Service & Supply | Oilfield Services | Third Quarter (3Q) Update | Frac Markets - Pressure Pumping

Liberty : Frac Fleets To Jump +20% in the Fourth Quarter

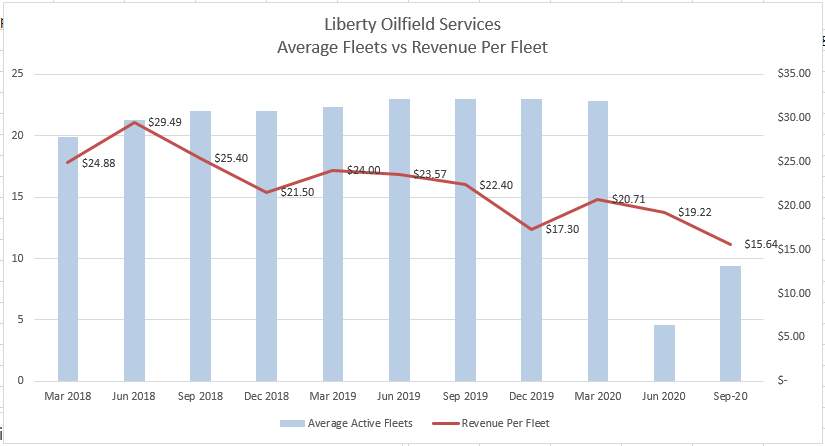

Liberty Oilfield Services reported its 3q quarter results. The most notable was a comment was "expect granter than 20% sequential growth in frac fleets in the 4Q.

Wright continued, "In the fourth quarter we anticipate average active fleets, excluding the OneStim acquisition, will increase greater than 20% from 9.4 average fleets working in the third quarter. Our progress is a testament to the focus and ingenuity of our team during a volatile time, and we thank their commitment to driving significant improvement across all facets of our organization: efficiency, safety, culture, operations, and ESG technologies. It is this perseverance and enthusiasm that sets the stage for Liberty to execute in 2021."

Quick read.

- Revenue was up +67% to $147 sequentially

- Net Loss of $49 milliion..

- Total liquidity of $154 million (Cash + borrowing base availablity)

- Expect to complete OneStim acquisition in the 4Q quarter.

Original Press Release

Summary Results and Highlights

- Revenue of $147 million, a 67% increase from the second quarter of 2020

- Net loss1 of $49 million, or $0.41 fully diluted loss per share, and Adjusted EBITDA2 of $(3) million including non-cash items of over $4 million for the quarter ended September 30, 2020

- Expect greater than 20% sequential growth in average active frac fleets in the fourth quarter of 2020

- Total liquidity was $154 million including ABL availability as of the September 30, 2020 borrowing base

- Expect to complete the acquisition of Schlumberger's North American pressure pumping business, OneStim, towards the end of the fourth quarter of 2020

"As our industry emerges from the depths of the downturn, our third quarter results showcase an endorsement from our customers of our high-quality service and technology offerings. Our business expanded with top tier customers during the third quarter, and we entered a major gas basin, the Haynesville Shale, with an existing customer. The completions activity rebound is modestly ahead of the pace we expected earlier this year. Revenues increased to $147 million in the third quarter and Adjusted EBITDA2, excluding non-cash items, was approximately $1 million for the quarter. Total liquidity was $154 million, with no borrowings drawn on our ABL facility. The past six months have been a testing time for our industry and the world. I am proud of the strength and tenacity that the Liberty family has demonstrated throughout this period of volatility," commented Chris Wright, Chief Executive Officer.

Mr. Wright continued, "During the third quarter, we also announced an agreement to acquire Schlumberger's North American pressure pumping and related businesses, OneStim, marking a transformative change for Liberty and the oilfield services industry. Our customer base has undergone a similar change, with several sizeable consolidations amongst exploration and production ("E&P") operators announced recently. Adding the OneStim business to Liberty's industry leading platform accelerates our ability to support our customers in the next stage of the shale revolution. Liberty continues our track record of countercyclical investing and delivering superior returns."

Outlook

While the COVID-19 pandemic will continue to bring uncertainty in global oil demand in the months ahead, incremental monthly improvement in completions activity from a low point in May is a welcome sign of progress. U.S. land rig counts have also increased weekly over the last few weeks, marking a directional shift from declines observed through much of the third quarter.

Against this backdrop, E&P operators are focused on capital discipline and returns. Efficiency, safety and quality from service companies are central to achieving these goals. Liberty's superior service offering is driving increased interest from operators with environmental, social and governance ("ESG") compliant objectives together with the ever-present demand for higher productivity and efficiency.

Commenting on the outlook, Wright stated, "With our pending acquisition of OneStim, Liberty will have unmatched technological advantages, scale, vertical integration, balance sheet strength, and a best-in-class team positioned to unlock shareholder value from these assets. We aim to employ the same principles we successfully executed with our acquisition of Sanjel assets during the 2015 to 2016 downturn: maintain our culture of innovation and excellence, grow market share, and invest in technology systems that benefit us and our customers. Opportunities emerge during challenging times, and we believe the addition of OneStim positions us well entering the next phase of our journey as a company."

Wright continued, "In the fourth quarter we anticipate average active fleets, excluding the OneStim acquisition, will increase greater than 20% from 9.4 average fleets working in the third quarter. Our progress is a testament to the focus and ingenuity of our team during a volatile time, and we thank their commitment to driving significant improvement across all facets of our organization: efficiency, safety, culture, operations, and ESG technologies. It is this perseverance and enthusiasm that sets the stage for Liberty to execute in 2021."

Third Quarter Results

For the third quarter of 2020, revenue increased 67% to $147 million from $88 million in the second quarter of 2020.

Net loss before income taxes totaled $59 million for the third quarter of 2020 compared to $77 million for the second quarter of 2020.

Net loss1 (after taxes) totaled $49 million for the third quarter of 2020 compared to $66 million in the second quarter of 2020.

Adjusted EBITDA2, which includes non-cash stock compensation expense, increased 75% to $(3) million from $(13) million in the second quarter. Please refer to the reconciliation of Adjusted EBITDA (a non-GAAP measure) to net income (a GAAP measure) in this earnings release.

Fully diluted loss per share was $0.41 for the third quarter of 2020 compared to $0.55 for the second quarter of 2020.

Balance Sheet and Liquidity

As of September 30, 2020, Liberty had cash on hand of $85 million, a reduction from second quarter levels as working capital increased in line with revenue, and total debt of $106 million, net of deferred financing costs and original issue discount. The term loan requires only a 1% annual amortization of principal, paid quarterly, with no substantial payment due until maturity in September 2022, subject to mandatory prepayments from excess cash flow. There were no borrowings drawn on the ABL credit facility, and total liquidity, including availability under the credit facility, as of the September 30, 2020 borrowing base, was $154 million.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -