Drilling & Completions | Quarterly / Earnings Reports | Debt | First Quarter (1Q) Update | Financial Results | Capital Markets | Drilled Uncomplete (DUC)

Kimbell Royalty First Quarter 2020 Results

Kimbell Royalty Partners, LP reported its Q1 2020 results.

Q1 2020 Highlights

- Q1 2020 oil, natural gas and natural gas liquids ("NGL") revenues of $25.6 million, up 12% as compared to Q1 2019

- Q1 2020 run-rate daily production of 12,602 barrels of oil equivalent ("Boe") per day (6:1), up 5% as compared to Q1 2019

- Including a full quarter of production attributable to the Springbok assets, record Q1 2020 run-rate daily production of 15,188 Boe per day (6:1), up 27% as compared to Q1 2019

- Q1 2020 net loss of $59.8 million and Q1 2020 net loss attributable to common units of $39.3 million, compared to Q1 2019 net loss attributable to common units of $3.7 million. The Q1 2020 net loss amount was primarily due to a non-cash ceiling test impairment expense of $70.9 million related to the substantial weakness in commodity prices

- Q1 2020 consolidated Adjusted EBITDA of $18.8 million, up 17% as compared to Q1 2019

- Including a full quarter of revenues attributable to the Springbok assets, Q1 2020 consolidated Adjusted EBITDA of $23.3 million1, up 44% compared to Q1 2019 and a new record

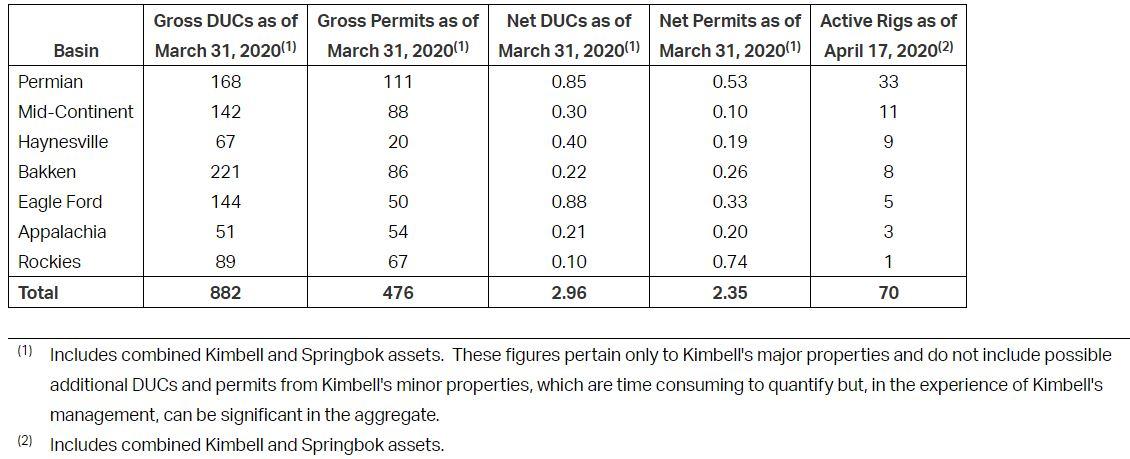

- Including the Springbok assets1, 2.96 net (882 gross) drilled but uncompleted wells ("DUCs") and 2.35 net (476 gross) permitted locations on Kimbell's acreage as of March 31, 2020

- Q1 2020 cash distribution of $0.17 per common unit (50% of Q1 2020 cash available for distribution); implies a 10.1% annualized yield based on the May 6, 2020 closing price of $6.75 per common unit; Kimbell intends to pay down $15 million of debt in Q2 2020

- Completed a public offering of 5 million common units for net proceeds of approximately $73.6 million, which were used to pre-fund the cash portion of the Springbok acquisition, which closed on April 17, 2020

- Completed the redemption of 50% of Kimbell's outstanding Series A Cumulative Convertible Preferred Units for an aggregate redemption price of $61.1 million on February 12, 2020

Robert Ravnaas, Chairman and Chief Executive Officer of Kimbell's general partner commented, "We are pleased with our first quarter performance and, after giving effect to a full quarter of production and revenues attributable to the Springbok acquisition, we had record production and consolidated Adjusted EBITDA. Despite the positive start to this year, we are all responding and adjusting to the unprecedented global economic impact resulting from the COVID-19 pandemic and the uncertainties related to the U.S. oil market and the potential for production curtailments. We believe that we are well-positioned to weather this storm, with approximately 60% of our first quarter production coming from natural gas, for which the outlook appears increasingly strong, one of the lowest PDP decline rates in the industry, our robust fixed-price hedges for oil and natural gas and a strong balance sheet and liquidity position."

First Quarter 2020 Distribution and Debt Repayment

On April 24, 2020, the Board of Directors of Kimbell Royalty GP, LLC, Kimbell's general partner (the "Board of Directors"), approved a cash distribution payment to common unitholders of 50% of cash available for distribution for the first quarter of 2020, or $0.17 per common unit. The Board of Directors also approved a $15 million repayment of outstanding borrowings under Kimbell's revolving credit facility. The cash distribution will be payable on May 11, 2020 to common unitholders of record at the close of business on May 4, 2020. The Board of Directors will review the distribution policy quarterly.

Kimbell expects that substantially all of its first quarter distribution will not constitute taxable dividend income and instead will generally result in a non-taxable reduction to the tax basis of unitholders' common units. The reduced tax basis will increase unitholders' capital gain (or decrease unitholders' capital loss) when unitholders sell their common units. Furthermore, Kimbell expects that substantially all distributions paid to common unitholders from 2020 through 2023 will not be taxable dividend income and less than 25% of distributions paid to common unitholders for the subsequent two years (2024 to 2025) will be taxable dividend income.

Financial Highlights

Total first quarter 2020 revenues were $35.9 million, compared to $17.9 million in the first quarter of 2019. First quarter 2020 net loss was $59.8 million, and net loss attributable to common units was $39.3 million, or $1.29 per common unit, compared to net loss attributable to common units of $3.7 million in the first quarter of 2019. The increase in net loss during the first quarter of 2020 was primarily due to a $70.9 million non-cash ceiling test impairment recorded during the quarter related to the substantial weakness in commodity prices driven by recent production disagreements among members of the Organization of Petroleum Exporting Countries ("OPEC") and other foreign, oil-exporting countries, coupled with decreased demand resulting from the COVID-19 pandemic and increasing supply by domestic producers. This non-cash ceiling test impairment is not expected to impact the cash flow available for distribution generated by Kimbell or its liquidity or ability to make acquisitions in the future.

Total first quarter 2020 consolidated Adjusted EBITDA grew to $18.8 million, compared to $16.1 million in the first quarter of 2019 (consolidated Adjusted EBITDA is a non-GAAP financial measure. Please see a reconciliation to the nearest GAAP financial measures at the end of this news release). During the first quarter of 2020, average realized price per Bbl of oil was $44.48, per Mcf of natural gas was $1.75, per Bbl of NGLs was $12.22 and per Boe combined was $19.83.

G&A expense was $6.5 million in Q1 2020, $4.4 million of which was Cash G&A expense, or $3.85 per Boe (Cash G&A and Cash G&A per Boe are non-GAAP financial measures. Please see definition under Non-GAAP Financial Measures at end of this news release). Unit-based compensation in Q1 2020, which is a non-cash G&A expense, was $2.1 million or $1.84 per Boe. Cash G&A expense including a full quarter of the Q1 2020 production attributable to the Springbok assets was $3.20 per Boe.

Kimbell believes that the ongoing COVID-19 outbreak and OPEC disagreements have generated a supply/demand imbalance in the oil and natural gas markets, and Kimbell expects that as the supply/demand imbalance continues, and as oil storage facilities reach capacity and/or purchasers of crude products cancel previous orders, more of its operators may adjust or reduce their drilling activities, which could have an adverse effect on Kimbell's business, production, cash flows, financial condition and results of operations in the second quarter of 2020.

As of March 31, 2020, Kimbell had outstanding 34,378,849 common units and 20,644,047 Class B units. As of May 7, 2020, Kimbell had outstanding 36,602,811 common units and 23,141,181 Class B units.

Production

First quarter 2020 average daily production was 13,358 Boe per day (6:1), which consisted of 756 Boe per day relating to prior period production recognized in Q1 2020 and 12,602 Boe per day of run-rate production. The 12,602 Boe per day of run-rate production for Q1 2020 was comprised of approximately 40% from liquids (27% from oil and 13% from NGLs) and approximately 60% from natural gas (6:1). The prior period production recognized in Q1 2020 was primarily due to new wells outperforming estimates. Including a full quarter of production attributable to the Springbok assets, Q1 2020 run-rate daily production was 15,188 Boe per day and was comprised of approximately 41% from liquids (28% from oil and 13% from NGLs) and approximately 59% from natural gas (6:1).

Operational Update

As of March 31, 2020, Kimbell had 882 gross (2.96 net) drilled but uncompleted wells ("DUCs") and 476 gross (2.35 net) permitted locations on its acreage. In addition, as of April 17, 2020, Kimbell had 70 rigs actively drilling on its acreage, which represents an approximate 13.7%2 market share of all land rigs drilling in the continental United States as of such time, up from 11.9%3 at year-end 2019.

Liquidity

At March 31, 2020, Kimbell had approximately $101.2 million in debt outstanding under its revolving credit facility and was in compliance with all financial covenants under its revolving credit facility.

On May 7, 2020, after taking into account the previously disclosed drawdown to fund the cash portion of the purchase price for the Springbok acquisition, Kimbell had approximately $186.7 million in borrowings outstanding under its revolving credit facility. After giving effect to the repayment of $15 million in outstanding borrowings discussed above, which is anticipated to occur in Q2 2020, Kimbell expects to have approximately $171.7 million in outstanding borrowings under its revolving credit facility and approximately $53.3 million in undrawn capacity (or approximately $128.3 million if aggregate commitments were equal to Kimbell's current borrowing base, which is $300 million) and pro forma total debt to Q1 2020 annualized consolidated Adjusted EBITDA, including a full quarter of the Springbok assets, of approximately 1.8x. Increases in commitments pursuant to the accordion feature of the revolving credit facility are subject to the satisfaction of certain conditions, including obtaining additional commitments from new or existing lenders.

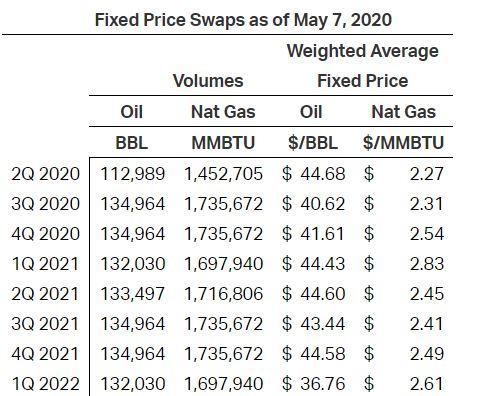

Hedging Update

The following provides information concerning Kimbell's hedge book as of May 7, 2020:

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results