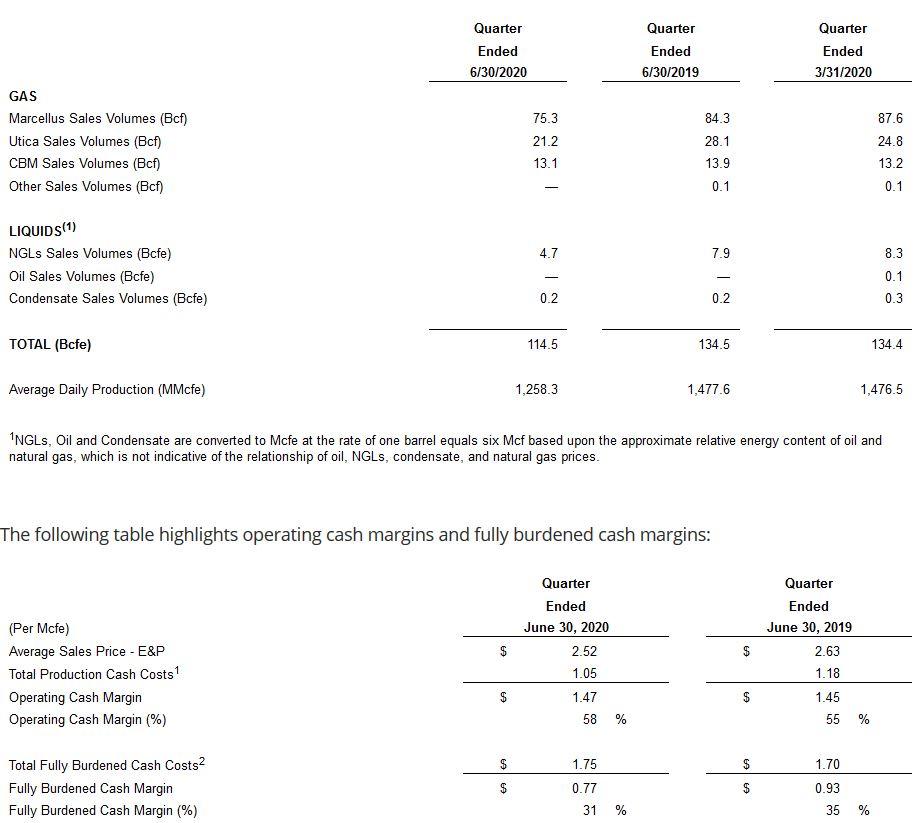

Operations Update

During the quarter, CNX used up to two horizontal rigs and drilled eight wells. The company currently has one rig in operation along with one frac crew. During the quarter, the company utilized one all-electric frac crew to complete 11 wells, which included eight Southwest Pennsylvania Marcellus Shale wells and three Monroe County, Ohio, Utica Shale wells. In the first quarter, CNX turned-in-line six wells.

During the quarter, volumes decreased due to the temporary shut-in of a portion of CNX's liquids-rich Shirley-Pennsboro production in May and June of 2020 in response to low NGL prices. Additionally, two new pads of dry gas turn-in-lines from April and May were temporarily shut-in May and June due to low natural gas prices. These decisions were made to take advantage of improved gas prices at the start of winter.

CNX's natural gas and liquids production in the quarter came from the following categories:

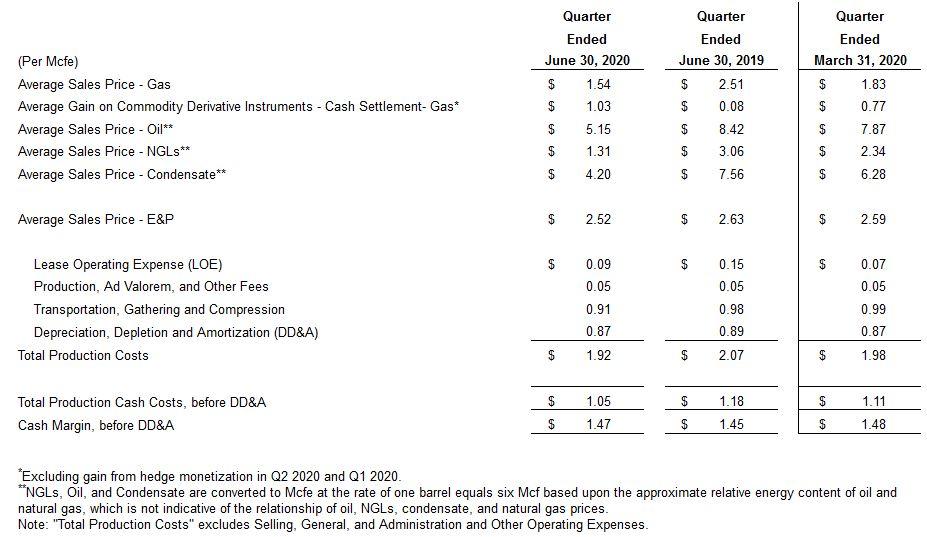

Price & Cost Data per Mcf

In the second quarter of 2020, total production costs were lower compared to the year-earlier quarter, due to improvements to LOE, transportation, gathering and compression, taxes, and DD&A. The primary driver to the improvement to LOE was a decrease in water disposal costs due to an increase in the reuse of produced water in well completions activity. The primary driver to improvement to transportation, gathering, and compression costs was due to the decline in processing fees due to a drier Marcellus production mix. The full commissioning of the Dry Ridge and Buckland compressor stations throughout the second half of 2019 allowed the majority of the gas produced from the Richhill Marcellus Shale field to avoid processing through blending.

Marketing

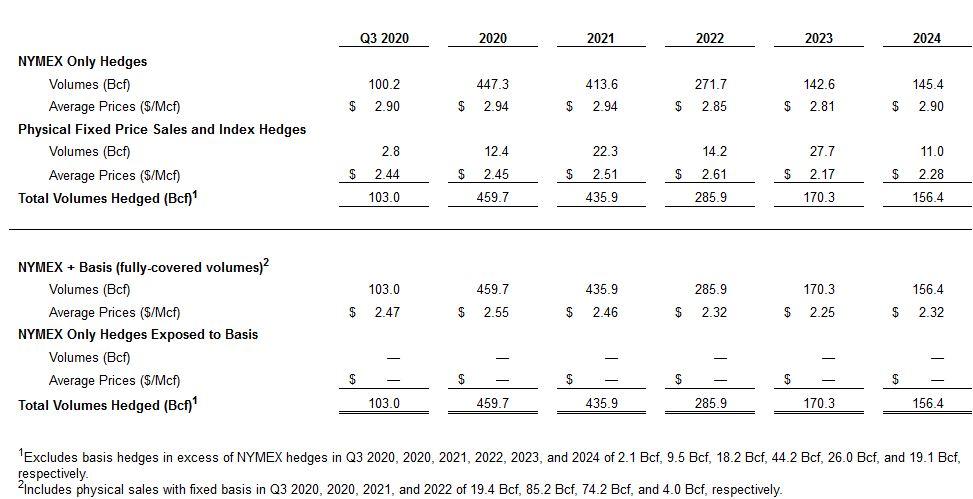

Total hedged natural gas production in the 2020 third quarter is 88.9(1) Bcf. The annual gas hedge position is shown in the table below:

In April 2020, CNX monetized and terminated approximately 39 million MMBtus of NYMEX natural gas hedges and a similar quantity of financial basis hedges that were to settle at various times from May through November of 2020. In connection with these monetizations, CNX received $29 million of net proceeds. In addition, during the second quarter of 2020, CNX purchased financial swaps for May through November of 2020 under which CNX will pay a fixed price to and receive a floating price from its hedge counterparties. These moves gave CNX additional flexibility to move production to higher price periods while immediately taking the monetization proceeds.

CNX's hedged gas volumes include a combination of NYMEX financial hedges, index (NYMEX and basis) financial hedges, and physical fixed price sales. In addition, to protect the NYMEX hedge volumes from basis exposure, CNX enters into basis-only financial hedges and physical sales with fixed basis at certain sales points. CNX's gas hedge position through 2024 as of July 8, 2020, excluding the 2020 purchased swaps, is shown in the table immediately below

During the second quarter of 2020, CNX added (sold) additional NYMEX natural gas swaps of 1.7 Bcf, 20.5 Bcf, 6.7 Bcf, 6.7 Bcf, 6.8 Bcf, and 0.9 Bcf for 2020, 2021, 2022, 2023, 2024, and 2025, respectively and additional index natural gas swaps of 1.0 Bcf and 0.8 Bcf for 2020 and 2021, respectively. To help mitigate basis exposure on NYMEX hedges, in the second quarter CNX added 3.1 Bcf, 11.7 Bcf, 28.6 Bcf, 25.2 Bcf, 25.5 Bcf, and 6.8 Bcf of basis hedges for 2020, 2021, 2022, 2023, 2024, and 2025, respectively.

Finance

At June 30, 2020, CNX's Stand-alone net debt to trailing-twelve-months (TTM) adjusted Stand-alone EBITDAX (including distributions from CNXM) (a non-GAAP measure)(1) was 2.3x. On a consolidated basis, CNX's net debt to TTM adjusted EBITDAX (a non-GAAP measure)(1) was 2.6x.

At June 30, 2020, CNX's credit facility had $550 million of borrowings outstanding and $205 million of letters of credit outstanding.

During the quarter, the company completed the private offering of $345 million aggregate principal amount of its 2.25% convertible senior notes due 2026. The company used the net proceeds to pay down a portion of its 5.875% notes due in 2022. As of June 30, 2020, the company had an aggregate principal balance of its 5.875% notes due in 2022 of approximately $414 million. The company has paid down the aggregate principal amount of these notes by approximately $482 million year-to-date.

CNX did not repurchase any shares of common stock during the second quarter of 2020.

Guidance Update

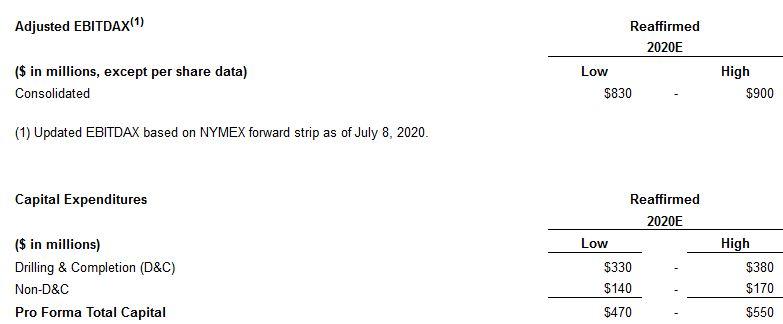

2020 Guidance Update

CNX reaffirms its 2020 production volumes of 490-530 Bcfe. Due to the pricing contango in 2020, the company shut-in certain wells starting in May to take advantage of anticipated higher price months later in the year. If the current gas price contango continues through the summer, the company expects that these shut-in wells will be back online in early November. Even though this would result in the company being at the lower end of the production range, the company would expect to be at the high-end of the adjusted EBITDAX range under this scenario.

In 2020, CNX reaffirms FCF(a) of approximately $300 million.

2021 Guidance Update

As previously discussed, the company believes that the decision to manage production through well shut-ins during the second quarter in 2020 will positively impact 2021 results. The company continues to expect the following results in 2021: production volumes of approximately 550 Bcfe, total capital expenditures of approximately $440 million, and EBITDAX(a) of approximately $920 million. Due to the recently-announced CNXM transaction, the company expects FCF(a) of approximately $425 million, which is an increase of $25 million from the previous guidance. If 2021 gas prices strengthen further, the company could produce approximately 600 Bcfe, or if gas prices weaken, the company has the flexibility to reduce activity. The company anticipates that the bulk of the FCF in 2021, like 2020, will be used to reduce the company's absolute debt and leverage ratio.

2022-2026 Guidance

CNX expects to shift to a maintenance of production (MOP) plan in 2022-2026. Over this time period, the company continues to expect average production volumes of approximately 560 Bcfe by turning-in-line 25 wells each year on average. Due to the recently-announced CNXM transaction, CNX expects annual FCF(a) for 2022-2026 to average $515 million each year, compared to the previous guidance of $500 million of consolidated FCF.

2020-2026 Cumulative

CNX expects cumulative FCF(a) over its 7-year plan to be over $3.0 billion.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

Northeast - Appalachia News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

EQT's Completion Efficiency Drove Outperformance In 2Q

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD