Well Lateral Length | Top Story | Quarterly / Earnings Reports | First Quarter (1Q) Update | Well Spacing | Forecast - Production | Capital Markets | Capital Expenditure | Drilling Activity

EQT's Q1 Spend Down 22% YOY, Drilling Dips Slightly; Improves Drill Days, Frac Stages Up 30%

EQT Corp. reported its Q1 2019 results. The highlights are below.

The company is still in an ongoing proxy battle with the Rice brothers over control of the company.

Q1 Spending Down 22%; Drilling Only Down Slightly, Lateral Record

- Capital expenditures decreased 22% to $476 million while feet of pay turned-in-line increased compared to the first quarter 2018.

- During the quarter, the Company drilled 30 wells - down from 32 wells in Q1 2018

- During the quarter, the Company drilled 17 wells with total curve and lateral footage of greater than 14,000 feet in one-run, and surpassed the mile-per-day rate of penetration mark on 4 wells.

- The team also set a basin bit record for the longest one run at 19,426 feet. Horizontal drilling performance improved 32% when compared to November of 2018 to 0.79 days per 1,000 feet, down from 1.17 days per 1,000 feet.

Efficiencies: Drilling Days Improve 25% QOQ; Frac Stages Up 30%

Positive operational results included significant improvements in rig and frac crew efficiencies such as:

- Drilling days per 1,000 feet improved 25% over prior quarter and 32% since November 2018

- Frac stages per crew increased 30% and non-productive time decreased 70% over the first quarter 2018

The Company's frac plug drill-out operations have also seen significant efficiency gains with a 71% improvement in the average number of plugs per day, reducing cycle times by nearly 3 days per 100 plugs. In April, the Company's frac plug drill-out operations completed 43 frac plugs and cleaned 7,550 feet in a 24-hour period - setting a Company record.

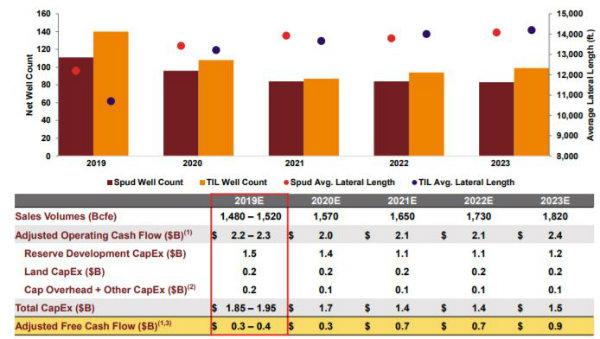

Raises Production Guidance as Output Jumps (Capex Unchanged); Details Five Year Plan

Sales volumes of 383 Bcfe exceeded guidance of 360-380 Bcfe and increased 13% YOY

- Full year sales volume guidance raised 10 Bcfe to 1,480 - 1,520 Bcfe while full year capital expenditure guidance remains unchanged at $1.85 - $1.95 billion

h

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

Northeast - Appalachia News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

EQT's Completion Efficiency Drove Outperformance In 2Q

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD