Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets

NGL Energy Partners Fiscal Second Quarter 2020 Results

NGL Energy Partners LP reported its second quarter fiscal 2021 results.

Highlights for the quarter include:

- Income from continuing operations for the second quarter of Fiscal 2021 of $6.0 million, compared to a loss from continuing operations of $15.6 million for the second quarter of Fiscal 2020

- Adjusted EBITDA from continuing operations for the second quarter of Fiscal 2021 of $138.0 million, compared to $123.5 million for the second quarter of Fiscal 2020

- Successful completion of our Poker Lake pipeline, which has an initial capacity of over 350,000 barrels per day and connects into our integrated Delaware Basin produced water pipeline infrastructure network

- New, long-term acreage dedications for water disposal services and a long-term extension and expansion to an existing acreage dedication with leading independent and super major producers in the Delaware Basin

Mike Krimbill, NGL's CEO, said: "Our second quarter results reflect the expected increase in Adjusted EBITDA related to the sale of crude oil stored for contango, as well as the sale of skim oil barrels we held during our first fiscal quarter. Our second quarter earnings also reflect the full benefit of reduced operating expenses in the Water Solutions segment, with operating expense averaging $0.27 per barrel, compared to $0.32 per barrel during the first quarter of this fiscal year and $0.40 per barrel during Fiscal 2020. This decrease in expenses is significant as it represents approximately $50 - $60 million in annual cost savings based on average volumes for the quarter. Additionally during the quarter, we were able to enter into several new, long-term water disposal contracts, as well as extend and expand certain other water disposal contracts, in the Delaware Basin with both high quality, independent and super major producers. Our Crude Logistics segment continued to perform despite the noise around the Extraction bankruptcy process and averaged approximately 123,000 barrels per day on Grand Mesa Pipeline. As previously stated, NGL will continue to vigorously defend the value of its contracts with Extraction and remains amenable to resolving the dispute through commercial considerations. Finally, the Liquids and Refined Products segment is heading into its peak earning season with strong inventory positions and we are looking forward to a successful year in this segment. In addition to maximizing results from operations, we are focused on reducing indebtedness and our bank commitments. We are reducing capital expenditures, further cutting costs and have decreased the common unit distribution, all of which increase our free cash flow. We are also evaluating assets sales and joint venture opportunities. These remain challenging times; however, we continue to manage the things we can control and focus on the future to create value for our stakeholders," Krimbill concluded.

Quarterly Results of Operations

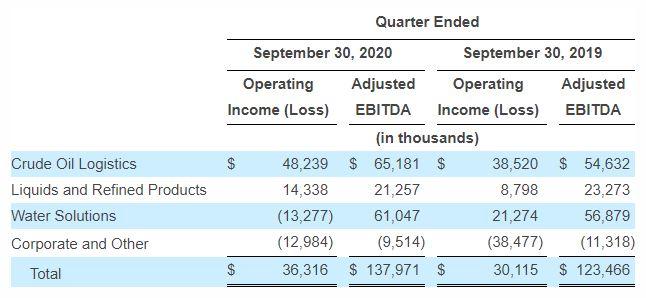

The following table summarizes operating income (loss) and Adjusted EBITDA from continuing operations by reportable segment for the periods indicated:

Crude Oil Logistics

Operating income for the second quarter of Fiscal 2021 increased compared to the second quarter of Fiscal 2020 primarily due to increased margins. The increased margin realized during the current quarter was due primarily to the sale of inventory that was purchased at lower prices and held during the three months ended June 30, 2020. During the three months ended September 30, 2020, financial volumes on the Grand Mesa Pipeline averaged approximately 123,000 barrels per day.

In June 2020, Extraction Oil & Gas, Inc. ("Extraction"), a significant shipper on the Grand Mesa Pipeline, filed a petition for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. Extraction has transportation contracts pursuant to which it has committed to ship crude oil on the pipeline through October 2026. As part of the bankruptcy filing, Extraction filed a motion requesting that the court authorize it to reject these transportation contracts, to which the Partnership filed an objection and took various other legal steps within the bankruptcy to protect the value of the contracts. On November 2, 2020, the bankruptcy court issued a bench ruling granting the motion to reject the transportation contracts effective as of June 14, 2020. As a result, we intend to appeal the bankruptcy court's ruling and raise what we respectfully believe are numerous infirmities with the ruling.

Liquids and Refined Products

Total product margin per gallon, excluding the impact of derivatives, was $0.036 for the quarter ended September 30, 2020, compared to $0.031 for the quarter ended September 30, 2019. This increase was primarily due to propane inventory values aligning with increased commodity prices. This increase was partially offset by lower margins for butane and refined products due to lower demand resulting from the COVID-19 pandemic.

Refined products volumes decreased by approximately 111.7 million gallons, or 33.6%, during the quarter ended September 30, 2020 compared to the quarter ended September 30, 2019. Propane volumes decreased by approximately 9.5 million gallons, or 3.6%, and butane volumes decreased by approximately 26.8 million gallons, or 15.7%, when compared to the quarter ended September 30, 2019. Other product volumes decreased by approximately 37.1 million gallons, or 24.5%, during the quarter ended September 30, 2020 compared to the same period in the prior year. The decrease in refined products, propane, butane and other product volumes was also primarily due to the continued lower demand as a result of the COVID-19 pandemic.

Water Solutions

The Partnership processed approximately 1.28 million barrels of water per day during the quarter ended September 30, 2020, a 1.9% increase when compared to produced water processed per day during the quarter ended September 30, 2019. This increase was primarily driven by our acquisition of Hillstone Environmental Partners, LLC in November 2019 in the Delaware Basin and was offset by lower disposal volumes in all other basins during the period resulting from lower crude oil prices, drilling activity and production volumes.

Revenues from recovered crude oil, including the impact from realized skim oil hedges, totaled $12.5 million for the quarter ended September 30, 2020, a decrease of $3.9 million from the prior year period. This decrease was the result of lower volumes and lower crude oil prices. The percentage of recovered crude oil per barrel of produced water processed has declined over the past several periods due to an increase in produced water transported through pipelines (which contains less oil per barrel of produced water) and the addition of contract structures that allow producers to keep the skim oil recovered from produced water. This decrease was partially offset by the sale of crude oil during the three months ended September 30, 2020, that we stored as of June 30, 2020 due to the lower crude oil prices.

Operating expenses in the Water Solutions segment decreased to $0.27 per barrel compared to $0.38 per barrel in the comparative quarter last year. The Partnership has taken significant steps to reduce operating costs and continues to evaluate cost saving initiatives in the current environment.

In October 2020, the Partnership successfully completed its Poker Lake pipeline and tie-ins, which has an initial capacity of over 350,000 barrels per day and connects into its integrated Delaware Basin produced water pipeline infrastructure network. NGL began receiving produced water volumes from Exxon's Poker Lake Development. Additionally, the Partnership recently announced new agreements, including acreage dedications, water transportation and disposal agreements, and water supply agreements, with leading super major producers and other key producers in the Delaware Basin. The Partnership expects to service these customers' produced water needs with its existing infrastructure with minimal capital expenditure requirements in the foreseeable future.

Corporate and Other

Corporate and Other expenses decreased from the comparable prior year period primarily due to lower compensation expense, in particular cash and non-cash incentive compensation, and a reduction in acquisition related expenses. These decreases were partially offset by legal costs incurred for defending the rejection of our transportation contracts in Extraction bankruptcy proceedings.

Capitalization and Liquidity

Total debt outstanding was $3.29 billion at September 30, 2020 compared to $3.15 billion at March 31, 2020, an increase of $139 million due primarily to the funding of certain capital expenditures incurred prior to and accrued on March 31, 2020 and $83.1 million of the remaining $100.0 million deferred purchase price of Mesquite Disposals Unlimited, LLC ("Mesquite"). Capital expenditures incurred totaled $24.4 million during the second quarter (including $6.8 million in maintenance expenditures) and $54.4 million year-to-date. These expenditures are expected to continue to decrease throughout Fiscal 2021 with full year expectations totaling $100 million or less for both growth and maintenance capital expenditures combined. Total liquidity (cash plus available capacity on our revolving credit facility) was approximately $122.1 million as of September 30, 2020 and the Partnership is in compliance with all of its debt covenants.

The Partnership is currently working with the syndicate of lenders that are a party to its revolving credit facility to extend the maturity of the facility by at least one year. The Partnership's proposal was submitted to all of the syndicate lenders in October 2020, and remains subject to approval by each lender.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results