Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Capital Markets | Capital Expenditure | Capital Expenditure - 2021

Continental Resources Third Quarter 2020 Results

Continental Resources reported its Q3 2020 results.

Preliminary 2021 Outlook

CEO Bill Berry said: "As a continuation of Continental's historic track record of sustainable cash flow and debt reduction, we are projecting a 65% to 75% cash flow from operations reinvestment rate for 2021, with free cash flow projections of approximately $400 million at $40 WTI and $650 million at $45 WTI. Additionally, Continental is prioritizing debt paydown and expects to significantly reduce total debt to $5 billion or below by year end 2021, and down to $4 billion or below by year end 2022 or 2023."

In anticipation of stronger gas fundamentals in 2021, the Company shifted Oklahoma rigs to gassier areas in the second quarter 2020. To date, approximately 202 MMcfpd of the Company's 2021 natural gas is hedged, with two-thirds of the hedges representing collars with a weighted average floor price of $2.67 and a weighted average ceiling price of $3.44. The Company expects to continue an active and ongoing hedging program in 2021 and 2022. In Oklahoma, condensate wells are delivering strong early time results, with 20 recently completed SCOOP condensate wells performing in line with or better than expectations and are expected to deliver over 50% rates of return at $3.00 Henry Hub. With oil and gas inventory depth and direct access to multiple premium oil and gas markets in Oklahoma, the Company has the flexibility to capitalize on both oil and gas commodity prices.

The Company is projecting a 65% to 75% cash flow from operations (CFFO) reinvestment rate for 2021. At the midpoint of projected 2021 Capex, the Company is projecting annual cash flow from operations of $1.6 billion and annual free cash flow (FCF) of approximately $400 million at $40 WTI. The Company is projecting annual cash flow from operations of $1.85 billion and annual FCF of approximately $650 million at $45 WTI. The Company is projecting approximately 8.0% to 14.0% free cash flow yield at $40 to $45 WTI. Free cash flow yield is estimated by dividing the 2021 annual FCF estimate range by the Company's current market capitalization, as of November 5, 2020. Additionally, the Company is projecting total debt below $5.0 billion at year-end 2021 and $4.0 billion or below by year-end 2022 and 2023.

In 2021, the Company is projecting $1.2 to $1.3 billion of Capex at $40 to $45 WTI and $3 Henry Hub. The Company is projecting a low single digit production growth year-over-year in 2021 and expects a cash flow breakeven price of $32 WTI in 2021.

3Q20 Results & Full-Year 2020 Expectations

- $291.2 Million Cash Flow from Operations in 3Q20; $258.3 Million Free Cash Flow

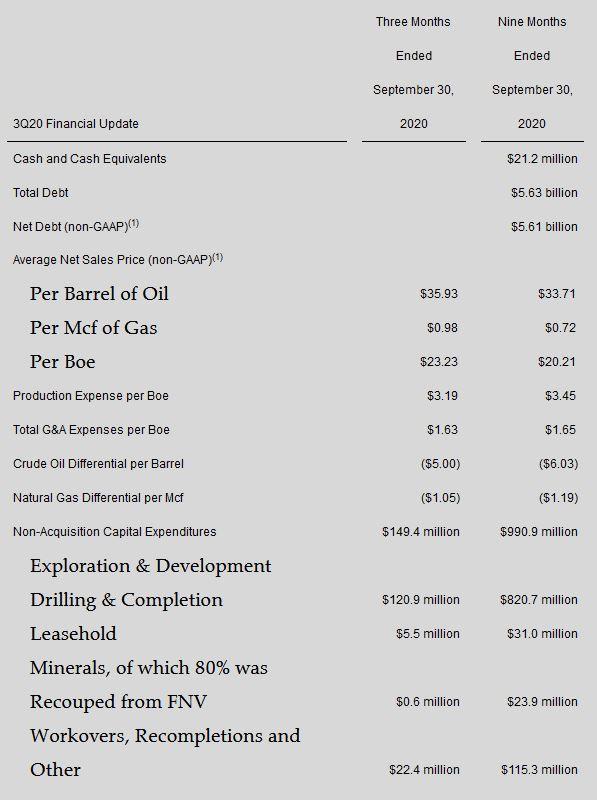

- $149.4 Million in Non-Acquisition Capex in 3Q20; On Track for $1.2 Billion in Full-Year 2020

- 297 MBoepd Average Daily Production in 3Q20 (57% Oil)

- Maintain 2020 Average Annual Production Guidance of 155 to 165 MBopd & 800 to 820 MMcfpd

- December 2020 Exit Rate Production of 315 to 325 MBoepd

- $1.63 Total G&A per Boe in 3Q20 in Line with Initial 2020 Guidance; $1.04 Cash G&A per Boe (Non-GAAP) and $3.19 Production Expense per Boe in 3Q20 Below Initial 2020 Guidance

- Improved Cost Metric Guidance for 2020

- 2020 Total G&A per Boe Guidance of $1.60 to $1.90 (Previously $1.60 to $2.00)

- 2020 Cash G&A per Boe Guidance: $1.10 to $1.30 (Previously $1.10 to $1.40)

- 2020 Production Expense per Boe Guidance: $3.50 to $3.75 (Previously $3.50 to $4.00)

- Operating Efficiencies Improve Year-Over-Year All-In Completed Well Costs (CWC) per

Well

- South: $9.0 Million CWC Improved 14% YoY (80% Structural); Targeting $8.9 Million YE20

- Bakken: $7.2 Million CWC Improved 12% YoY (70% Structural); Targeting $6.9 Million YE20

- Preliminary 2021 Outlook

- Oklahoma Oil & Gas Assets Provide Optionality to Capitalize on Strong Gas Prices in 2021

- Maximizing Free Cash Flow (FCF) & Prioritizing Debt Paydown

- Projecting Annual Cash Flow from Operations of $1.6 Billion and Annual FCF of Approximately

- $400 Million (Approx. 8.0% FCF Yield) at the Midpoint of Projected Capex Spend at $40 WTI

- Projecting Annual Cash Flow from Operations of $1.85 Billion and Annual FCF of approximately $650 Million (Approx. 14.0% FCF Yield) at the Midpoint of Projected Capex Spend at $45 WTI

- Projecting Total Debt Below $5.0 Billion at YE21; $4.0 Billion or Below by YE22/2023

- Projecting 65-75% Cash Flow from Operations (CFFO) Reinvestment Rate for 2021

- Projecting $1.2 to $1.3 Billion Capex Spend in 2021 at $40 to $45 WTI

- Projecting Low Single Digit Production Growth YoY with Cash Flow Breakeven Price of $32 WTI

Financial Results

The Company reported a net loss of $79.4 million, or $0.22 per diluted share, for the quarter ended September 30, 2020. In third quarter 2020, typically excluded items in aggregate represented $20.5 million, or $0.06 per diluted share of Continental's reported net loss. Adjusted net loss for third quarter 2020 was $58.9 million, or $0.16 per diluted share (non-GAAP). Net cash provided by operating activities for third quarter 2020 was $291.2 million and free cash flow was $258.3 million. EBITDAX was $473.3 million (non-GAAP).

Adjusted net income (loss), adjusted net income (loss) per share, free cash flow, free cash flow yield, EBITDAX, net debt, net sales prices and cash general and administrative (G&A) expenses per barrel of oil equivalent (Boe) presented herein are non-GAAP financial measures. Definitions and explanations for how these measures relate to the most directly comparable U.S. generally accepted accounting principles (GAAP) financial measures are provided at the conclusion of this press release.

CEO Bill Berry said: "The production we voluntarily curtailed was back on line in the third quarter 2020, performing well as anticipated. As we look to year end 2020 and into 2021, we will continue our track record of delivering sustainable free cash flow alongside ongoing debt reduction, low cost leadership and unmatched shareholder alignment, while responsibly fueling a better world through our ESG stewardship."

Production & Operations Update

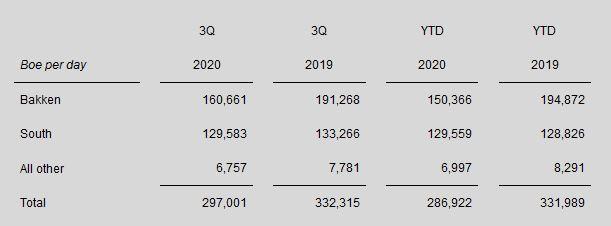

Third quarter 2020 total production averaged 297,001 Boepd. Third quarter 2020 oil production averaged 169,265 Bopd. Third quarter 2020 natural gas production averaged 766.4 MMcfpd. The Company maintains its full-year 2020 production guidance of 155,000 to 165,000 Bopd and 800,000 to 820,000 Mcfpd. The Company expects exit rate production of 315,000 to 325,000 Boepd in December 2020.

Technical innovations and operating efficiencies in the Bakken and Oklahoma continue to reduce cycle times and CWC, which include drilling and completion, full facilities costs and artificial lift. In the Bakken, CWC have improved 12% year-over-year to $7.2 million per well, with a $6.9 million target by year-end 2020. Approximately 70% of cost savings are structural. In Oklahoma, CWC have improved 14% year-over-year to $9.0 million per well, with an $8.9 million target by year-end 2020. Approximately 80% of cost savings are structural.

"The capital efficiency of our operations continues to improve through our teams' innovation and consistent performance from our assets. At the same time, our teams are constantly seeking strategic opportunities to cost-effectively grow our assets. We recently closed on a bolt-on acquisition in SCOOP that added 19,500 net acres and up to 185 high quality, oil-weighted operated wells to our inventory," said Jack Stark, President and Chief Operating Officer.

The following table provides the Company's average daily production by region for the periods presented.

Financial Update

CFO John Hart said: "Continental has consistently demonstrated low cost leadership and despite the market volatility we have faced this year, 2020 will be no exception. Thanks to our unique combination of assets and operational efficiencies, Continental will deliver positive free cash flow for the fifth consecutive year alongside improved guidance for LOE per Boe and cash G&A per Boe."

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Mid-Continent News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Devon Said To be In Talks to Acquire Enerplus

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans