Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure

Contango Oil & Gas Third Quarter 2020 Results

Contango Oil & Gas Co. reported its Q3 2020 results.

Third Quarter 2020 Highlights:

- Achieved run rate LOE savings on Central Oklahoma properties of 48% since taking over operations in the fourth quarter of 2019 and 38% savings relative to assumptions in our 2019 year-end SEC reserves. These savings are expected to increase the PDP PV-10 of the properties at 2020 year-end by more than 50% when measured based on 2019 year-end reserves assumptions.

- Production sales of 1,587 Mboe for the quarter, or 17.2 Mboe per day, including approximately 0.5 Mboe per day produced during the second quarter and placed into excess storage capacity until sold in the third quarter at higher prices. Excluding this sale of second quarter oil inventory, our production sales were 1,537 Mboe for the quarter, or 16.7 Mboe per day, nearly three times the 5.6 Mboe per day produced in the prior year quarter, primarily due to additional production from the properties acquired from White Star Petroleum, LLC and certain affiliates (collectively, "White Star") and Will Energy Corporation ("Will Energy") in the fourth quarter of 2019. Production sales also came in at the high end of guidance for the quarter.

- Total operating expenses of $17.2 million for the quarter, and operating expenses exclusive of production and ad valorem taxes of $15.6 million, at approximately 10% below the low end of guidance due to ongoing internal cost savings initiatives.

- Net loss of $6.8 million compared to a net loss of $7.8 million in the prior year quarter.

- Recurring Adjusted EBITDAX (a non-GAAP measure, as defined and presented herein) of $16.2 million, compared to $5.2 million in the prior year quarter primarily due to the properties acquired from White Star and Will Energy.

- The previously disclosed Management Services Agreement ("MSA") with Mid-Con Energy Partners, LP ("Mid-Con"), under which the Company provides technical, management, and administrative services as operator of record on Mid-Con's oil and gas properties as part of the Company's new, cost-effective "fee for service" management business, became effective on July 1, 2020. The Company recorded $1.0 million in revenue related to the MSA in the third quarter of 2020.

- Subsequent to quarter end, the Company entered into an Agreement and Plan of Merger with Mid-Con and Mid-Con Energy GP, LLC, the general partner of Mid-Con ("Mid-Con GP"), pursuant to which Mid-Con will merge with and into a wholly-owned, direct subsidiary of the Company (the "Mid-Con Acquisition"). The Mid-Con Acquisition is expected to close in late 2020 or early 2021, at which time the MSA will be terminated. See Note 13 "Subsequent Events" in our recently filed Form 10-Q for the third quarter of 2020 for further information.

- Subsequent to quarter end, the Company entered into an amendment to its revolving credit agreement with JPMorgan Chase Bank N.A., as administrative agent, and the lenders party thereto (the "Credit Agreement") under which, among other things, the Company's borrowing base will be increased from $75 million to $130 million upon the closing of the Mid-Con Acquisition. See Note 13 "Subsequent Events" in our recently filed Form 10-Q for the third quarter of 2020 for further information.

- Subsequent to quarter end, the Company completed a private placement with a select group of institutional and accredited investors for the sale of 26,451,988 shares of the Company's common stock for gross proceeds of approximately $39.7 million. The immediate use of those proceeds was for the repayment of debt outstanding under our Credit Agreement and general corporate purposes, including costs and fees of the offering and future producing acquisitions. See Note 13 "Subsequent Events" in our recently filed Form 10-Q for the third quarter of 2020 for further information.

Wilkie S. Colyer, the Company's Chief Executive Officer, said, "We are quite pleased with our results in the third quarter. We came in at the high end of guidance on barrels produced and below the low end of guidance on both LOE and cash G&A. In spite of the continued downward pressure COVID-19 has put on our industry, along with many others, Contango has continued to find ways to accrete value to its shareholders. We were able to execute a merger agreement subsequent to quarter end at a meaningful discount to PDP PV-10 which we look forward to closing in the coming months. In conjunction with the merger, we raised additional equity capital in a very tough capital markets environment. As importantly, we were able to realize significant field level cost savings on assets acquired from White Star Petroleum via a section 363 sale process late last year, resulting in more than a 50% increase in the value of those producing reserves. We believe this process can be repeated in future acquisitions, augmenting our return expectations, particularly on assets held by non-natural owners. We view these types of costs savings as organic growth drivers to complement our inorganic acquisition strategy. Lastly, I'd like to thank our shareholders and lenders, led by JPMorgan, for their continued support, along with our dedicated employees."

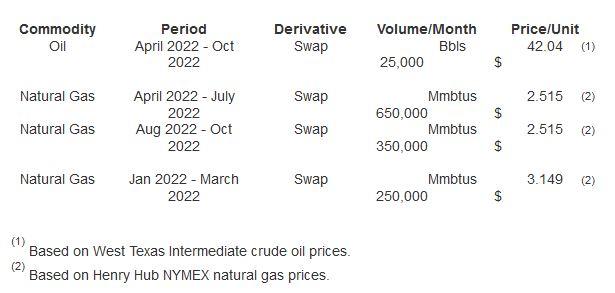

"Protecting our liquidity is also a priority for us as we look to potentially take advantage of acquisition opportunities in the current environment. Consequently, through our hedging program we have price protected approximately 71% of our forecasted PDP oil production for the remainder of 2020 with swaps at an average floor price of $55.12 per barrel and 67% of forecasted PDP gas production for the remainder of 2020 at an average floor price of $2.57 per Mmbtu. In 2021, we have approximately 69% of total forecasted PDP oil production hedged at $51.71 per barrel and 58% of currently forecasted PDP natural gas production hedged at $2.49 per Mmbtu. In October 2020, we entered into additional gas hedges and currently have approximately 65% of the first ten months of forecasted 2022 PDP natural gas production hedged at $2.59 per Mmbtu. We also entered into additional oil hedges for April through October 2022 and currently have approximately 37% of forecasted oil production for that time period hedged at $42.04 per barrel."

Impact of the COVID-19 Pandemic and 2020 Plan Changes

The COVID-19 pandemic has resulted in a severe worldwide economic downturn, significantly disrupting the demand for oil throughout the world, and has created significant volatility, uncertainty and turmoil in the oil and gas industry. This has led to a significant global oversupply of oil and a subsequent substantial decrease in oil prices. While global oil producers, including the Organization of Petroleum Exporting Countries ("OPEC") and other oil producing nations reached an agreement to cut oil production in April 2020, downward pressure on, and volatility in, commodity prices has remained and could continue for the foreseeable future, particularly given concerns over available storage capacity for oil. We have commodity derivative instruments in place to mitigate the effects of such price declines; however, derivatives will not entirely mitigate lower oil prices. While there has been modest recovery in oil prices, the length of this demand disruption is still unknown, and there is significant uncertainty regarding the long-term impact to global oil demand, which will ultimately depend on various factors and consequences beyond the Company's control, such as the duration and scope of the pandemic, the length and severity of the worldwide economic downturn, additional actions by businesses and governments in response to both the pandemic and the decrease in oil prices, the speed and effectiveness of responses to combat the virus, and the time necessary to equalize oil supply and demand to restore oil pricing. In response to these developments, we have continued to implement measures to mitigate the impact of the COVID-19 pandemic on our employees, operations and financial position. These measures include, but are not limited to, the following:

- work from home initiatives for all but critical staff and the implementation of social distancing measures;

- a company-wide effort to cut costs throughout our operations;

- utilization of our available storage capacity to temporarily store, when appropriate, a portion of our production in order to market that oil at a later date and capitalize on the contango in the commodity price curve;

- suspension of any further plans for operated onshore and offshore drilling in 2020;

- pursuit of additional "fee for service" opportunities similar to the MSA entered into in June 2020 with Mid-Con, which will be terminated at the closing of the Mid-Con Acquisition; and

- potential acquisitions of PDP-heavy assets, with attractive, discounted valuations, in stressed/distressed scenarios or from non-industry owners.

Summary of Third Quarter Financial Results

Net loss for the three months ended September 30, 2020 was $6.8 million, or $(0.05) per basic and diluted share, compared to a net loss of $7.8 million, or $(0.19) per basic and diluted share, for the prior year quarter. Pre-tax net loss for the three months ended September 30, 2020 was $6.1 million, compared to a pre-tax net loss of $7.8 million for the prior year quarter.

Average weighted shares outstanding were approximately 131.7 million and 41.8 million for the current and prior year quarters, respectively.

The Company reported Adjusted EBITDAX, a non-GAAP measure defined below, of approximately $15.8 million for the three months ended September 30, 2020, compared to $3.0 million for the same period last year, an increase attributable primarily to the incremental contribution from the properties we acquired from White Star and Will Energy in the fourth quarter of 2019, offset in part by lower commodity prices. Recurring Adjusted EBITDAX (defined below as Adjusted EBITDAX exclusive of non-recurring business combination expenses and strategic advisory fees and legal judgments) was $16.2 million for the current quarter, compared to $5.2 million for the prior year quarter.

Revenues for the current quarter were approximately $31.3 million compared to $12.5 million for the prior year quarter, an increase also primarily attributable to the additional production from the acquired Will Energy and White Star properties, despite the 21% decrease in the weighted average equivalent sales price in production period over period. Current quarter revenues also included $1.0 million related to our fee for service agreement with Mid-Con.

Production sales for the third quarter were approximately 1,587 Mboe, or 17.2 Mboe per day, at the upper level of guidance for the quarter, compared to 516 Mboe, or 5.6 Mboe per day for the third quarter of 2019. The properties acquired from White Star and Will Energy contributed approximately 12.7 Mboe per day to the third quarter of 2020. During the second quarter, due to the extreme variability in oil prices ranging from a low of ($37.63) per Bbl to a high of $40.46 per Bbl, we placed into available storage approximately 50,000 barrels of oil (net to the Company) produced during the second quarter, for later sale at higher prices. These volumes were sold in the third quarter of 2020.

The weighted average equivalent sales price during the three months ended September 30, 2020 was $19.13 per Boe, compared to $24.31 per Boe for the same period last year, a decline attributable to the decrease in all realized commodity prices in the current year quarter as a result of the decrease in demand for commodity products due to the COVID-19 pandemic and the failure of OPEC and Russia to reach any agreement on oil production quotas until April 2020. In comparison to the third quarter of 2019, we experienced a 29% decline in oil prices, a 31% decline in natural gas prices and a 23% increase in natural gas liquids prices in the third quarter of 2020.

Operating expenses for the three months ended September 30, 2020 were approximately $17.2 million, compared to $5.4 million for the same period last year, an increase attributable primarily to the properties acquired from White Star and Will Energy. Included in operating expenses are direct lease operating expenses, transportation and processing costs, workover expenses and production and ad valorem taxes. Operating expenses exclusive of production and ad valorem taxes of $1.5 million and $0.7 million, respectively, were approximately $15.6 million for the current quarter, and below the low end of guidance, compared to approximately $4.8 million for the prior year quarter. Total unit costs for operating expenses and G&A expenses improved 33% quarter over quarter.

DD&A expense for the three months ended September 30, 2020 was $6.2 million, or $3.90 per Boe, compared to $8.5 million, or $16.42 per Boe, for the prior year quarter. The lower depletion expense in the current quarter was a result of lower depletable property cost as a result of the proved property impairment recorded during the first quarter of 2020.

Total G&A expenses were $6.1 million for the three months ended September 30, 2020, compared to $5.9 million for the prior year quarter. Recurring G&A expenses (defined as G&A expenses exclusive of business combination expenses and non-recurring strategic advisory fees of $0.3 million and legal judgments of $0.1 million for the current quarter) were $5.7 million, or $3.60 per Boe for the current quarter. Recurring G&A expenses exclusive of business combination expenses and non-recurring strategic advisory fees of $0.1 million and legal judgments of $2.1 million for the prior year quarter were $3.7 million, or $7.08 per Boe. The increase from the prior year is primarily due to the costs of additional personnel, systems costs and other administrative expenses added in conjunction with the acquired Will Energy and White Star properties which more than tripled our production base. Recurring Cash G&A expenses (defined as recurring G&A expenses exclusive of non-cash stock-based compensation of $1.8 million and $0.6 million for the respective current and prior-year quarters) were $4.0 million for the current quarter, compared to $3.1 million for the prior year quarter.

Loss from our investment in affiliates (i.e., Exaro Energy III ("Exaro")) for the three months ended September 30, 2020 was approximately $0.1 million, compared to $0.6 million for the three months ended September 30, 2019.

Loss on derivatives for the three months ended September 30, 2020 was approximately $7.4 million. Of this amount, $13.0 million was non-cash, unrealized mark-to-market losses attributable to improvement in benchmark commodity prices at the end of the current quarter compared to the benchmark prices at the end of the second quarter of 2020, offset in part by $5.6 million in realized gains on derivative settlements during the current quarter. Gain on derivatives for the three months ended September 30, 2019 was approximately $1.9 million, of which $1.0 million was non-cash, unrealized mark-to-market gains, and the remaining $0.9 million were realized gains.

2020 Capital Program & Capital Resources

Capital costs for the three months ended September 30, 2020 were approximately $1.6 million, of which $0.8 million was related to the completion of a salt water disposal well and associated facilities in the Southern Delaware Basin in Pecos County, Texas. The remaining costs were primarily related to capitalized workovers and leasehold acquisition costs.

We anticipate that the remainder of our 2020 capital budget will be very limited, with our focus being on preserving our financial liquidity, flexibility and identifying opportunities for cost efficiencies in all areas of our operations. Our total 2020 capital expenditure budget is currently estimated at approximately $18.7 million, including $7.7 million of the exploration expenses related to the Iron Flea prospect incurred in 2020. For the remainder of 2020, we currently expect to limit our onshore capital expenditures to $1.4 million for workovers intended to increase cashflow through enhanced production or reductions in recurring costs. We currently expect that our offshore expenditures for the remainder of 2020, which are expected to be non-material, will be focused on the evaluation and development of another exploratory prospect. We may revise our 2020 capital expenditure budget if deemed appropriate in light of changes in commodity prices or economic conditions.

As of September 30, 2020, we had approximately $66.0 million outstanding under the Company's Credit Agreement, $1.9 million in an outstanding letter of credit and $3.0 million in cash. The borrowing base was $75 million as of September 30, 2020, with a borrowing availability of $7.1 million.

Mid-Con Acquisition

On October 25, 2020, the Company and Mid-Con entered into the Mid-Con Acquisition providing for the Company's acquisition of Mid-Con in an all-stock merger transaction in which Mid-Con will become a direct, wholly owned subsidiary of Contango. The Mid-Con Acquisition is expected to close in late 2020 or early 2021, at which time the MSA with Mid-Con will be terminated. Concurrently with the announcement of the Mid-Con Acquisition, we announced the execution of an agreement with a select group of institutional and accredited investors to sell 26,451,988 shares of the Company's common stock for gross proceeds of approximately $39.7 million. The proceeds were immediately used for the repayment of debt outstanding under our Credit Agreement and general corporate purposes, including costs and fees of the offering and future producing acquisitions. See Note 13 "Subsequent Events" in our recently filed Form 10-Q for the third quarter of 2020 for further information.

On October 30, 2020, we entered into the Third Amendment to the Credit Agreement (the "Third Amendment") under which the Company's borrowing base will be increased from $75 million to $130 million, effective upon the closing of the Mid-Con Acquisition. The Third Amendment also provides for, among other things, a $10 million automatic reduction in the borrowing base on March 31, 2021, and postpones the November 1, 2020 scheduled borrowing base redetermination required under the Credit Agreement until December 31, 2020. See Note 13 "Subsequent Events" in our recently filed Form 10-Q for the third quarter of 2020 for further information. The borrowing base may also be adjusted by certain events, including the incurrence of any senior unsecured debt, material asset dispositions or liquidation of hedges in excess of certain thresholds. The Credit Agreement matures on September 17, 2024. See Note 10 "Long-Term Debt" in our recently filed Form 10-Q for the third quarter of 2020 for further information.

Derivative Instruments

As of September 30, 2020, we had the following financial derivative contracts in place with members of our bank group or third-party counterparties under an unsecured line of credit with no margin call provisions. These contracts represent approximately 71% of our currently forecasted remaining 2020 oil production from proved developed reserves ("PDP") and 67% of our currently forecasted remaining 2020 natural gas production from PDP. We also have hedged approximately 69% of our currently forecasted 2021 PDP oil production and 58% of our currently forecasted 2021 PDP natural gas production.

In addition to the above financial derivative instruments, as of September 30, 2020, we had a costless swap agreement with a Midland WTI - Cushing oil differential swap price of $0.05 per barrel of crude oil. The agreement fixes the Company’s exposure to that differential on 10,000 barrels per month for October 2020 through December 2020.

As of September 30, 2020, based on strip prices at that time, the mark to market value of our hedge portfolio was $6.4 million, as reflected in the Company’s balance sheet as of September 30, 2020.

In October 2020, and subsequent to the end of the third quarter, we entered into the following additional derivative contracts:

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -