Quarterly / Earnings Reports | Water Treatment | First Quarter (1Q) Update | Financial Results | Capital Markets | Water Managment & Disposal

NGL Energy Partners Fiscal Q1 2023 Results

NGL Energy Partners LP reported its first quarter Fiscal 2023 financial results.

Highlights include:

- Net income for the first quarter of Fiscal 2023 of $23.1 million, compared to a net loss of $134.5 million for the first quarter of Fiscal 2022

- Adjusted EBITDA(1) for the first quarter of Fiscal 2023 of $123.9 million, compared to $91.1 million for the first quarter of Fiscal 2022

- Record Water Solutions quarterly Adjusted EBITDA(1) of $105.0 million, a 28.9% increase compared to the first quarter of Fiscal 2022 and a 16.4% increase from the immediately preceding fiscal quarter

- Record produced water volumes processed of approximately 2.15 million barrels per day during the first quarter of Fiscal 2023, growing 29.2% from the same period in the prior year and 11.8% over the immediately preceding fiscal quarter

- Subsequent to the first quarter of Fiscal 2023, the Partnership placed the entire Ambassador Pipeline into propane service by connecting the southern leg from the Wheeler terminal into Marysville storage

Mike Krimbill, NGL’s CEO, said: “Our Water Solutions segment outperformed during this past quarter, achieving record numbers for both produced water volumes processed and Adjusted EBITDA(1), while managing costs in a challenging supply chain and inflationary macro environment. Due to the positive results of the first fiscal quarter, we are increasing our guidance for the Water Solutions segment to more than $410 million of Adjusted EBITDA(2) for Fiscal 2023. Full year guidance for Adjusted EBITDA(2) is in excess of $600 million. The Ambassador Pipeline is now fully operational and in service and we expect the additional supply from the pipeline will benefit many of Michigan’s propane customers in one of the largest retail propane markets in the U.S. Fiscal 2023 is starting out well and we look forward to the next three quarters,” Krimbill concluded.

Quarterly Results of Operations

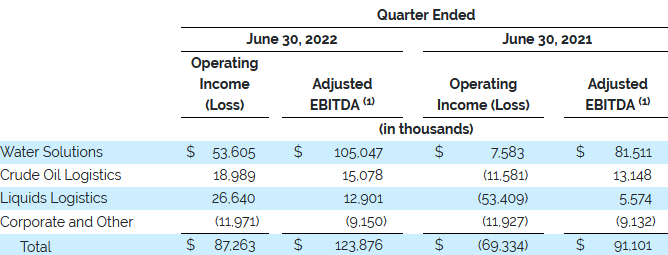

The following table summarizes operating income (loss) and Adjusted EBITDA(1) from continuing operations by reportable segment for the periods indicated:

Water Solutions

Operating income for the Water Solutions segment increased $46.0 million for the quarter ended June 30, 2022, compared to the quarter ended June 30, 2021. The Partnership processed approximately 2.15 million barrels of produced water per day during the quarter ended June 30, 2022, a 29.2% increase when compared to approximately 1.67 million barrels of water per day processed during the quarter ended June 30, 2021. This increase was due to higher production volumes (and associated produced water) primarily in the Delaware Basin driven by the recovery in crude oil prices from the prior year. The Partnership also sold approximately 137,000 barrels per day of produced and recycled water for use in our customers’ completion activities.

Revenues from recovered crude oil, including the impact from realized skim oil hedges, totaled $32.9 million for the quarter ended June 30, 2022, an increase of $16.9 million from the prior year period. This increase was due to increased skim oil barrels sold as a result of higher produced water volumes processed, higher skim oil volumes captured per barrel of produced water processed and higher realized crude oil prices received from the sale of skim oil barrels.

Operating expenses in the Water Solutions segment decreased to $0.25 per produced barrel processed compared to $0.26 per produced barrel processed in the comparative quarter last year primarily due to continued efforts to control operating costs per barrel along with higher produced water volumes processed. Three of the Water Solutions segment’s largest variable expenses, utility, royalty and chemical expenses, were not (and are not expected to be) impacted by the rise in inflation due to negotiating long-term utility contracts with fixed rates, royalty contracts with no escalation clauses and a fixed chemical expense per barrel with our chemical provider.

Crude Oil Logistics

Operating income for the quarter ended June 30, 2022 increased $30.6 million compared to the quarter ended June 30, 2021 primarily due to an increase in average commodity prices period over period and a decrease in net derivative losses. Our product margins also continue to benefit due to high crude oil prices, which have a favorable impact on contracted rates with certain producers, as well as increased differentials on certain other sales contracts. During the three months ended June 30, 2022, physical volumes on the Grand Mesa Pipeline averaged approximately 79,000 barrels per day, compared to approximately 77,000 barrels per day for the three months ended June 30, 2021.

Liquids Logistics

Operating income for the Liquids Logistics segment increased $80.0 million for the quarter ended June 30, 2022, compared to the quarter ended June 30, 2021. The prior year included a loss of $60.1 million related to the sale of the Partnership’s membership interest in Sawtooth Caverns, LLC (“Sawtooth”). Butane margins increased compared to the quarter ended June 30, 2021 due primarily to net unrealized gains on derivatives of approximately $6.1 million recognized in the quarter ended June 30, 2022, compared to net unrealized losses on derivatives of $6.5 million recognized in the quarter ended June 30, 2021. Excluding the impact of derivatives, butane product margin was negatively impacted by lower location differentials. The remaining increase in operating income was primarily related to higher product margins on refined products and biodiesel sold due to tighter supply in certain markets as well as favorable supply contracts and inventory positions in a volatile market. These increases were partially offset by lower propane product margin related to the impact of derivatives and decreased service revenue due to the sale of Sawtooth.

Corporate and Other

Corporate and Other expenses remained consistent to the comparable prior year period.

Capitalization and Liquidity

Total liquidity (cash plus available capacity on our asset-based revolving credit facility) was approximately $286.2 million as of June 30, 2022. Borrowings on the Partnership’s revolving credit facility totaled approximately $171.0 million. The increase from March 31, 2022 was primarily due to increases in working capital balances driven by increased inventory volumes and higher net account receivable balances.

The Partnership is in compliance with all of its debt covenants and has no significant debt maturities before November 2023. The Partnership expects to generate operational free cash flow in Fiscal Year 2023, which will be utilized to repay outstanding indebtedness and improve leverage.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results