Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Drilled Uncomplete (DUC)

Kimbell Royalty Second Quarter 2020 Results

Kimbell Royalty Partners, LP reported its Q2 2020 results.

Second Quarter 2020 Highlights

- Q2 2020 run-rate daily production of 14,069 barrels of oil equivalent ("Boe") per day (6:1)

- Including a full quarter of the production attributable to the Springbok assets, Q2 2020 run-rate daily production of 14,090 Boe per day (6:1), down 7% from Q1 2020 record production of 15,188 Boe per day (6:1)

- Substantially all of the decrease in production between Q1 2020 and Q2 2020 was due to curtailments that occurred in Q2 2020

- Q2 2020 production was comprised of approximately 41% from liquids (28% from oil and 13% from natural gas liquids ("NGL")) and approximately 59% from natural gas (6:1)

- Q2 2020 oil, natural gas and NGL revenues of $16.8 million, reflecting impacts from the COVID-19 pandemic and related supply/demand imbalances in the U.S. oil and natural gas markets that significantly depressed production prices

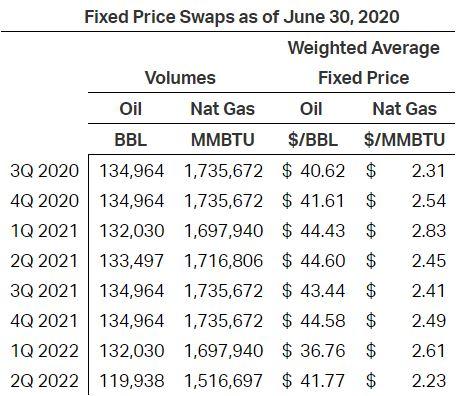

- Q2 2020 realized hedging gains of $2.9 million; substantial portion of projected oil and natural gas production hedged through Q2 2022

- Q2 2020 net loss of $76.8 million and Q2 2020 net loss attributable to common units of $48.0 million. The Q2 2020 net loss amount was primarily due to a non-cash ceiling test impairment expense of $65.5 million related to the substantial weakness in commodity prices

- Q2 2020 consolidated Adjusted EBITDA of $12.1 million

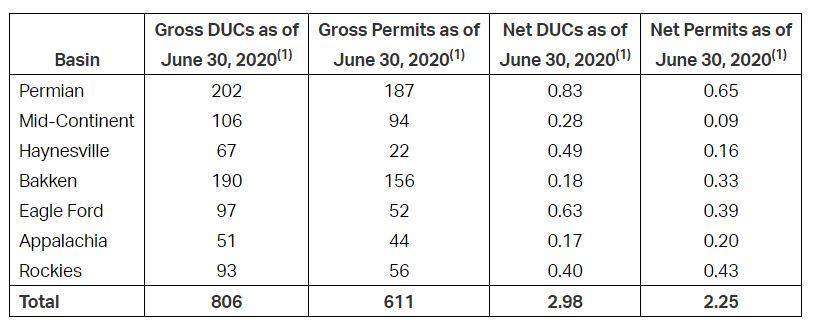

- As of June 30, 2020, Kimbell had 806 gross (2.98 net) drilled but uncompleted wells ("DUCs") and 611 gross (2.25 net) permitted locations on its acreage

- As of June 30, 2020, Kimbell had 29 rigs actively drilling on our acreage, which represented 11.6%1 market share of all rigs drilling in the continental United States as of such time

- Announced a cash distribution of $0.13 per common unit and an increase in the pay-out ratio of cash available for distribution from 50% in Q1 2020 to 75% in Q2 2020; implies a 5.8% annualized yield based on the August 5, 2020 closing price of $9.00 per common unit; Kimbell intends to utilize the remaining 25% of its available cash to repay a portion of the outstanding borrowings under Kimbell's credit facility

- On June 1, 2020, Kimbell received unanimous reaffirmation of its $300.0 million borrowing base and total commitments of $225.0 million

Robert Ravnaas, Chairman and Chief Executive Officer of Kimbell's general partner commented, "We are encouraged by what we see as a gradual recovery in both commodity prices and the U.S. economy and are cautiously optimistic that the worst is behind us with regard to production curtailments. Despite challenges during the second quarter, we believe we benefited from the full integration of the Springbok assets and increased our Q2 2020 payout ratio from 50% to 75% of cash available for distribution. We believe the Kimbell business model is highly differentiated from most companies in the U.S. energy sector given our pure royalty model, diverse asset base, mix of commodities, substantial hedges and low PDP decline rate, which is among the best in the industry. While many risks and uncertainties remain in the economy and surrounding the continuing COVID-19 crisis, we believe Kimbell is well-positioned to manage its business through these challenges."

Second Quarter 2020 Distribution and Debt Repayment

On July 24, 2020, the Board of Directors of Kimbell Royalty GP, LLC, Kimbell's general partner (the "Board of Directors"), approved a cash distribution payment to common unitholders of 75% of cash available for distribution for the second quarter of 2020, or $0.13 per common unit. The cash distribution will be payable on August 10, 2020 to common unitholders of record at the close of business on August 3, 2020. The Board of Directors will review the distribution policy quarterly. Kimbell expects to utilize the remaining 25% of cash available for distribution for the second quarter of 2020 to pay-down $2.5 million of outstanding borrowings under Kimbell's credit facility.

Kimbell expects that substantially all of its second quarter distribution will not constitute taxable dividend income and instead will generally result in a non-taxable reduction to the tax basis of unitholders' common units. The reduced tax basis will increase unitholders' capital gain (or decrease unitholders' capital loss) when unitholders sell their common units. Furthermore, Kimbell expects that substantially all distributions paid to common unitholders from 2020 through 2023 will not be taxable dividend income and less than 25% of distributions paid to common unitholders for the subsequent two years (2024 to 2025) will be taxable dividend income.

Financial Highlights

Kimbell's second quarter 2020 average realized price per Bbl of oil was $24.89, per Mcf of natural gas was $1.44, per Bbl of NGLs was $7.87 and per Boe combined was $13.09.

During the second quarter of 2020, the Company's total revenues were $12.8 million, net loss was $76.8 million and net loss attributable to common units was $48.0 million, or $1.39 per common unit. The net loss during the second quarter of 2020 was primarily due to a $65.5 million non-cash ceiling test impairment expense recorded during the quarter related to the substantial weakness in commodity prices. This non-cash ceiling test impairment is not expected to impact the cash flow available for distribution generated by Kimbell or its liquidity or ability to make acquisitions in the future.

Total second quarter 2020 consolidated Adjusted EBITDA was $12.1 million (consolidated Adjusted EBITDA is a non-GAAP financial measure. Please see a reconciliation to the nearest GAAP financial measures at the end of this news release). Our second quarter 2020 consolidated Adjusted EBITDA was reduced by a one-time $300,000 expense related to the transition services agreement entered into in connection with our acquisition of the Springbok assets.

G&A expense was $6.9 million in Q2 2020, $4.3 million of which was Cash G&A expense, or $3.48 per Boe (Cash G&A and Cash G&A per Boe are non-GAAP financial measures. Please see definition under Non-GAAP Financial Measures at end of this news release). Unit-based compensation in Q2 2020, which is a non-cash G&A expense, was $2.5 million or $2.04 per Boe. Cash G&A expense per Boe was increased by a one-time $300,000 expense related to the transition services agreement entered into in connection with our acquisition of the Springbok assets.

Although there has been stabilization in the oil and natural gas markets since the second quarter, Kimbell believes that the ongoing COVID-19 outbreak and potential supply/demand imbalances in the oil and natural gas markets could continue to have an adverse effect on Kimbell's business, production, cash flows, financial condition and results of operations in the second half of 2020.

At June 30, 2020, Kimbell had approximately $171.7 million in debt outstanding under its revolving credit facility, total debt to Q2 2020 trailing twelve month consolidated Adjusted EBITDA of approximately 2.3x and was in compliance with all financial covenants under its revolving credit facility.

After giving effect to $477,051 in borrowings to fund acquisitions under Kimbell's micro investment strategy so far in Q3 2020 and the repayment of $2.5 million in outstanding borrowings discussed above, which is anticipated to occur in Q3 2020, Kimbell expects to have approximately $169.7 million in outstanding borrowings under its revolving credit facility and approximately $55.3 million in undrawn capacity (or approximately $130.3 million if aggregate commitments were equal to Kimbell's current borrowing base, which is $300.0 million). Increases in commitments pursuant to the accordion feature of the revolving credit facility are subject to the satisfaction of certain conditions, including obtaining additional commitments from new or existing lenders.

Production

Second quarter 2020 average daily production was 14,254 Boe per day (6:1), which consisted of 185 Boe per day relating to prior period production recognized in Q2 2020 and 14,069 Boe per day of run-rate production. The 14,069 Boe per day of run-rate production for Q2 2020 was comprised of approximately 41% from liquids (28% from oil and 13% from NGLs) and approximately 59% from natural gas (6:1). The prior period production recognized in Q2 2020 was primarily due to new wells outperforming estimates.

Operational Update

As of June 30, 2020, Kimbell had 806 gross (2.98 net) DUCs and 611 gross (2.25 net) permitted locations on its acreage. In addition, as of June 30, 2020, Kimbell had 29 rigs actively drilling on its acreage, which represents an approximate 11.6% market share of all land rigs drilling in the continental United States as of such time.

Hedging Update

The following provides information concerning Kimbell's hedge book as of June 30, 2020:

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results