Top Story | Capital Markets | Capital Expenditure | Corporate Strategy | Capital Expenditure - 2021

Chevron to Keep Spending Flat at $14B in 2021; Spend $2B in the Permian

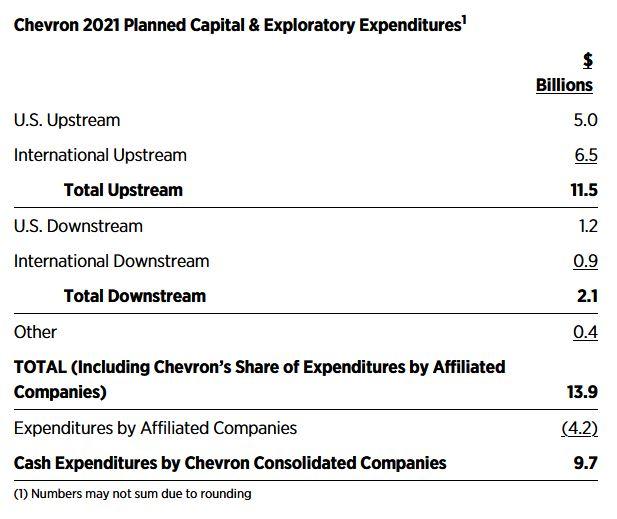

Chevron Corp. has announced a 2021 capital plan of $14 billion (flat compared to 2020).

Included in its 2021 spending is over $300 million for investments to advance the energy transition.

Upstream Investments:

- $6.5 billion is allocated to currently producing assets, including about $2 billion in the Permian (up from $1.5B in 2020)

- Approximately $3.5 billion is planned for major capital projects underway (~75% is associated with the Future Growth Project and Wellhead Pressure Management Project (FGP / WPMP) at the Tengiz field in Kazakhstan)

- The remaining $1.5 billion is allocated to exploration, early stage development projects, and midstream activities

CEO Michael Wirth said: "Chevron remains committed to capital discipline with a 2021 capital budget and longer-term capital outlook that are well below our prior guidance. With our major restructuring behind us and Noble Energy integration on track, we're prepared to execute this program with discipline."

Lowers Investment Outlook for 2022-2025

The company also lowered its longer-term guidance to $14 to $16 billion annually through 2025 (down 27% at the midpoint from its prior estimate of $19-22 billion).

During this time period, as capital is expected to decrease for a major expansion in Kazakhstan.

The company plans to increase investments in a number of assets, including the Permian, other unconventional basins, and the Gulf of Mexico.

Wirth added: "Chevron is in a different place than others in our industry. We've maintained consistent financial priorities starting with our firm commitment to the dividend. We took early and swift action at the beginning of the pandemic to prudently allocate capital, reduce costs and protect our industry-leading balance sheet. And we've completed a major acquisition and restructuring that positions our company to deliver higher returns and grow long-term value."

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Austral-Asia News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Gulf of Mexico News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -