Capital Markets | Capital Expenditure | Capital Expenditure - 2021

GeoPark IDs 2021 Budget, Guidance; Talks Production Results

GeoPark Limited announced its operational update for the three-month period ended December 31, 2020.

The company also detailed its 2021 plan.

2021 Work Program

- 2021 work program of $100-120 million (including ~35% to exploration activities)

- Targeting 40,000-42,0004 boepd average production and operating netbacks of $280-330 million at $45-50 Brent per bbl5

2020 Highlights:

Extending 18-Year Production Growth Track Record and Hitting Production Targets- Annual average production of 40,192 boepd in 2020, hitting 40,000-42,000 boepd guidance

- 2020 exit production over 40,000 boepd

- Consolidated oil and gas production of 39,304 boepd

- CPO-5 block (GeoPark non-operated, 30% WI) production increased to 10,310 bopd gross, 55% higher compared to 3Q2020

- Successful drilling of Indico 2 appraisal well in the CPO-5 block in 4Q2020, currently producing 6,200 bopd of light oil with an estimated payback under 3 months

- 2020 cost and investment reductions totaled over $290 million across regional platform

- 2020 work program reduced by 65% to $65-75 million including 23 gross wells drilled (21 operated) with an 87% success rate, comprising development, appraisal and exploration wells

- 2020 Extraordinary Cash Dividend of $0.0206 per share ($1.25 million), paid on December 9, 2020

- 2020 Quarterly Dividend of $0.0206 per share ($1.25 million), paid on December 9, 2020

- Resumed discretionary share buyback program, having acquired 106,486 shares for $1.0 million since November 6, 2020, while executing self-funded and flexible work programs

- $201 million of cash & cash equivalents as of December 31, 20201 ($163.7 million as of Sept. 30, 2020)

- $75 million oil prepayment facility, with $50 million committed and no amounts drawn

- $132.9 million in uncommitted credit lines2

- Long-term financial debt maturity profile with no principal payments until September 2024

- Continuously adding new hedges over the next 12 months

- Full integration of Amerisur Resources Plc ("Amerisur") assets and operations

- Divesting 10% non-operated WI in the Manati gas field in Brazil for up to R$144 million (approximately $27 million3), subject to agreement by the remainder of the consortium and required regulatory approvals

- Reorganization of portfolio into asset-based platform vs. country-based

- Protocols, preventive measures and crisis response plans in place across GeoPark's regional platform

- Field teams sharply reduced to a minimum with back-up teams and contingencies in place to keep people working safely and production flowing

- GeoPark closely engaged with local communities implementing a significant range of measures to fight Covid and provide emergency supplies, with efforts coordinated at local, regional and federal levels

James F. Park, Chief Executive Officer of GeoPark, said: "Track records matter and 18 years of steady production growth, despite external volatility, is a meaningful demonstration of the brains, muscle and heart of the GeoPark team. We salute these amazing women and men for continuing to stay focused and do the hard work to advance our Company again on all fronts - technically, operationally, strategically, and financially - even with all the turmoil and hurt the planet endured this last year. As always, our team has learned a lot and come out even stronger and more united than ever - and is ready and looking forward to the big opportunity and promise of 2021."

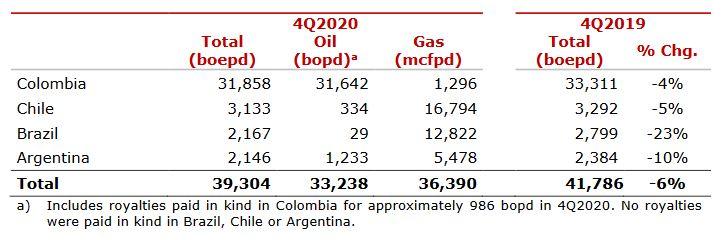

Breakdown of Quarterly Production by Country

Production Update

Consolidated:Annual average 2020 production of 40,192 boepd compared to 40,046 boepd in 2019. Oil and gas production in 4Q2020 decreased by 6% to 39,304 boepd from 41,786 boepd in 4Q2019, due to limited drilling and maintenance activities in Colombia, Chile and Argentina and lower gas demand in Brazil, partially offset by the addition of production from the Amerisur acquisition in Colombia. Oil represented 85% of total reported production in 4Q2020 and 4Q2019.

Colombia:Average net oil and gas production in Colombia decreased by 4% to 31,858 boepd in 4Q2020 compared to 33,311 boepd in 4Q2019, reflecting limited drilling and maintenance activities in the Llanos 34 block (GeoPark operated, 45% WI), partially offset by the recent acquisition of Amerisur and successful drilling of the Indico 2 appraisal well in the CPO-5 block.

The Llanos 34 block average net production was 25,759 bopd (or 57,242 bopd gross) in 4Q2020, representing 81% of GeoPark's net production in Colombia, while the CPO-5 block average net production was 3,093 bopd (or 10,310 bopd gross), representing 10% of GeoPark's net production in Colombia and a 55% increase compared to 3Q2020.

Appraisal and exploration drilling in the CPO-5 block:

- Indico 2 appraisal well, located approximately 0.8 km northwest of the Indico 1 well, was successfully drilled and put on production in November 2020. The operator ONGC Videsh drilled and completed Indico 2 to a total depth of 10,925 feet. The well tested 5,500 bopd of 35 degrees API, with a 0.1% water cut, and is currently producing 6,200 bopd. Additional production history is required to determine stabilized flow rates of the well.

- Aguila 1 exploration well was drilled by the operator ONGC Videsh to a total depth of 9,961 feet. According to petrophysical logging interpretation and other relevant information, the well encountered non-commercial oil accumulations, and following these results a decision was made to abandon the well.

- Further exploration, appraisal and development activities are budgeted in the CPO-5 block in 2021 with the drilling of 5-6 gross wells plus the acquisition of 3D seismic, as part of GeoPark's fully funded and flexible work and investment program.

- CPO-5 is a large high-potential block offering multi-play, low cost development, appraisal and exploration opportunities, adjacent to and on trend with the Llanos 34 block, and with over 20 drilling leads and prospects delineated to date.

Other activities in operated and non-operated blocks:

- Initiated 3D seismic acquisition in the PUT-8 block (GeoPark operated, 50% WI) which is located adjacent to the Platanillo Block (GeoPark operated, 100% WI) in the Putumayo basin, expected to continue in 1Q2021.

- Re-entry activities carried out into the Grulla 1 well in the Llanos 94 block (GeoPark non-operated, 50% WI) showed non-commercial oil accumulations, and following these results a decision was made to abandon the well.

Average net production in Chile decreased by 5% to 3,133 boepd in 4Q2020 resulting from lower gas production in the Jauke gas field, partially offset by the discovery of the Jauke Oeste gas field in early 2020. Maintenance and well intervention activities will be carried out in the Jauke 1 gas well during 1Q2021, aimed at increasing gas production levels. The production mix during 4Q2020 was 89% gas and 11% light oil (compared to 81% gas and 19% light oil in 4Q2019).

Brazil:Average net production in Brazil decreased by 23% to 2,167 boepd in 4Q2020 compared to 2,799 boepd in 4Q2019. Compared to 3Q2020, Brazilian production increased by 37% due to higher demand in the Manati gas field (GeoPark non-operated, 10% WI). The production mix during 4Q2020 was 99% natural gas and 1% condensate (compared to 96% natural gas and 4% oil and condensate in 4Q2019).

Agreement to sell 10% WI in the Manati gas field:

- On November 23, 2020, GeoPark announced that its Board of Directors approved an agreement to sell its 10% non-operated WI in the Manati gas field to Gas Bridge for a total consideration of R$144.4 million (approximately $27 million), including a fixed payment of R$124.4 million plus an earn-out of R$20.0 million, which is subject to obtaining certain regulatory approvals.

- The transaction was agreed with an effective date of December 31, 2020 and is subject to certain conditions, including the acquisition by Gas Bridge of the remaining 90% WI and operatorship of the Manati gas field.

- Two other non-operating partners in the Manati gas field consortium with a combined 55% WI have announced their respective agreements to sell their WI to Gas Bridge.

- Closing of the transaction would occur in 4Q2021, subject to the agreement by the remainder of the consortium and required regulatory approvals.

Average net production in Argentina decreased by 10% to 2,146 boepd in 4Q2020 (57% oil, 43% gas) compared to 2,384 boepd in 4Q2019 (66% oil, 34% gas), mainly resulting from limited maintenance activities combined with the natural decline of the fields.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

South America News >>>

-

Vaca Muerta 2025–2026: Acceleration, Optimization, and Strategic Impact

-

Argentina/Vaca Muerta Developers to Double Well Activity; Increase Frac Fleets

-

Hess Corporation First Quarter 2023 Results -

-

Shell Fourth Quarter, Full Year 2022 Results -

-

Shell CEO van Beurden to Step Down; Wael Sawan Tapped as Successor -